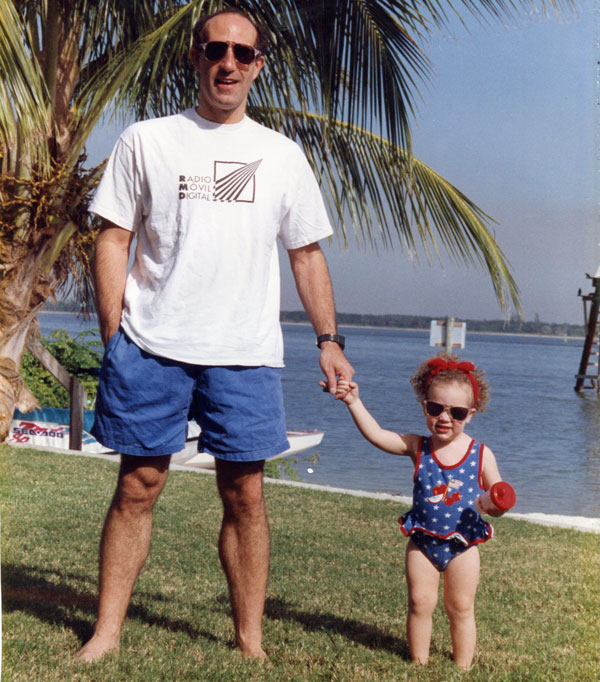

Not long ago, I received an unexpected early Father’s Day gift from my older daughter when she returned home for a long weekend visit with mom and dad.

Since graduating from college Alyssa had been living in the Chicago area, where she worked as a research assistant for a prestigious university. She thoroughly enjoyed living in the city and the job had turned out to be a great start to her career in the healthcare field.

Alyssa was about to start graduate school and move to St. Louis.

During her visit home I checked in with her about her finances, as I tend to do whenever anyone in my family changes jobs, moves, or goes through some sort of transition.

Alyssa told me that over the previous three years she had accumulated more than $10,000 in her employer’s 403(b) program! Stunned and impressed, I commended her on the important habit of saving that she was forming.

I shared with her that this first slug of retirement savings, if given five decades to compound at historical averages, is likely to be worth more than $300,000 when she retires. Quite a nice start to building a nest egg for the future.

Like most parents, my wife and I have tried to impart to our kids the value of living within one’s means and developing a saving habit.

When I asked Alyssa how she had managed to save so much, given her entry-level salary and the high cost of city living, her answer surprised me.

Financial security

She said, “Dad, you once told us that saving in your 20s is worth eight times what you save in your 30s. Of all the advice that you have given me, that one lesson, to save as much as you can early on, really struck a chord with me.”

That was one of my proudest moments as a father!

First, there was the satisfaction of knowing that my daughter had listened to, and acted upon, one of the many (okay, probably too many) pieces of fatherly advice that I had given her over the years.

More importantly, I was thrilled that Alyssa had taken this advice to heart because of what it meant for her future. The habit of socking away money early on and letting it grow over time is the key to achieving long-term financial security.

Knowing that my daughter had learned this lesson, and was on the path to a bright financial future, was one of the best Father’s Day gifts imaginable.