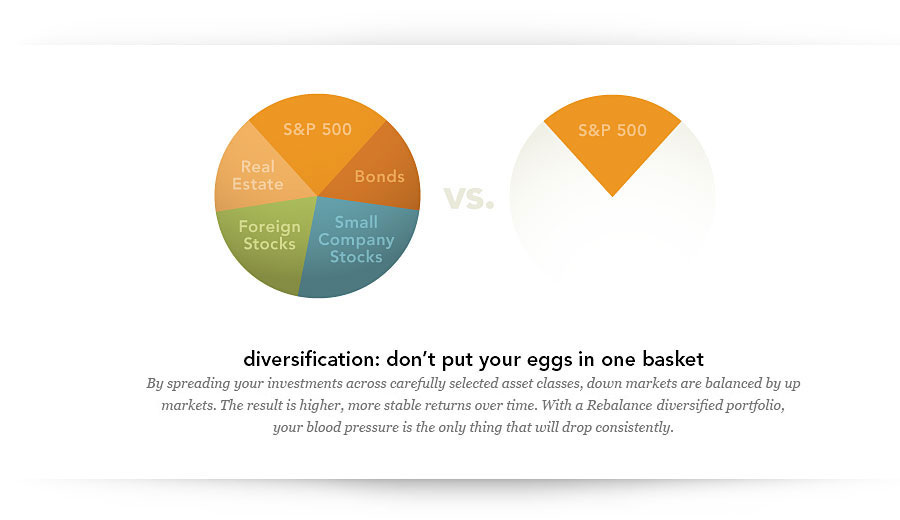

The Rebalance strategy follows a widely accepted approach known as modern portfolio theory (MPT). Developed through time-tested finance research, modern portfolio theory seeks to increase investment return while lowering risk. The heart and soul of the concept is diversification. The idea is to own a variety of asset classes, thus avoiding the concentration of risk into any given single investment.

It starts with you. The first step is to identify your personal, acceptable level of risk tolerance. Then we build a diversified portfolio that offers the maximum return for your chosen risk level.

Diversification is more than simply putting your eggs into different baskets. It actively lowers risk. That’s because asset classes generally are “uncorrelated,” that is, as one declines in value, another rises. For instance, you likely have noticed that when stocks fall in price, bonds rise, and vice versa. The stabilizing effect of diversification is amplified by adding up to six asset classes to your portfolio. A thoughtful collection of asset classes thus offers a lower investment risk than any single asset. Interestingly, research shows that adding asset classes that some might perceive as “risky” in fact lowers the overall risk in a portfolio. For this reason, diversification rightly has been described as “the only free lunch in the investment game.”

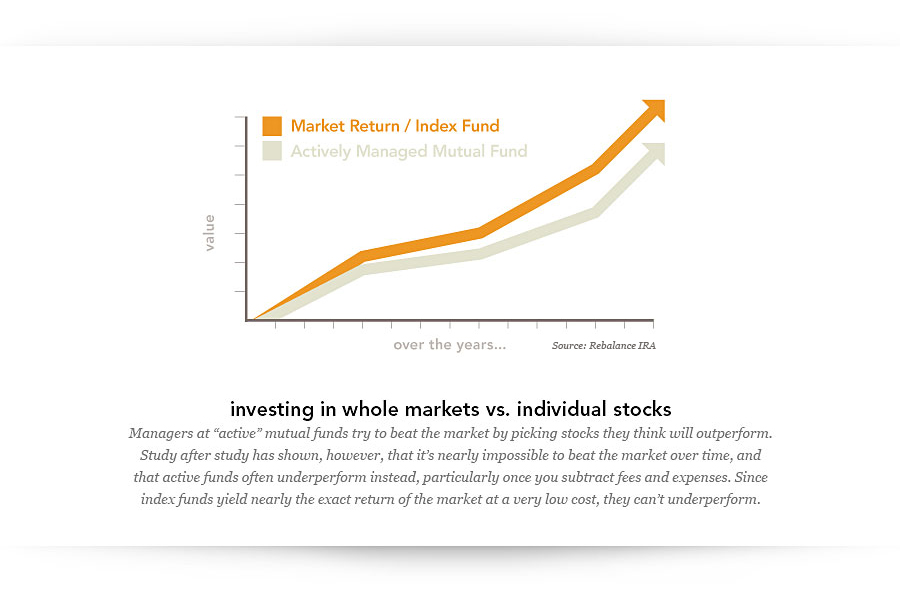

MPT is the opposite of “stock picking.” Analysts who pick stocks attempt to find a small group of stocks or bonds that they believe will outperform entire markets represented by a corresponding index, such as the S&P 500. Instead of analyzing and purchasing single companies or sectors, however, MPT counsels you to buy the index itself.

The theory assumes that investors are rational and that markets are efficient. Over time, owning an index is likely to lead to a higher return compared to owning a subset of individual stocks chosen by an analyst. Research has shown this to be true: You can get a solid, wealth-building return while taking far less risk.

An important concept to understand is volatility, a measurement of how far below average an investment’s “bad years” are likely to be. Short-term volatility can be thought of as “risk.” How much might a single asset decline in value? How would you, as an investor, react to such a short-term decline?

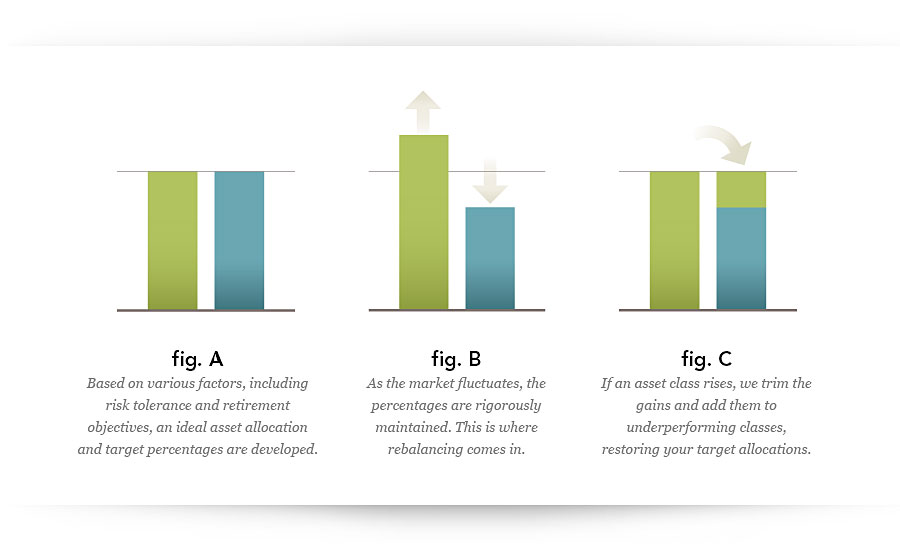

Using modern portfolio theory, investments are statistically measured in terms of both their expected long-term rate of return and their short-term volatility. A portfolio is then created that combines assets in such a way that the return is the weighted average of the assets held within.

By combining assets whose returns are uncorrelated, MPT seeks to reduce the total variance of the portfolio. A reliable return with lower risk and lower cost, compounding over time, creates a winning retirement portfolio.

In a given year, different asset classes perform differently, making it difficult to predict which asset will perform best. It might be entertaining to try to predict the “best” asset class, but such forecasting is risky and unsustainable. Research demonstrates that people who jump from asset to asset—leaping from rock to rock, faster and faster across a rushing stream—usually finish with worse results than an investor who undertakes a careful, disciplined process. People simply can’t predict the future, and when they try they often end up knee-deep in trouble.

Finance research experts, major endowments, pension funds, and private investment professionals broadly agree that MPT is a safe, solid, repeatable method for managing a portfolio. Historically, however, MPT-based advice has been available only through high-end financial advisors who typically require minimum account sizes of $1 million and who charge annual fees of at least 1% of assets under management.

Rebalance seeks to “democratize” modern portfolio theory by bringing this level of advice to everyone for a fraction of the cost.