As 2023 draws to a close, this question may be on many investors’ minds.

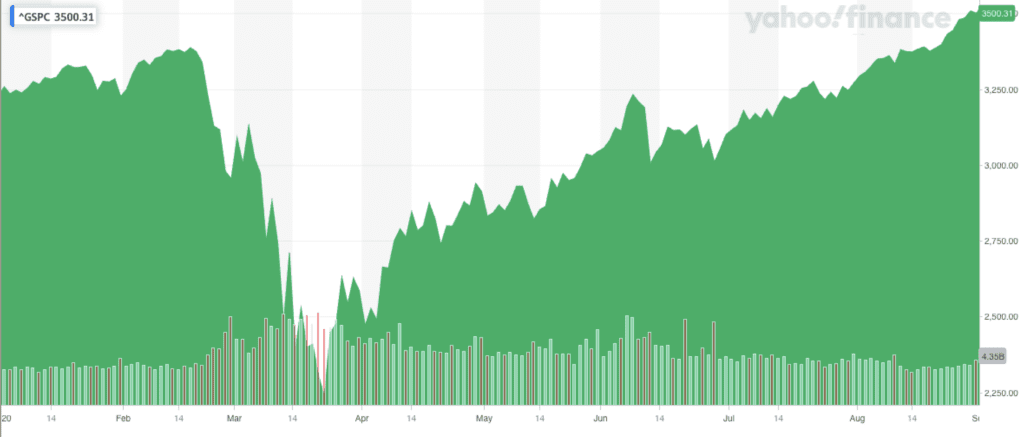

Stock markets in the year 2020 started off on an upward trend with the S&P 500 Index increasing from a closing value of $3,230.78 on 12/31/2019 to $3,386.15 on 2/19/2020 (a gain of about 4.8% in less than two months).

However, as the onset of the COVID-19 pandemic became increasingly apparent, investors feared the implications of this new disease and stock markets took a sharp decline. From 2/19/2020 to 3/23/2020, a downward trend prevailed with the S&P 500 Index reaching a low for the year of $2,237.40, representing a decline of over 33% in just over a month. If you were an investor during this time and looked at your account statement, you likely felt this and remember it vividly.

Amazingly, the S&P 500 Index turned around and recovered to the previous 2020 high by 8/18/2020 (closing at $3,389.78). The recovery from 3/23/2020 to 8/18/2020 represents a gain of about 51.5% which was achieved in less than five months.

Of course, COVID-19 had not gone away, but investors accounted for new information as it came in and, in general, decided that stocks were worth buying and holding. Just like with many other things the U.S. experienced with COVID, this drastic selloff and relatively quick recovery probably did not feel “normal”. The graphic below shows the index during the first eight months of 2020 (source: Yahoo Finance).

Looking at the calendar year of 2020 overall, the S&P 500 Index returned about 18.4%.

The rally continued through 2021 until the S&P 500 hit its all-time high of $4,796.56 on 1/3/2022 (as of this article, the index has yet to exceed that record).

Government stimulus to individuals and businesses, combined with historically low interest rates (meaning it was very inexpensive for people and businesses to borrow money), represent some of the major forces behind increasing corporate profits and stock prices in 2020 and 2021. One repercussion of this easy money was inflation (rising prices) which just about everyone has felt in at least one aspect of their life. Inflation has hurt many individuals and businesses alike.

The Federal Reserve (or the “Fed”) has a mandate to conduct monetary policy “so as to promote effectively the goals of maximum employment, stable prices, and moderate long-term interest rates” (source: Federal Reserve). This means the Fed aims to (A) keep unemployment down, (B) keep inflation at a reasonable level, and (C) keep long-term interest rates under control.

Let’s focus on the second listed item, inflation. One of the ways the Fed manages inflation is by controlling interest rates. The Fed can raise interest rates which makes it more costly for people and businesses to borrow money. This typically has the effect of slowing down borrowing/lending, spending, and inflation. If it gets it just right, the Fed can bring inflation to its target level (the current target is 2.0% pear year – read more here) without “breaking” the economy (i.e. causing problems with those other two parts of the Fed’s mandate, unemployment and long-term interest rates).

Getting it just right is the “soft landing” you have likely heard about on the news. Inflation has dropped significantly and is headed in the right direction but not yet at the Fed’s target. Headline inflation (measured using the 12-month percentage change in the Consumer Price Index) was 3.1% in November 2023 while it was 7.1% in November 2022 (source: U.S. Bureau of Labor Statistics). Time will tell whether we’ll see inflation at the 2% target without the country going into a recession.

[Note: It is important to clarify that reducing the level of inflation usually does not mean prices go down. When prices are still going up but not as rapidly as before (i.e. inflation is going down) that is called “disinflation”. Disinflation is what the U.S. has experienced in 2023 and it is what the Fed intended. When prices actually go down (i.e., a negative rate of inflation), that is referred to as “deflation”. While lower prices on goods might sound nice at first, broad economic deflation can actually be a cause and symptom of declining economic activity and is generally not a good sign.]

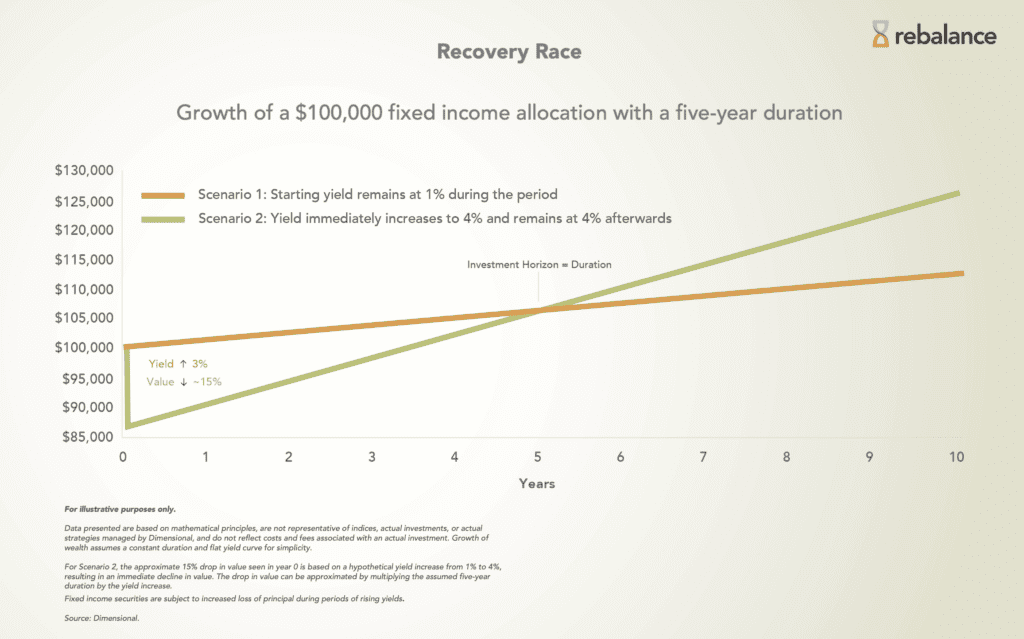

Most investors in U.S. markets had a particularly painful year in 2022 as inflation and other forces drove stock prices down. Adding to the pain was that most bond holdings also declined in value as interest rates were increasing. There is an inverse relationship between interest rates and bond prices, so as rates went up bond prices went down. This can be difficult to experience as an investor when it’s commonly expected that bond prices will “hold up” when stocks are down.

However, the silver lining to the bond story is that interest payments and bonds reaching maturity can now be reinvested at higher interest rates. Generally speaking, it is actually a good thing for long-term bond investors that interest rates have gone up. The chart below shows a hypothetical situation of how rising rates initially hurt a bond portfolio, but ended up helping it to do better than if rates had stayed low.

So far, 2023 has been much better than last year for most investors in stocks and bonds. We’ve seen stocks recovering more quickly (the S&P 500 is up 21.79% year-to-date as of 12/8/2023) compared to bonds (Bloomberg U.S. Aggregate Bond Index is up 2.66% year-to-date as of 12/8/2023). This is not surprising as stocks tend to move more quickly and with greater magnitude (both up and down) than bonds. It could take some time for bonds to recoup their losses, but so far they’ve been headed in the right direction.

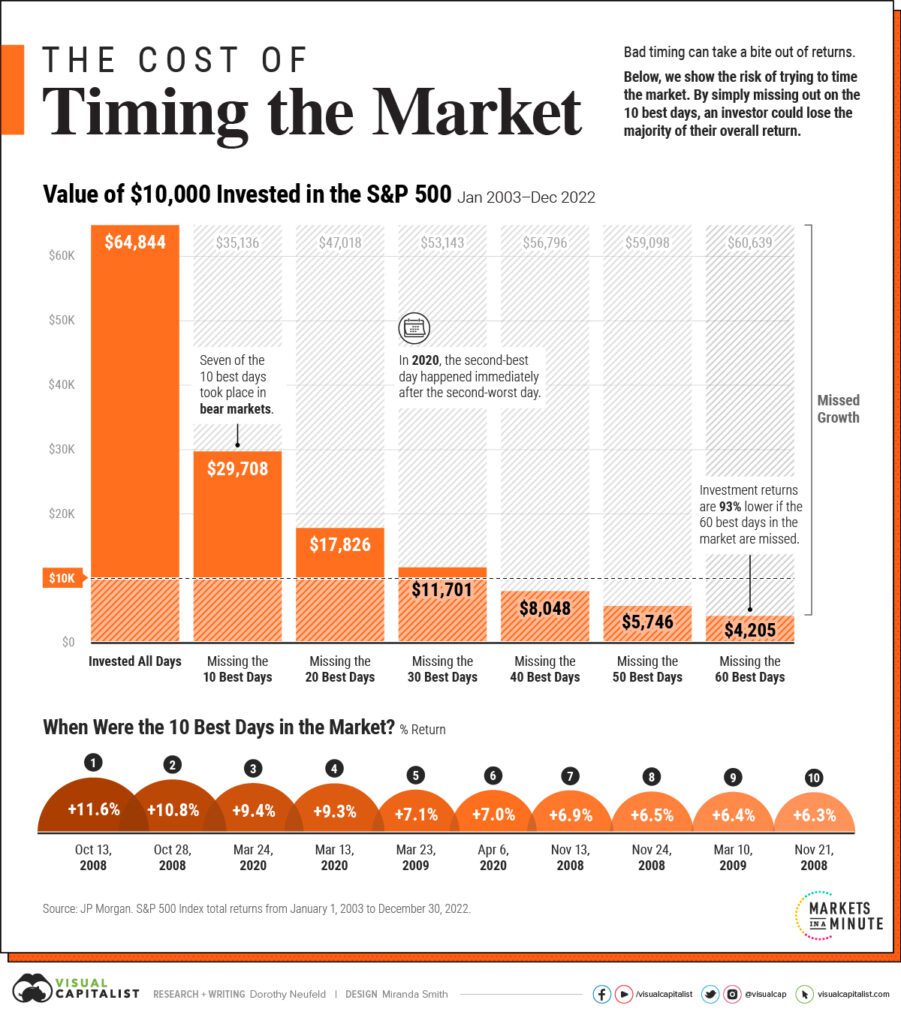

What does all of this mean going forward? The same as every year prior, we do not know exactly what the future will hold. But what we have seen time and time again is that patient investors have been rewarded. The infographic below illustrates the potential consequences of trying to time the market.

(This data is historical and is for illustrative purposes only. Past performance is not a guarantee of future results. Infographic source: Visual Capitalist.)

If you made it through the last four years without panicking and impulsively making changes to your investments, then give yourself some credit. It is not an easy thing to do. If you did press the eject button and go to cash when things were down in 2020 or 2022, cut yourself a break. You were not the only one. Use it as a learning experience so you can remain disciplined the next time things get difficult.

Every person is different, which is why it’s essential to assess your investment goals, cash flow situation, time horizon, and tolerance for risk so that you can invest in a portfolio that is suited to your individual situation.