Do you know how long you will live? Do you have enough money to make it? What does it take to reduce financial anxiety over retirement, once and for all?

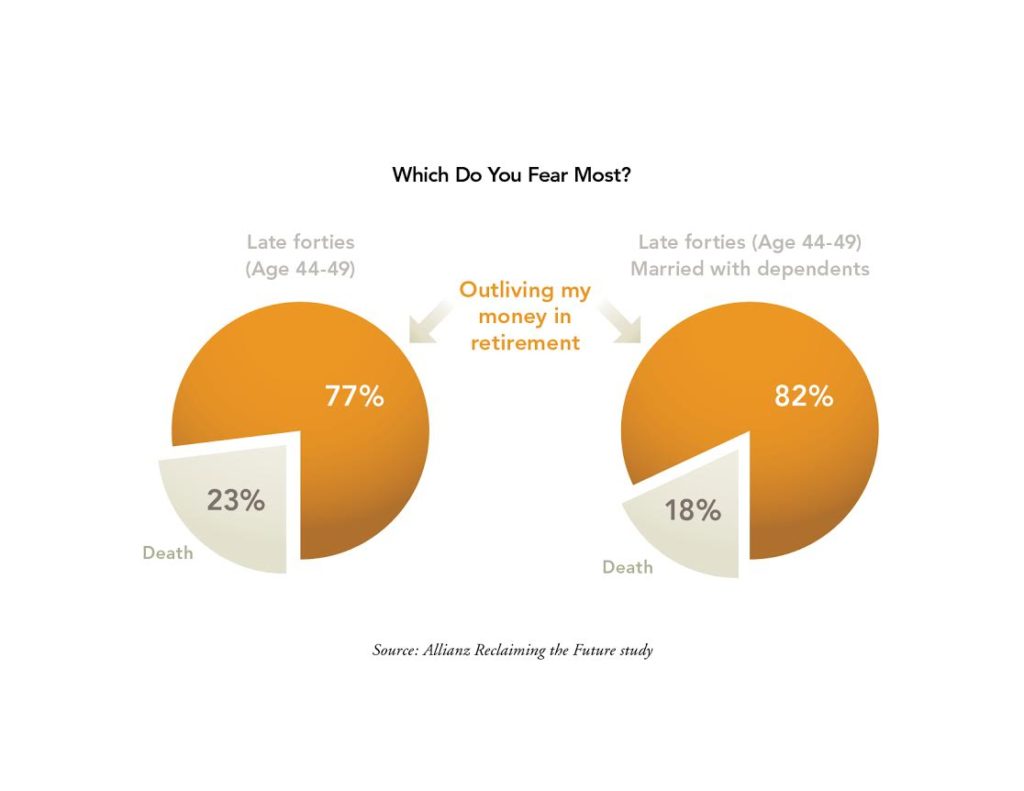

Sorry to be so blunt. Those are indeed scary questions. In fact, a recent survey by the Allianz insurance company found that 82% of respondents said running out of money in retirement is more scary than dying.

That’s an incredible insight but one that demonstrates how well most people understand the reality of life and death but largely don’t understand money.

Yes, we all will die someday, so why worry about it? Really, the important thing is to take care of your health and try to enjoy the life you have, right?

So, as we age, we diet and exercise and stay away from risky pastimes like rock climbing and ski-jumping.

The thing is, if we spent even half the time learning about investing and planning as we do new diets, our fear of money would dissipate faster than that five extra pounds we picked up over winter.

My colleague Mitch Tuchman wrote a great article on MarketWatch this week on exactly this problem. As he explains it, we are missing the forest for the trees when it comes to retirement.

A higher purpose

Very often it only takes a single conversation with a financial advisor to realize just how ready we are for retirement, and the simple steps one can take to ensure success.

Got a 401k? Increase your contribution. Unsure how and when to claim Social Security? You’ve got options.

Unclear how to invest prudently and in a way that will build your nest egg consistently over time? Decades of tested data show the way.

Reducing your financial anxiety is important and it can lead to major changes in your outlook on life — even put you in the unexpected position of using your money for a higher purpose, if you so choose.

It’s as much about planning as it is about attitude, and that comes from knowing where you stand today.