From solo 401(k)s to SEP IRAs, a self-employed retirement guide

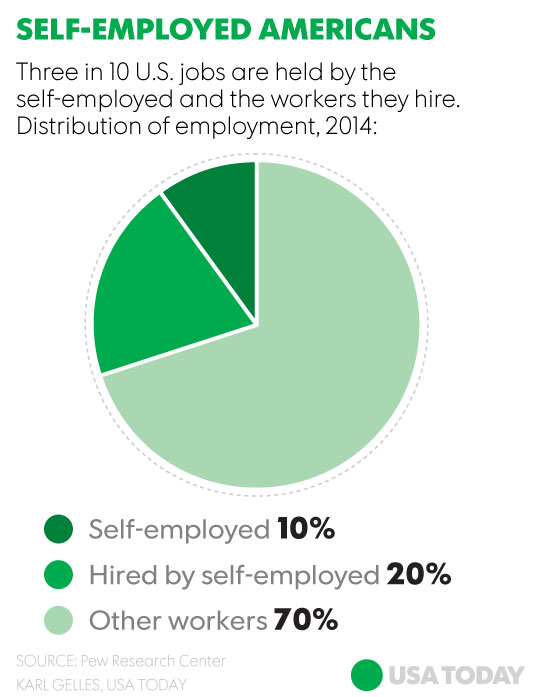

Are you self-employed? You may be interested in the retirement investing strategies and best practices Scott Puritz discussed with USA Today.

Americans running their own businesses wear many hats, acting as their own tech support, accountant and secretary, among other duties.

As a result, it’s easy for many to forget another key role they must play: that of retirement benefits coordinator. “If you’re a traditional employee, there’s a menu of things you get. But if you’re an independent contractor or an entrepreneur, you have to fend for yourself when it comes to benefits, including retirement planning,” says Scott Puritz, Managing Director of retirement services firm Rebalance in Bethesda, Md.

But thankfully, there are a number of tools and incentives out there for self-employed individuals to ensure they can save for retirement just as effectively as those working for a big company with full benefits.

Solo 401(k)s

The 401(k) plans common among larger employers are great ways to save for retirement because of their tax-deferred nature, says Jamie Hopkins, retirement income program co-director at The American College of Financial Services. “We know that’s one of the best ways to save, on a tax-advantaged basis, because you get to put more money away by using pretax dollars,” he says. “And then afterwards, your investments also get to grow tax-free.”

The best course of action for many contractors and freelancers, then, is to establish their own tax-deferred plan, Hopkins says. And in fact, there is a so-called “solo” 401(k) option for the self-employed that offers many of the same benefits as larger plans offered by big corporations.

Puritz says his firm increasingly recommends solo 401(k) plans to the self-employed over the alternatives. Not only are there tax benefits, but solo 401(k)s allow his clients to save much bigger sums — up to 25% of income or $53,000 for tax year 2015. And if you’re older than 50, the limit is as much as $59,000.

The biggest restriction is that participants must operate as sole proprietors, claiming themselves as the only employee of their business, he adds. But for high earners looking to save a lot for retirement or reap the tax benefits, solo 401(k)s are a powerful tool.

“These folks tend to be 55, 65 years old where they are consultants and right at the sweet spot of their profession in terms of revenue generation,” Puritz says. “Their kids are off to college, their mortgage is paid down and they can sock away a lot of money.”

A solo 401(k) has the additional benefit of being a credit line of sorts for your business because you can borrow the funds you contribute to your retirement account, says Hopkins.

“You pay yourself back, so terms might actually be better and cheaper than taking a short-term loan from elsewhere,” Hopkins says.

This flexibility may be attractive to entrepreneurs who want to invest to grow their businesses. But just make sure you pay the 401(k) loan back in full and within 12 months, he adds, or else you’re not just bleeding down your retirement funds but also incurring big penalties for the early withdrawal of those funds.

IRAs for the Self-Employed

An alternative to a solo 401(k) is the simplified employee pension IRA or SEP IRA. While these accounts aren’t as flexible, with lower contribution limits and no potential for loans, they do offer lower administrative fees and less paperwork.

“The benefit of a SEP compared with the solo 401(k) is that it’s incredibly easy to set up and with no annual filing requirements,” Hopkins says. “It’s very simple.”

The fact that you can set up and fund a SEP IRA in minutes makes it ideal to self-employed Americans who perhaps don’t have the means or the inclination to save a huge sum of money via a solo 401(k), he says.

It’s also worth noting that while SEP IRAs and 401(k)s are dedicated savings vehicles for the self-employed, contractors and freelancers will also have access to mainstream IRA products they may already be familiar with.

“If you chose to set up a SEP or a solo 401(k), it doesn’t mean that you lose access to a Roth IRA or a traditional IRA,” Hopkins said. “Those are still available to you under the same restrictions for everyone else.”

In fact, funding both a tax-deferred plan like a SEP and a Roth IRA may be a wise choice for younger workers “because we don’t know where tax rates are going to go in the future,” Hopkins said. After all, a Roth IRA is funded with after-tax income, so withdrawals can be made tax-free regardless of how much rates change in the next 10 or 20 years.

But the bottom line is that whatever retirement-planning vehicle you use, the idea is to set up a disciplined way to save and plan for the long term. In many ways, that process is more important than where your contributions go.

“There are big behavioral and financial benefits to setting money aside for your retirement, making it automatic and not spending it,” Hopkins said. “That’s really what you’re after.”