Investing Your Big Fat IRA

Two Forbes Magazine reporters were allowed to attend a portion of the annual Rebalance Investment Committee meeting in New York. They were so impressed that they wrote two articles and showcased our firm’s Diversified Growth retirement portfolio.

Nagging question for someone departing from a job, at retirement or in midcareer: where to roll over the 401(k). Inertia, memories of the 2008 crash or misgivings about managing a large pot of money may lead to a bad answer. Good answers are readily at hand.

What you do with a retirement account will, in the end, depend largely on two things: your tolerance for risk and your tolerance for fees. You’ll do best if you can stand a fair amount of market risk and are averse to paying fees — meaning you are prepared to make decisions on your own. But not everyone has those inclinations.

If you are fearful, plenty of money managers are ready to hold your hand. The country’s IRA assets are probably close to $6 trillion (last official count: $5.4 trillion two years ago), and they provide a rich bounty of fee income.

The pros will tell you that you need their help “rebalancing.” That means periodically adjusting an account so that it maintains a desired weighting of stocks and bonds, or of U.S. and foreign securities. If stocks run ahead, as they have done recently, your money manager would sell some and reinvest in bonds. That’s a worthy activity, if the main purpose is to maintain a portfolio’s risk level. Whether rebalancing adds to returns, as is often claimed, is another matter.

Does rebalancing have to cost you a stiff management fee? Not at all. The Vanguard Balanced Index Fund maintains a steady 60/40 blend of stocks and bonds, and it’s dirt cheap at 9 basis points ($90 annually per $100,000 invested). For a slightly higher expense burden you can get a Vanguard balanced fund that has foreign stocks and bonds in the mix.

Vic Presutti, a 76-year-old in Dayton, Ohio, chose the cheap solution. When he retired from a job in operations research at the U.S. Air Force 16 years ago, he plopped his entire federal thrift account into an IRA invested in the Vanguard Balanced Index Fund.

“Occam’s razor says the simplest answer is often the right one,” Presutti explains. “I used to own a Janus fund and agonize over it. With this I don’t.”

At the other extreme: the custom-made portfolios of mutual funds you might get from a stockbroker in a branch office of a national firm like Edward Jones or Wells Fargo. Personalized advice is costly. A wrap fee in the neighborhood of 1.5% typically comes on top of mutual fund expense ratios. There’s a good chance your combined expenses will top 2%.

In the wide-open space between the costly stockbrokers and the cheapskate do-it-yourselfers lies a large population of semi-automated money managers connecting to clients via telephone and the Internet. They’ll put you in low-cost index funds — and rebalance them — for a fee of 0.25% to 0.5% annually.

“We give wealth services to the masses,” says Mitch Tuchman, the 58-year-old software entrepreneur turned money manager who co-founded Rebalance two years ago along with fellow Harvard Business School classmate Scott Puritz. His firm’s 0.5% fee entitles a customer to at least an hour a year of phone counseling in which retirement ambitions and fears are probed and a prefab package of exchange-traded funds assigned. Add in the 0.15% expense ratio for the firm’s most popular portfolio and the cost comes to 0.65%.

That’s a lot–just shy of $4,000 a year on a $600,000 portfolio. But Tuchman says his clients are the ones who would never go it alone with their rollovers. If he doesn’t rescue them, he says, they will remain the prey of stockbrokers charging three times as much. (Tuchman is a Forbes.com contributor.)

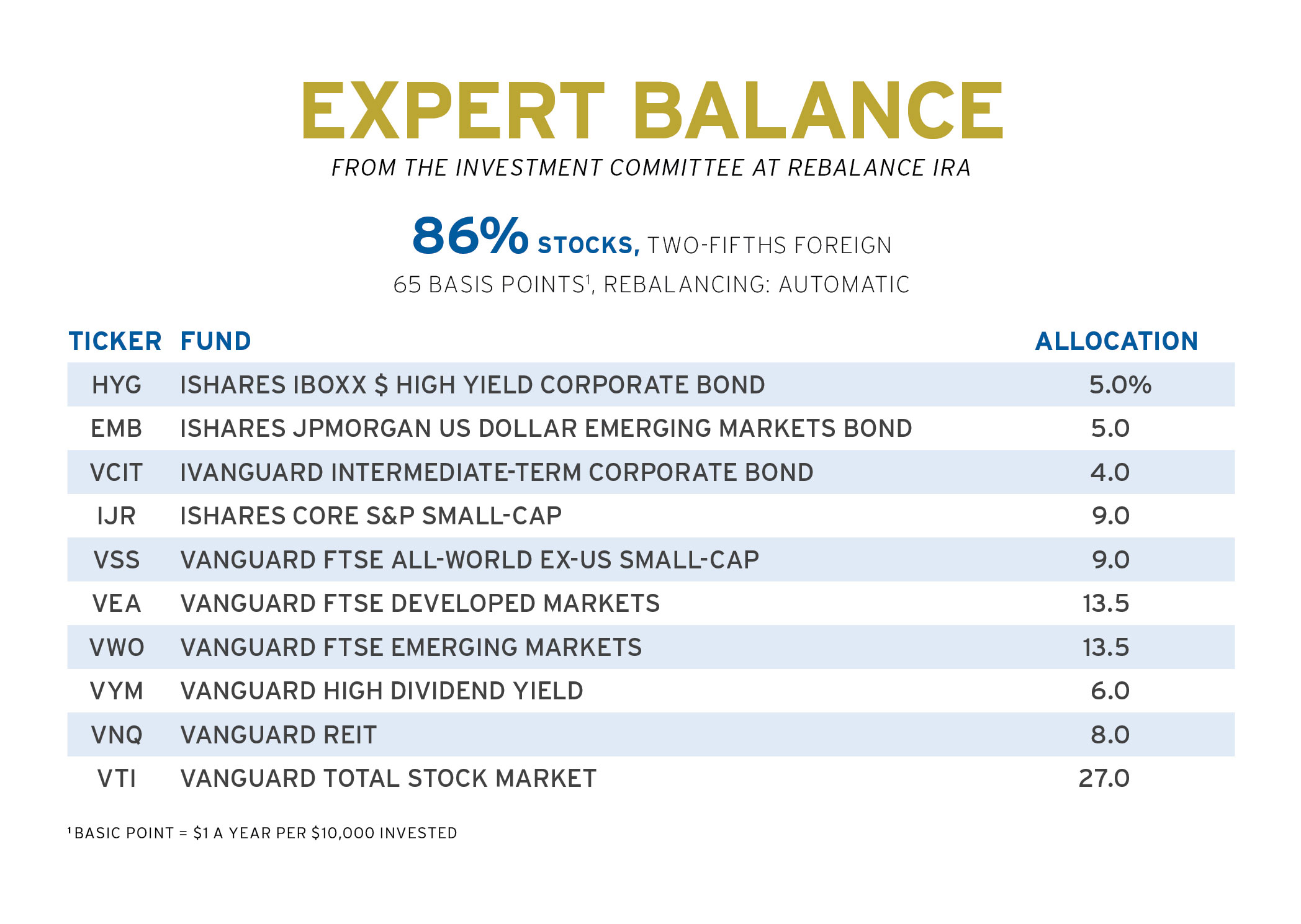

For a moderately risk-tolerant mid-career saver, Rebalance would recommend a mix with an 86% dose of stocks. The package was created with the help of an Investment Committee comprised of finance luminaries, including Burton Malkiel (author of the classic A Random Walk Down Wall Street) and Charles Ellis (a veteran of half a century of pension fund consulting).

The Rebalance Investment Committee undertakes elaborate evaluations of risks, rewards and costs to arrive at investment recipes. The risk-tolerant one is heavy on small companies because, the experts determined, small companies tend to do better than large ones. It’s heavy on emerging markets because that’s where there will be more economic growth. It’s light on bonds because those things offer such meager rewards. (Why buy an AT&T bond paying 2.5% when the stock yields double that?, Professor Malkiel asks.)

You can get all this expertise without paying for it. Our Copycat portfolio starts out the same as Tuchman’s. But you’d be on your own with any rebalancing or with figuring out how this IRA fits in with the rest of your assets and liabilities.

With or without professional help, contemplate these matters:

How much risk can you stand? The hazards of stocks are considerable at any time. Now, posit economists at the San Francisco Federal Reserve Bank in a recent paper, we have the risk that retiring Baby Boomers will line up en masse to exit equities, depressing returns for the next decade. It doesn’t help matters that stocks are at the moment trading at an abnormally high multiple of their long-term earnings.

Ask whether you have the stamina to hang in for a rebound if Wall Street pulls a repeat of 2008. And who guarantees that there will be a rebound? Stocks might crash and not recover in your lifetime.

What other assets do you have? Charles Ellis, the pension expert on the Rebalance Investment Committee, says younger workers have a big asset they don’t think about: their future career earnings. This somewhat predictable income stream is more like a bond than a stock. To balance out, he says, younger savers should lean toward stocks.

Do you have enough in that IRA? A midcareer sum of $600,000 is a lot more than most people have, yet it may fall short for a better-paid worker expecting to maintain a standard of living in retirement. Fidelity Investments has a formula saying that a 50-year-old should have four years’ salary salted away.

At age 66, $1 million looks like a lot. But with a safe 4% withdrawal rate, an IRA of that size generates only $40,000 a year, or maybe $30,000 after taxes. It scarcely makes up for the traditional corporate pension that has gone missing.

How much effort do you want to put into fussing with your IRA? You could rebalance every week, or add all sorts of exotic categories like emerging market bonds, and still end up doing no better than someone with a plain old balanced fund mixing stocks and bonds. The simple solution chosen by Vic Presutti has a lot going for it.