Investing May Be Cheaper, but Fees Still Hurt

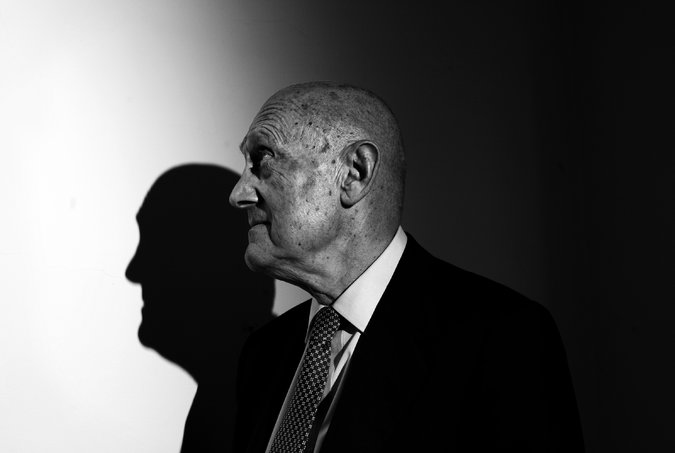

Professor Burton Malkiel, a key member of the Rebalance Investment Committee, is profiled in a recent New York Times article on the power of low-cost index investing.

Mutual fund expenses can take a big bite out of shareholders’ returns. That bite, on average, is shrinking, but academic and industry experts say it could — even should — be diminishing faster: Plenty of investment companies still charge a lot, and many consumers still opt for pricey funds.

Morningstar, the investment research company, and the Investment Company Institute, an industry group, both track mutual fund expenses. Their data, while differing slightly, tells the same tale: Investing in mutual funds is getting cheaper. And that means many investors can keep more of their return dollars.

“The only thing I’m sure about in investing is the lower the fee I pay, the more there’s going to be for me,” said Burton G. Malkiel, a professor emeritus of economics at Princeton University and the author of the well-known investment primer “A Random Walk Down Wall Street.” “Fees have come down, on average, because fees for index funds are so much lower than active funds, and people have moved to them.”

The measurement of fund expenses is a little technical, but it’s worth understanding. Fees are usually expressed as a ratio of expenses divided by fund assets. That number is called the mutual fund expense ratio.

Morningstar, in its 2015 fee study, reported that the asset-weighted average expense ratio for all funds was 0.64 percent last year, down 15 percent from five years earlier. Someone who invested $10,000 in a fund with that expense ratio would pay $64 a year in expenses. Thus, if her fund returned 5 percent, or $500, in the first year, she would pocket $436.

The asset-weighted average includes fund size in the calculations as opposed to equally counting everything from monsters like Fidelity’s Contrafund, with $103 billion in assets, to minis like Bridgeway’s Ultra-Small Company fund, with $128 million in assets. With asset-weighting, a big fund like Contra affects the overall average expense ratio more than a smaller fund like Ultra-Small.

When you cut through the complexities, it’s clear that the fund industry hasn’t gone the way of Walmart in its pricing. Rather, as Professor Malkiel suggested, many investors’ preference for cheaper fare is dragging down the average. Consider the popularity of the Vanguard 500 index fund — one of the country’s largest funds — which charges 0.17 percent for its basic investor shares. Vanguard’s chunk of industry assets under management has grown to an industry-leading 19.2 percent, as people have moved into its funds, the Morningstar report said.

But falling expenses are “more than just a phenomenon of money going into a handful of low-cost providers,” said Brian Reid, chief economist for the Investment Company Institute. “Competition has driven many companies to offer lower-cost share classes.”

A generation ago, investors typically had a choice between lower-cost funds acquired directly from fund companies and higher-cost ones generally bought through financial advisers. Today, investors using financial advisers can also often buy lower-cost shares, which don’t carry the sales charges that the industry calls loads. Advisers typically charge their clients asset-management fees, and then purchase the cheaper shares on behalf of those clients.

“If you looked at funds that were broker-sold in 2000, about 50 percent had a no-load share class,” Mr. Reid said. “Now about 90 percent of them have a no-load share class.”

Fund companies are prospering anyway. Even with these kinds of changes, “industry fee revenue is at an all-time high, reaching $88 billion,” Morningstar said. Over the last decade, total assets under management have more than doubled, while fee revenue has grown by approximately 78 percent, the company said. Yet funds’ asset-weighted expense ratios declined by only 27 percent. “Thus a much larger share of the benefits of the increase in assets under management has stayed with the industry rather than being returned to fund shareholders,” Morningstar said.

On one level, that’s not surprising: Fund companies are typically motivated by profit, and their goal is to enrich their owners. (Vanguard, which is owned by fund shareholders, is an exception.)

Yet every mutual fund has its own board of directors, which has a fiduciary responsibility to serve the interests of the fund’s shareholders, not the investment company that sponsors it, said David M. Smith, a finance professor at the State University of New York at Albany. Fund boards “need to think much more seriously about expense ratios that they are authorizing,” he said.

“To me, this is one of the big disconnects in the industry,” he added. “Too often, fund boards of directors don’t seem to be looking out for the interests of the fund shareholders” when it comes to expenses, he said.

This disconnect can seem especially acute in sectors like emerging markets, where the total numbers of assets under management are smaller. The average emerging-markets stock fund has an expense ratio of 1.54 percent, according to Morningstar. Some funds charge even more. The A shares of the Templeton Developing Markets trust, which do not include a built-in sales charge, carry a net expense ratio of 1.68 percent, for example, and those of the Delaware Emerging Markets fund carry a ratio of 1.69 percent.

Compare that with Vanguard’s Emerging Markets Stock index fund, which carries an expense ratio of 0.33 percent, or with Fidelity’s actively managed Emerging Markets fund, which carries one of 1.07 percent.

Seemingly small differences can add up to major costs. An investment of $10,000 in a fund charging 0.33 percent and returning an annual average of 10 percent would be worth about $100,000 after 25 years, while the same investment in a fund charging 1.69 percent would be worth only about $70,000. That gap in fees becomes significant when it’s time to collect on the investment.

“How is it that some fund boards believe it costs twice as much to invest in emerging markets as it does in developed ones?” asked Russel Kinnel, Morningstar’s director of mutual fund research. “There’s a lot of company information out there, and you don’t need three analysts based in Tunisia.”

Fund companies can incur higher costs when they manage money in less liquid markets like emerging countries, and this is reflected in expense ratios, said Tim Cohen, a chief investment officer at Fidelity Investments. “We do look at where the rest of the market is priced” when setting expense ratios, he said.

If there is consensus about expenses among analysts and academics, it is that cheaper funds are likely to provide better returns to investors. For example, Morningstar has examined expense ratios repeatedly and found that, over the long term, the performance of cheap funds beats that of their costlier cousins.

“I’ve done studies that find that funds in the cheapest quintile of expense ratios are a much better bet than the rest of the fund world, even the second-cheapest quintile,” Mr. Kinnel said. “I have a lot of confidence in this finding, and one of the reasons I have so much confidence is that every time we study it, it has predictive value.”

In investing, as elsewhere in life, cheap is relative. Professor Malkiel said his benchmark for bargains in a fund category was whatever the cheapest index funds charged. Actively managed mutual funds, on average, don’t beat the market, he said. Thus the sensible path for retail investors is to accept the market’s returns, minus low expenses, that index funds can deliver, he said. “This wouldn’t hold if active funds were getting a higher post-fee return,” he said. “But the evidence is abundantly clear that they’re not.”

Not everyone wants to invest only in index funds, of course. Some investors enjoy the challenge of finding a fund that might beat the market. Others believe that active managers can succeed in less picked-over sectors or deliver market-matching returns with less risk.

Investors who opt for actively managed funds should seek those that have delivered a better-than-average return over three to five years than peer funds and have cheaper-than-average expense ratios, said Todd R. Rosenbluth, director of exchange-traded fund and mutual fund research at S&P Capital IQ.

“That way, the fees won’t weigh your returns down as much,” he said. “Actively managed equity funds have around a 1 percent expense ratio on average. So if you’re paying more than that, you may be paying too much.”