Dental Practice Rattled by COVID-19? Act Now to Secure Your Future

Surprisingly, dentists still do not plan well for their retirement years. Are you one of them? Financial advisor Scott Puritz offers a few easy things dentists can do now to jumpstart their retirement savings. It’s not as hard as you may imagine.

Do you think you’ll have a better quality of life during retirement, or a worse quality? Most people settle for “about the same,” but shockingly, in 2014, the American Dental Association reported that 96% of dentists will struggle to retire and maintain the same quality of life they enjoyed while working. That’s despite annual incomes well into six figures. Most interestingly, the data comes from a survey dated before COVID-19 ravaged dental practice budgets.

So, why do so many dentists think they will find themselves not living as well in retirement? In part, dentists often focus on paying down educational and business debt before starting to save money for retirement, even though the data shows that early, steady investing is the key to compounding wealth over time.

The allure of living debt-free is powerful, but the ability to save tax-free and begin the process of compounding interest is essential for a successful retirement. This debt is not exclusive to young dentists; mid-career dentists often accumulate a significant amount of debt compared to other professionals. Investing in your business through expansion can seem like an essential cost, but it too often comes at the expense of retirement savings.

Another common practice in the industry is relying on the sale of a dental practice to fund retirement. If the last year has taught us anything, it is that you may not be able to get the price you want for an asset when you want it. Expecting to sell a practice successfully is essentially taking a bet, and your ability to retire is the stake.

Invest in yourself first

Instead, we recommend practice owners consider first investing in their own retirement goals. That way, you’ll have the ability to generate monthly income later in life. If you sell the practice, that’s a bonus, not the whole ball of wax. Among other problems, receiving a large lump sum at once means the risk of high tax payments as well as the temptation to spend the money too quickly.

Another part of the problem is market risk. Many dentists are DIYers when it comes to retirement planning. Many well-educated people think that they can pick stocks and do well, but this rarely works out. Once taxes and fees have been paid and your time has been accounted for, it is very unlikely that you will be able to outperform the S&P 500 Index or a traditional 60/40 mix of stocks and bonds. If 92% of full-time professional large-cap stock investors can’t do it, why do other professionals believe they can achieve this vaunted goal on their own, part-time?

All of these issues have been exacerbated by COVID-19. It may seem like you’re facing an uphill battle. Fear not. There are some easy, common-sense steps to take that will help you retire comfortably.

The most obvious solution is to cut back now and save more for your retirement. But this isn’t always possible, especially during a period where many dentists have seen their income drop. Debt from setting up a practice and pursuing education combined with the costs of raising a family can mean that, despite earning good money, dentists do not have a large amount to put aside on a monthly basis.

Nevertheless, putting any money aside now will allow that money to grow over time. For reference, a return on investment of just over 7% means your savings should double every 10 years. Making radical adjustments in the medium term may not be possible, but an easy first step could be a calendar reminder to talk to a financial advisor around tax time next year.

Topics for you and your financial advisor

First, make sure you are taking advantage of any tax saving incentives that allow you to save for retirement. While 401(k)s are a great way to invest in retirement, there is also the option of adding a cash balance plan. These plans are different and can allow dental practice owners and partners to defer taxes on up to $260,000 annually.

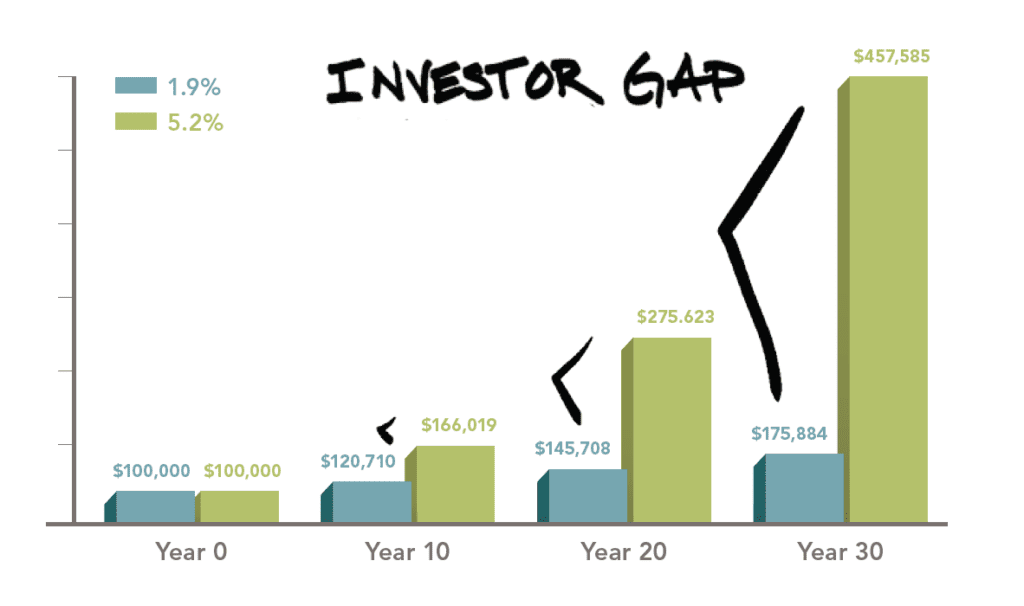

Second, ensure that you pay low fees for your retirement plan. Many typical 401(k) plans charge more than 2% of your assets under management (AUM) annually, regardless of your portfolio’s performance that year. Our company, Rebalance, has fees of 0.7% of AUM and lower. Over the lifetime of a retirement plan this can equate to tens of thousands, even hundreds of thousands, of dollars that stay in your plan and grow for you.

Additionally, make sure that you are getting at least a solid market return on your investments. The image below shows how $100,000 will grow over time depending on your rate of return. This is why getting steady gains while reducing fees is key in preparing for retirement, not “beating the market” just to pay it back in the next downward slide, all while paying huge fees for the experience.

Traditional 401(k) plans from paycheck processing and insurance companies tend to charge high fees of 1% to 2% of the plan assets, without providing other resources, such as staff education, risk management and IRS reporting services. In comparison, modern 401(k) plans can reduce fees to as low as 0.7% while providing these service levels as included features.

Third, if you are a confirmed DIYer, it’s still worth considering moving your money to a low-fee manager. It’s hard to imagine a financial advisor who would feel confident doing their own dental work, no matter how minor the treatment.

Letting go is hard but consider the value of your time. Having your money invested by a fiduciary who will also manage IRS reporting can save a dental practice owner dozens of hours annually. Also remember that fiduciaries, as opposed to brokers, have a legal responsibility to act in your interest. Instead of working for commissions, a fiduciary offers you advice and guidance with the goal of benefiting you first, ahead of themselves or their firms. Not every person who claims the title of financial advisor is a fiduciary, even if they claim in their marketing to “put the client first.” Ask point-blank, “Are you a fiduciary?” and then get it in writing. Any response short of, “Yes of course, here you go” is a red flag.

Having this level of trusted guidance is especially important right now as COVID-19 has led to concern over the state of the stock market.

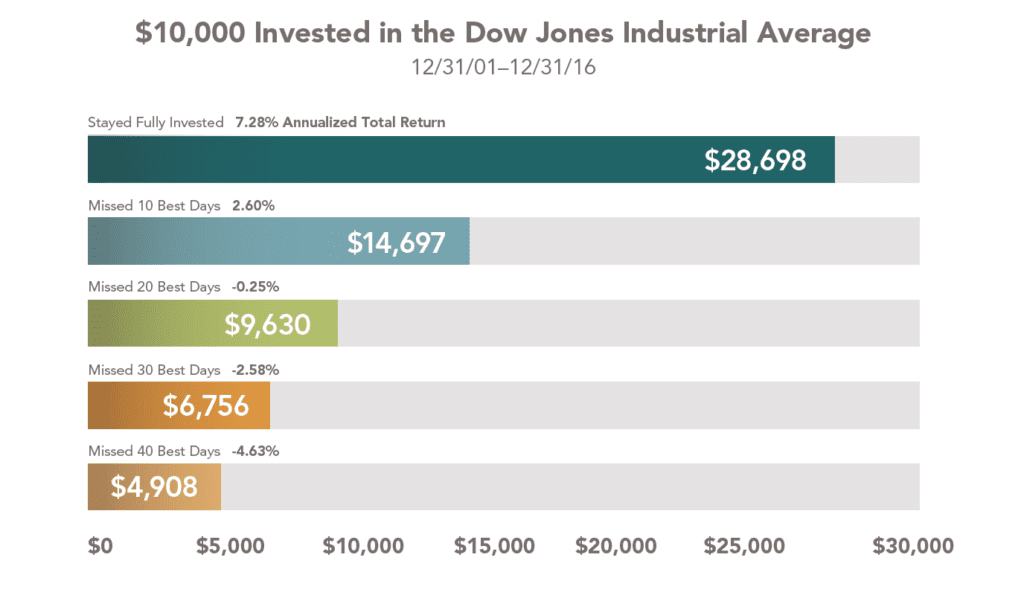

You may wonder, what should I do about my retirement investments? Should I stay in the market? The easy answer is “yes.” As the chart here shows, entering and exiting the market leaves you liable to miss major market gains, even if you happened to be in cash for just 10 days during the past 15 years. Your goal should be “time in the market,” not “timing the market” for the best results.

If you still want to control your own assets, it is possible to remove much of the stress of holding a portfolio by broadly diversifying. Princeton professor Burt Malkiel, author of the perennial bestseller, A Random Walk Down Wall Street, and a member of the Rebalance investment committee, refers to diversification as “the only free lunch” offered by financial markets.

As Malkiel explains, holding a wide variety of asset classes has historically left investors experiencing slightly lower gains during bull markets but far less drastic losses during bear markets. We find that owning a portfolio of low-cost exchange traded funds (EFTs), rather than selecting stocks, is the best way to do this. Using ETFs managed by a fee-only fiduciary advisor rather than a brokerage firm can see your annual fees fall from 2.5% to under 1%.

If you have found yourself in a financially precarious position, take a look at the CARES Act. There are provisions in these acts that may help you in the short-term. Some highlights worth exploring are hardship loans, and loans against your retirement account. Just make sure that you fully understand the implications of your actions and remember that the deadline to take action is December 31. We have a great help center to help you better understand the resources available during COVID-19 at covid.rebalance360.com/.

Finally, have a financial plan and stick to it. Make sure that you cut your fees, and make sure that you are getting a good rate of return. Commit yourself to planning for retirement today and your future self will thank you.

I hope this advice is helpful. If you have questions about planning for your retirement, feel free to call or email me at jmyers@rebalance360.com.