Those who pulled back during that time or never jumped in missed the recovery that peaked in 2022 when the Dow Jones Industrial Average had a record market closing of 36,799.65 points on Jan. 4, 2022.

For the first time since the stock market crash of 2008, consumer confidence with the stock market has returned. According to legendary Washington Post columnist, Michelle Singletary, investors have had a bumpy ride over the past decade. In the process, they have been rewarded with annual returns of approximately 12%.

More Americans own stocks. This is great for their financial future.

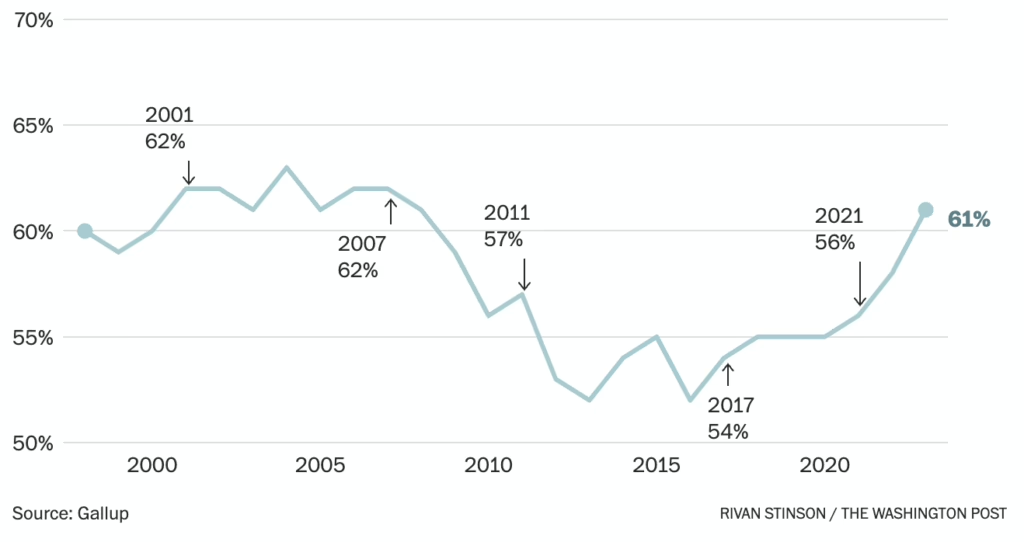

At 61 percent, this is the highest level since 2008, with millennials preferring traditional investments over cryptocurrency

By Michelle Singletary, June 6, 2023

Stock market gains over several decades helped me send my kids to college debt-free, buy cars with cash and, most recently, pay off my mortgage 11 years early.

I also expect my investments will account for a great share of my retirement income through my 401(k) plan.

Forget the fad investments such as cryptocurrency. Like so many others, I’ve chosen to place my financial well-being in the stock market. At times it’s been a rough ride, but it was better than letting inflation erode the value of cash sitting in low-paying deposit accounts.

Since 1998, Gallup has asked Americans about their stock ownership as part of its annual Economy and Personal Finance survey. The Great Recession scared a lot of folks out of the market, depressing ownership levels for more than a decade; it got as low as 52 percent in 2013 and 2016, according to Gallup’s most recent poll, taken in April.

But stock ownership is surging, according to Gallup’s latest survey.

“We’re finally back to where we were right before the Great Recession,” said Jeffrey Jones, a senior editor at Gallup.

Sixty-one percent of U.S. adults say they have money in the stock market, either as an individual stock, a mutual fund, or a self-directed 401(k) or IRA plan. It’s the highest level since 2008.

“While it’s hard to generalize about what investors are doing as a group, I think a huge factor is that performance has been so strong,” said Christine Benz, director of personal finance and retirement planning for Morningstar, a financial services firm.

Benz pointed out that the U.S. market has gained about 12 percent on an annualized basis over the past decade and about 10 percent over the past 15 years, which includes 2008, the worst of the global financial crisis.

“No other major asset class came close,” Benz said. “Bonds returned a little more than 1 percent over the past decade and 3 percent over the past 15 years.”

Stocks’ head-turning results are the key factor in the increase in market participation, Benz said.

Another reason is company retirement plans.

“When you look at 401(k) participant behavior, you tend to see a very pleasing pattern of investors buying, and buying some more, and just hanging on,” Benz said. “They’re not paying close attention to what’s going on with their accounts on a day-to-day basis, and that redounds to the benefit of their long-run returns and financial well-being.”

Not surprisingly, higher-income Americans are more likely to own stocks. More than 8 in 10 Americans with an annual household income of $75,000 or more own stock.

Older Americans aren’t exiting the stock market, according to Gallup. Baby boomers continued to hold on to their shares as they moved into their mid-60s, Jones said. Since 2001, more than 6 in 10 baby boomers have held stock.

And then there are the millennials. Those on the older side — now in their early 40s — are investing as they become established in their career and have more income to invest. Sixty-seven percent of those 30 to 49 own stock, according to Gallup.

“Over the last decade, they have seen stocks bounce back,” Jones said.

Here’s what you should take away from Gallup’s findings:

Volatility should not discourage you from investing. Set aside money you need in the short term, and then let the stock market do what it has historically done. Positive returns aren’t guaranteed, but it’s better than speculating on gold or crypto.

Gallup has long asked Americans which is the best long-term investment: bonds, real estate, savings accounts or CDs, stocks or mutual funds, or gold. Real estate and gold rank higher than the stock market this year. Gold was third behind real estate and stocks between 2015 and 2022.

Gallup put another version of the best-investment question to a random half-sample of respondents but added cryptocurrency along with the usual options.

Last year, 8 percent chose cryptocurrency, putting it ahead of bonds.

Following the collapse of crypto exchange company FTX last year and bitcoin’s price volatility, just 4 percent of Americans say cryptocurrency is best, according to the same survey Gallup took in April.

The bad news for the crypto market just keeps coming. The Securities and Exchange Commission filed a lawsuit this week, accusing Binance, the world’s largest crypto exchange, of violating securities laws and making false statements to investors. In another action, the SEC charged Coinbase with raking in “billions of dollars unlawfully facilitating the buying and selling of crypto asset securities.”

Benz said there are two trouble spots for investors overall and, in particular, for young adults with less experience — trading too often and speculative investing.

On actively trading: It’s dicey trying to time the market’s ups and downs. “Very few professional investors have had any luck with that sort of market timing, casting doubt on new investors’ ability to get it right,” Benz said.

On speculative investing: Don’t risk too much of your portfolio with cryptocurrencies, speculative stocks or narrowly defined exchange-traded funds, she said.

“I think it’s probably okay for younger adults to dabble a little bit in speculative assets if they need to scratch that itch,” Benz said.

But if your goal is to build wealth for the long haul, stick with broad-based stock funds and/or target-date funds. Most target-date funds hold a mix of stocks, bonds and other investments. This set-it-and-forget-it type of investing is designed to become more conservative as an investor gets closer to a particular retirement date. Target date funds are generally higher in equities for younger investors.

“That ability to be hands-off is particularly valuable as people progress in their careers and have families,” Benz said. “They may well have too much to do to tend to their portfolios.”