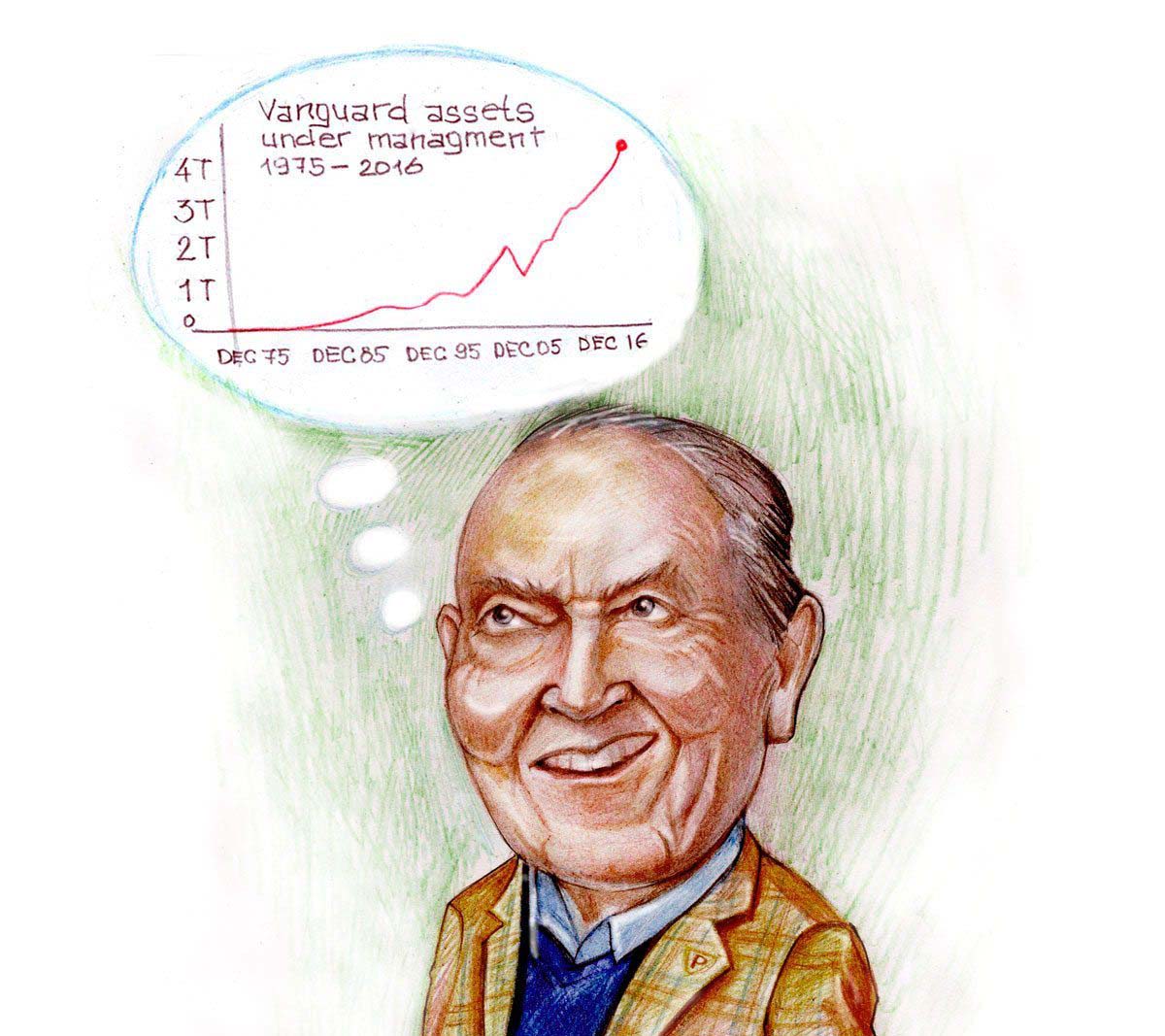

Jack Bogle, the founder of the massively ayuccessful (and just plain massive) Vanguard Group, recently said his former company is perhaps getting too big for its own good.

And big it is. The house that Jack built took in $276.2 billion so far this year, more than its eight largest competitors combined. Much of that money is coming from high-fee brokerages as investors finally accept that fees do irreparable damage to their investment returns.

Vanguard charges fund fees on average of 0.12%, compared to an industry average of 0.62%. Many brokerage accounts pile on fees that add up to a shocking 2% to 3% or more, once you add up mutual fund fees, wrap fees and other charges in the fine print.

But what does Bogle mean by “too big”? You’ll likely find a lot of folks writing about his interview with Morningstar as evidence that passive investing has run its course. That’s silly, but let’s break down the problem first.

Bogle isn’t to say, for one, that passive investing is too big. He’s saying the company he founded is nearing a limit on its ability to reduce costs.

“The economies of scale just can’t keep going on much longer. We’ve only got 12 basis points to go, and let me say it: There’s an irreducible minimum, no matter how big you are, just for the fun of it, 8 basis points, cost a lot of money to run this business,” Bogle said.

“We’re now talking about a 4 basis point improvement in cost. I just don’t think it’s worthwhile, hyping and trying to bring in more and more money,” Bogle said.

The important point here is that the problem Bogle is identifying is the completely internal problem of running Vanguard.

If the company manages to slice another few basis points off its costs — a laudable goal that might take 25 years in Bogle’s estimation — so what? At what point is marketing no longer worthwhile, Bogle asks? “You will get the market return less 5 basis points. If a manager guaranteed that to you over the next 10 years, he would probably take in billions or trillions. And we substantively guarantee that,” he says.

That’s very different from saying passive investing itself is “too big.” When you own an index fund of the broad stock market, you own the underlying stocks. Owning more or less of an investment is not something that becomes unsustainable.

In fact, investors would own them anyway via active management schemes, but they would simply pay more for holding the same stocks. Very often, those managers own stocks in essentially the same proportions, so-called “closet indexers” who attempt to track the market but at a higher fee.

Bogle goes on to lament the fact that so few companies have followed his vision of low-cost investing for all. He frankly fears regulation in the future if Vanguard and its few competitors get so large as to dominate as an oligopoly — a virtual monopoly run by a small number of firms.

Buffett’s elephant gun

You hear this lament about size from none other than Warren Buffett. His problem is different, but Buffett makes the same point.

Buffett’s Berkshire Hathaway has so much cash on hand to invest that he has trouble finding investments big enough to warrant attention. He often jokes about getting out his “elephant gun” to make a buy. Berkshire has $90 billion in cash to invest, which is the real challenge.

Why? Because when you’re that big, just making a bid moves the price higher. It becomes nearly impossible to invest without affecting the investment itself, to your own detriment.

Bogle’s index fund strategy is the opposite of this. He wants Vanguard investors to own all of the stock market and all of the bond market, be broadly diversified and stay invested through thick and thin. That’s hardly a recipe for moving the market.

Rather, it’s owning the stock market, not stocks. It’s seeking the return of business, not speculation. And it’s allowing economic growth and compounding to create gains, instead of trying to trade your way rich.

If more people do that through Vanguard than anyone else, it’s time for the rest of the industry to change. Now that’s the free market speaking!