I was honored and thrilled to participate in a sold-out panel for the CFA Society (co-sponsored by the Financial Planning Association) aimed at educating investors on the many differences between active and passive investing. During the lively panel discussion, I represented the side of “passive” or index investing, speaking to the potentially harmful drawbacks of active investing and the managers who participate in this practice.

At Rebalance, we are staunch advocates of index investing, namely due to the method’s historically proven benefits: lower costs, lower risks, and higher long-term returns. As such, I was proud to educate both consumers and investing professionals on how they can harness the power of index investing, and in turn live well and retire with more.

Below you can find a brief summary of the event (provided by Thomas King and Matt Hummel of the CFA Society), and if you would like to learn more about the differences between these investment methodologies, I encourage you to watch this brief video featuring Rebalance Investment Committee member Charley Ellis.

On the 6th of September the CFA Society Washington DC hosted a debate amongst three experienced investment professionals on the relative merits of the active and passive investment management techniques. The three panelists were:

- Lowell D. Pratt Jr., CFA; President of the Burney Company which undertakes investment research to inform active management, amongst other services;

- Scott Puritz; Managing Director of Rebalance which provides retirement planning services and constructs portfolios using ETFs exclusively;

- Jeff Porter, CFA, CFP; Principal and Chief Investment Officer at Sullivan Bruyette Speros & Blayney which provides financial planning and portfolio management services.

The debate was moderated by Walter Nocket, CFA, CFP; Senior Manager at Sullivan Bruyette Speros & Blayney. The discussion began with an agreement amongst the panellists that the primary goal of most investors investing for retirement is the achievement of positive risk-adjusted excess return. The crux of the debate was whether active managers could deliver this.

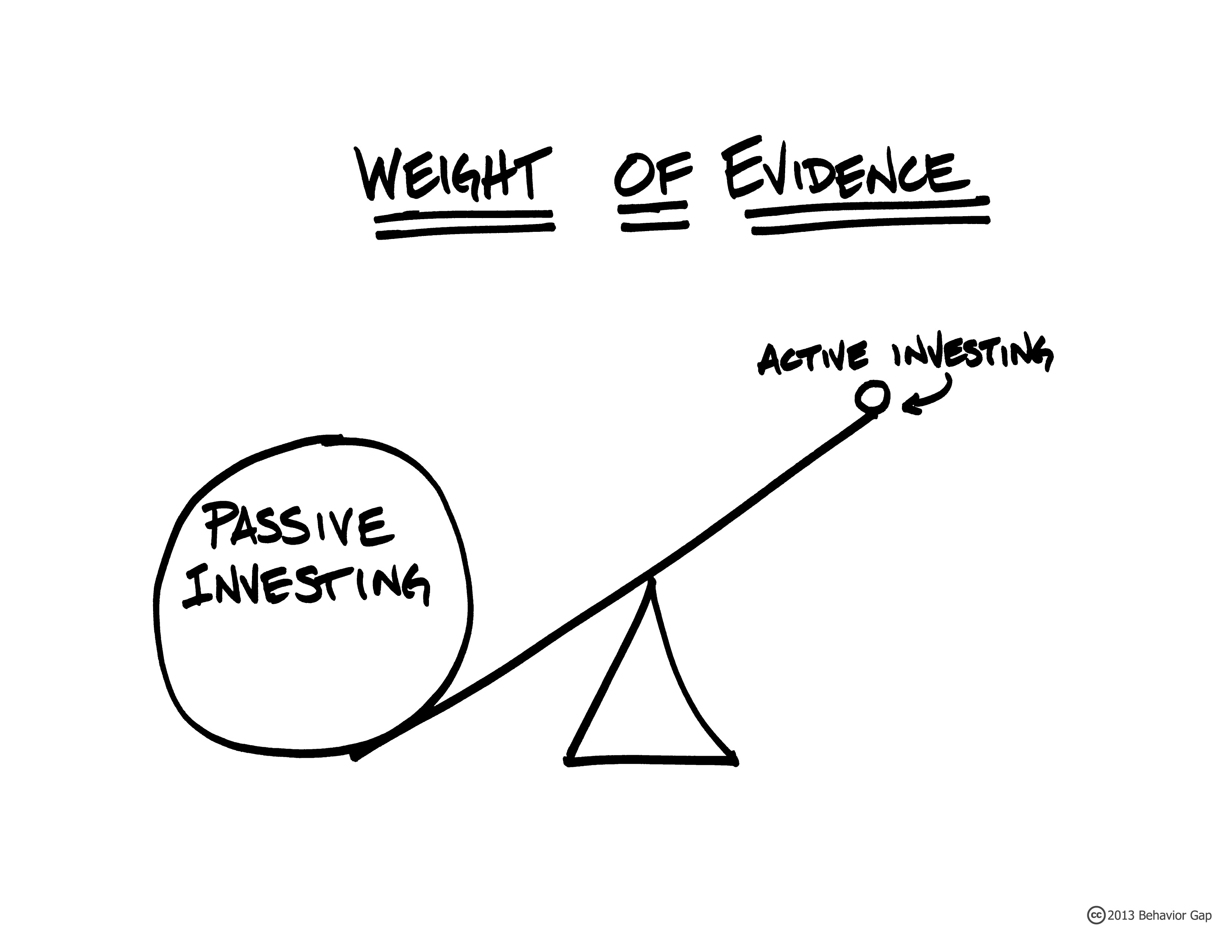

Studies have proven that most active managers underperform their benchmark and of those that do, rarely do so consistently. The importance of costs as an indicator of long-term performance was discussed, and it was agreed that index funds have lower costs than active management. In defense of active management, it was stated and agreed that it is particularly important after a crash, when investment opportunities are abundant.

The reduction in the number of opportunities available for professional active managers as a result of the decline in the participation of amateur investors in the market was discussed. Smart beta was discussed as a method which attempts to include the benefits of both strategies.

The final point of discussion was the slow migration of active managers to passive strategies, and the implications of this movement on the asset management industry. The debate was generously sponsored by FlexShares, the ETF branch of Northern Trust.