Retirement Investing Archive

Your Single Biggest Retirement Investing Mistake

by Mitch TuchmanIn defense circles, it’s known as “fighting the last war.” A country shaped by a protracted conventional conflict can be unprepared for guerrilla attacks. A nation used to commanding the high seas is unlikely to muster an effective standing army. Fighting the last war with your investments is a major tactical blunder. Sticking to a… Continue reading

Retirement Realities

by Charley EllisProfessor Charles D. Ellis of the Rebalance Investment Committee on the need to increase saving at any age in order to deflect the risk of real financial pain in retirement. Continue reading

The Real Cost Of The Pay Gap: Less Money In Retirement

by Sally BrandonHere’s a news flash: Unequal pay for women can mean unequal retirement. It’s common knowledge that women earn less than their male peers, about 77 cents on the dollar, the so-called “pay gap.” What’s less appreciated is the danger of when they earn less: The high-earning years in mid-career, when most people first get serious… Continue reading

Lessons From The 2008 Stock Market Crash

by Charley EllisProfessor Charles D. Ellis of the Rebalance Investment Committee on how the 2008 stock market crash tested his beliefs but, ultimately, confirmed his approach toward portfolio indexing for retirement. Continue reading

Market Timing Is Dangerous

by Burt MalkielProfessor Burton Malkiel of the Rebalance Investment Committee explains how market timing leads to emotional trading and, all too often, portfolio crushing mistakes that diminish retirement investment returns Continue reading

Do Investors Trade Too Often?

by Jay VivianJay Vivian, former managing director of the IBM Retirement Funds, talks about how the urge to trade is our own worst enemy, even if we think we know what will happen next in the markets. Continue reading

You Can’t Time The Market

by The Rebalance TeamInvestors are always in search of special techniques they can use to maximize their returns and save more for retirement. And who can blame them? A person’s retirement savings represents years of hard work as well as their hopes and dreams for the future. One common misconception is that investors can somehow save more by… Continue reading

Yale’s Robert Shiller: Stock-picking A Mistake for Most

by Mitch TuchmanIt’s possible to successfully pick stocks, says Nobel Prize winner and Yale economist Robert Shiller in a new interview, but like any game it’s competitive and hard — and best left alone by most. Shiller himself favors value investing, buying the stocks of “boring” companies whose valuations seem temporarily depressed. Nevertheless, he admits that he… Continue reading

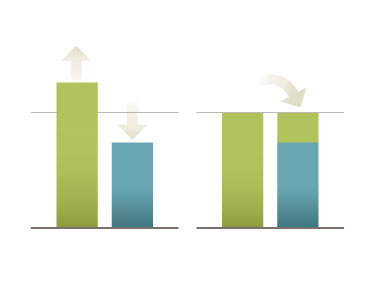

Smart Retirement Investors Rebalance Their Portfolios

by Jay VivianJay Vivian, former managing director of the IBM Retirement Funds, on the risk off putting of rebalancing in retirement funds and why having discipline on rebalancing makes a huge difference years later. Continue reading