Retirement Investing Archive

3 Crucial Retirement Investment Errors

by Mitch TuchmanThe latest data on our collective preparedness for retirement is out and it’s not great news, as you can imagine. One in four of us has less than $1,000 set aside for retirement, a depressing reality. But there’s good news buried under the oft-repeated scare-tactic headlines. The percentage of us who are at least “somewhat confident”… Continue reading

How to Decide If A Pension Lump Sum Makes Sense

by Mitch TuchmanGetting ready to retire can be a strangely stressful time, even for folks who objectively have done everything right in regard to saving and investing. I see this a lot, particularly when it comes to pensions. Over the decades of working, a pension is just something in the background. It’s growing, of course, but the employee… Continue reading

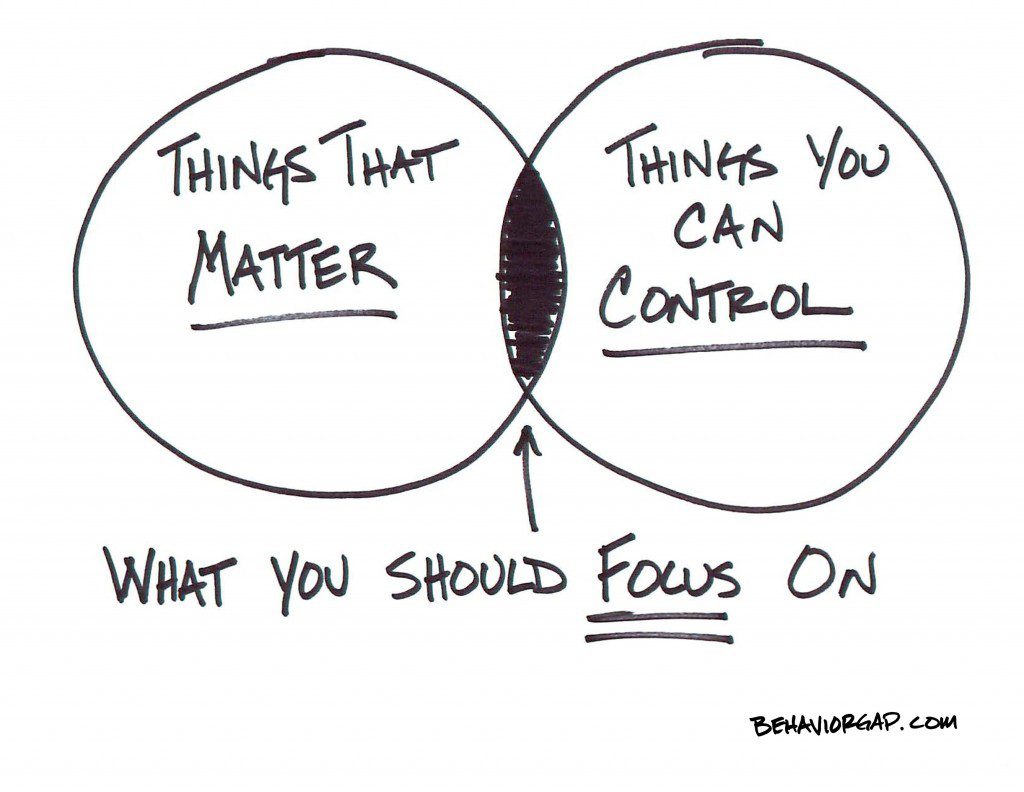

The Gold And Oil Crash Doesn’t Matter

by Mitch TuchmanGold is falling like a rock (which it is), preparing to bust through $1,000 an ounce and possibly headed lower. Oil could hit $20 a barrel before the dust settles, energy analysts warn. What the heck is going on? Nothing unusual at all. Commodities are volatile. That’s because prices for so-called “real assets” are driven entirely by… Continue reading

Jim Cramer: Profit From This Market Drop

by Mitch TuchmanJim Cramer, the CNBC host known for doling out advice to active traders, is read by millions. Many of them, for better or worse, are not traders but long-term retirement investors. Thus his otherwise logical approach to stock investing sometimes can turn out to be exactly backwards. Cramer himself has extolled the virtues of index… Continue reading

Jeremy Siegel: Stocks Could Rise By 10%

by Mitch TuchmanJeremy Siegel, the Wharton finance professor best known for the investment bestseller Stocks for the Long Run, sees no reason why the stock market can’t go up by 10% during 2016. Wait, you might say, Siegel is a famous stock bull. Of course he would say that. But his reasoning is more sound than you might… Continue reading

Investing for 2016 in an Expensive Market

by Burt MalkielIn his annual Wall Street Journal start-of-the-year stock market analysis, Rebalance Investment Committee member Professor Burton Malkiel explains how best to invest for 2016 in an “expensive” market. How do you invest when everything is expensive? U.S. stocks are selling at more than 25 times their cyclically adjusted earnings. Bond yields are unusually low (the… Continue reading

Saving For College Vs. Retirement

by Sally BrandonSally Brandon, Vice President of Client Services, explains why it’s usually better to finance your retirement instead of your kids’ needs, such as a saving for college. More on kids and retirement priorities. transcript I think it’s an interesting thing that I’m having to deal with personally right now. I have a son that’s a senior… Continue reading

How To Save: Out Of Sight, Out Of Mind

by Sally BrandonSaving has a reputation for not being much fun. It smacks of deprivation and penny-pinching, of spending your vacation at the Jersey Shore instead of the French Riviera. About half of Americans say they have only enough cash on hand to live for six months, reports Bankrate.com, and 25% can only pay their bills for… Continue reading

How Stock Volatility Quadruples A Portfolio

by Mitch TuchmanIt’s that time of the trading year when nobody seems to know what to make of the numbers. Stocks are down, bonds feel high, the economy sends mixed signals. Desperate for direction — any direction — investors attempt to guess the next move of the Federal Reserve (raise rates at last? stick to nearly zero?)… Continue reading