Blog Archive

How to Protect Yourself from Cyber Theft

by Sally BrandonCyber theft is a serious global issue that affects all industries and people. In recent years, as new apps and programs have evolved, this has become even more prevalent, especially within the financial services world. There are a variety of imposter scams that we would like to bring to your attention, so that you can… Continue reading

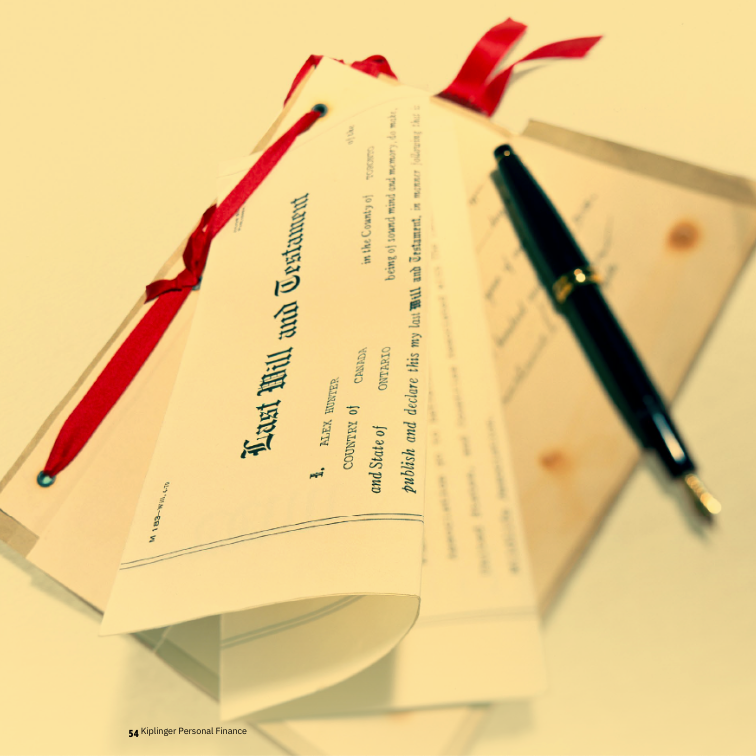

An Inheritance With Strings Attached

Have you recently received an inheritance? Avoid hefty tax bills that can come from inherited IRAs. An Inheritance With Strings Attached New rules for inherited IRAs could leave some heirs with a hefty tax bill. By Sandra Block, September, 2023 In the first quarter of 2023, Americans held more than $12 trillion in IRAs. If… Continue reading

The Exact Age When You Make Your Best Financial Decisions

Believe it or not, there is a magic age for making the best financial decisions of your life. You may or may not be surprised what this age is. Read this excellent Wall Street Journal article to discover the magic number. The Exact Age When You Make Your Best Financial Decisions There’s a magic number… Continue reading

Letter to a Young Crypto Enthusiast (or the Merely Curious)

While Rebalance does not consider cryptocurrencies to be a credible investment asset class, it is useful to keep abreast of investing trends. New York Times columnist Ron Leiber does a terrific job of explaining the cryptocurrency landscape. Letter to a Young Crypto Enthusiast (or the Merely Curious) An ever-growing number of young people, males in… Continue reading

Yes, There Are Alternatives to Stocks

Curious about where to invest your cash? New York Times columnist Jeff Sommer outlines how money market accounts and bonds have risen to the top as compelling investment options. Yes, There Are Alternatives to Stocks At the moment, money market funds and many bonds are not only less risky, but at current interest rates, they… Continue reading

Why It’s Smart to Revisit New Year’s Savings Goals Now

Summer is the perfect time to check in on the financial goals set in January at the beginning of the year. Columnist Ann Carrns outlines how to conduct a personal audit, which is essentially a financial health “checkup.” Why It’s Smart to Revisit New Year’s Savings Goals Now There’s still time this year to make adjustments, especially with… Continue reading

Understanding Equity Compensation

by Matt Jude, CFP®, ECAThe term equity compensation is a fancy way of saying that an employee receives some form of ownership (also known as equity) in their company as a part of their payment and benefits (i.e., the compensation package). Typically, this will be just one component of how an employer compensates an employee for his or her work — it can be… Continue reading

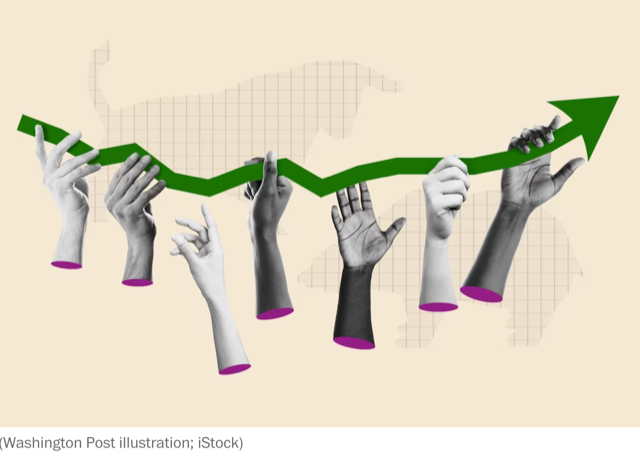

More Americans own stocks. This is great for their financial future.

For the first time since the stock market crash of 2008, consumer confidence with the stock market has returned. According to legendary Washington Post columnist, Michelle Singletary, investors have had a bumpy ride over the past decade. In the process, they have been rewarded with annual returns of approximately 12%. More Americans own stocks. This… Continue reading

What Investors Should Know About Money-Market Funds and CDs

Investors should consider using cash-equivalent investments, such as money market funds or CDs, to make sure that your idle cash is generating attractive short-term gains. Source: The Wall Street Journal May 6, 2023. What Investors Should Know About Money-Market Funds and CDs Investors are turning to these cash-equivalent investments, some of which are yielding 5%… Continue reading