Blog Archive

Charley Ellis: The Simple Reasons Index Investing Wins

by Mitch TuchmanIt always amazes me when people make the case for actively managed investment funds. If you understand the evidence against active trading — and in favor of index investing instead — it takes a heap of willful ignorance to keep believing. I understand why, though. Often, proponents of active management are investors of a certain… Continue reading

John Bogle: ‘Fight On’ For Retirement Investing Fairness

by Mitch TuchmanTransparency is a fancy word you hear a lot when it comes to corporations and government, but it just means being clear with people. Say what you do, then do what you say. It couldn’t be simpler, but nothing is simple once money is involved. And the more money at stake, it seems, the less… Continue reading

Stock Pickers Win Battles And Lose Wars

by Mitch TuchmanJuly was a bright spot for mutual fund managers who insist that stock picking is the way to make money. Sixty-seven percent of large-cap stock pickers beat their benchmarks while small-cap managers did their best so far this year, with 43% of them beating their index. Deal me in, right? Except that those July numbers were… Continue reading

Buffett, Bezos and Hedge Fund Guesswork

by Mitch TuchmanFunny how obvious things can be in the rear-view mirror. Jeff Bezos, founder of online retail giant Amazon, recently saw his wealth surpass that of investing legend Warren Buffett. Separately, Buffett’s own wager on the broad stock market index against a collection of hedge funds continues to embarrass the supposed “smart money” at those funds. There are some very… Continue reading

John Bogle: Investors Face This Highly Negative Trend

by Mitch TuchmanWhat’s going to hurt investors the most over the coming years? You might come up with any number of investment trends to worry about — inflation, debt, politics or terrorism, to name just a few. John Bogle, the founder of investment giant Vanguard, sees another trend, one he calls “highly negative” for investors and worth… Continue reading

3 Signs Your 401(k) Or IRA Costs Too Much

by Mitch TuchmanLawsuits are piling up on the desks of HR directors around the country, all with a common theme: The employee retirement plan was too costly and the company should have known better. Retirement investing is not an expensive process. There are only a few variables and the marketplace is fairly transparent. Unless, of course, you are… Continue reading

5 Investment Themes Bigger Than Brexit

by Mitch TuchmanA lot of ink is being spilled over a close but clear vote among Britons to leave the European Union, known as Brexit. You’ve probably seen lengthy explainers on why the vote matters to investors and what you should do about it. Hogwash, plain and simple. Sure, it’s a big deal — if you’re British. It’s important,… Continue reading

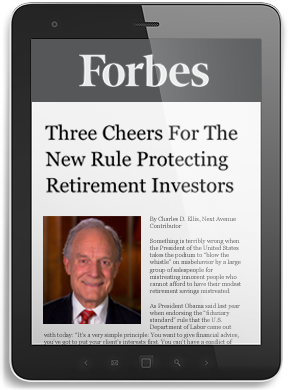

Three Cheers For The New Rule Protecting Retirement Investors

by Charley Ellis“If we want to change the way innocent folks get treated, we need to change the rules.” – Rebalance Investment Committee member Charley Ellis for Forbes. Something is terribly wrong when the President of the United States takes the podium to “blow the whistle” on misbehavior by a large group of salespeople for mistreating innocent… Continue reading

The $17 Billion Cost Of The Status Quo For America’s Retirement Savers

by Charley EllisSeptember 14, 2015 By Charles D. Ellis and Scott D. Puritz The Baltimore Sun showcases an opinion piece co-authored by Rebalance Managing Director Scott Puritz and a key member of the firm’s Investment Committee, financial luminary Charley Ellis. This op-ed examines the U.S. Dept.of Labor’s proposed rule designed to make retirement investing safer. You can… Continue reading