Blog Archive

Buffett, Bogle and Berkshire: 5 Amazing Numbers

by Mitch TuchmanBy now you’ve likely seen billionaire investor Warren Buffett’s latest effusive praise of Vanguard Group founder John Bogle. “If a statue is ever erected to honor the person who has done the most for American investors, the hands-down choice should be Jack Bogle,” Buffett wrote in his latest letter to investors in Berkshire Hathaway, Buffett’s… Continue reading

NPR Reporting On The Fight To Make Retirement Investing Safer

by Scott PuritzChris Arnold is a reporter with NPR who has a knack for explaining the complexities of investing in simple, plain English. In the ongoing fight for greater consumer protections, NPR produced a segment that highlights the intricacies of the fiduciary rule, and approached me for my “industry insider” opinion. It was my honor to speak about the… Continue reading

Seth Klarman Has Concerns About Indexing. We Don’t.

by Mitch TuchmanSeth Klarman is one of the few hedge fund managers praised by Warren Buffett. His Boston-based Baupost Group is famously tight-lipped and extraordinarily successful, currently managing around $30 billion. That puts him on par with the endowments of schools such as Harvard and Yale. As it happens, my business partner Scott Puritz and I were… Continue reading

Make Your Own Fiduciary Rule with Three Easy Steps

by Mitch TuchmanFinancial advisors should always act in your best interest. However, as of now, those who handle your hard earned retirement savings are not yet obligated by law to do so. With recent renewed interest in the U.S. Department of Labor’s “fiduciary rule,” there is question of whether the rule, protecting American retirement accounts, will actually… Continue reading

Do Millennials Spend More on Coffee or Retirement?

by Sally BrandonWould you rather spend your hard-earned money on coffee or your financial future? The answer may seem obvious, but it isn’t evident in a recent poll amongst millennials. In this short blog post, Food Network’s Amy Reiter details the startling results of a “coffee versus retirement” survey, which emphasizes an often talked about point – the need… Continue reading

Jack Bogle: Despite Trump, ‘Clients First’ Fiduciary Rule Here To Stay

by Mitch TuchmanJack Bogle, the visionary founder of Vanguard Group and father of index investing, has this to say about rumblings that the incoming Trump administration could kill the fiduciary rule: Don’t bet on it. Far from shrinking back, the Department of Labor’s fiduciary rule protecting retirement savers — which takes full effect in April — is likely… Continue reading

Buffett’s Advice When Markets Slip: Skimp On McDonald’s

by Mitch TuchmanIconic billionaire Warren Buffett is sitting in the driver’s seat of a Buick SUV, talking to the drive-through cashier at a McDonald’s. “I’ll have a Sausage McMuffin with an egg and cheese,” he tells the grinning young woman, who clearly recognizes him and spots a documentary camera operator in the passenger seat. He probably orders… Continue reading

Warren Buffett’s Advice When It Comes to Presidential Transitions

by Mitch TuchmanThe 2016 election has come and gone, and now a new President sits in office. For investors, it is increasingly clear that we have a elected a person who is perfectly willing to use social media to express himself, even tweeting about specific companies. That can do a lot of crazy things to a retirement portfolio in… Continue reading

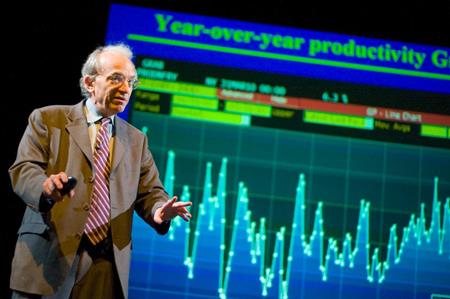

Why You Missed This Year’s Stock Market Bonanza, According to Jeremy Siegel

by Mitch TuchmanPredicting the future is impossible. Nobody, literally nobody, knows what will happen next. Yet back on Jan. 7 of this year Wharton’s Jeremy Siegel made an observation about stocks. “I actually think we’re going to get 8% to 10% this year,” Siegel told CNBC then. “I don’t think it’s going to be all that bad.” We… Continue reading