Blog Archive

John Bogle, Buffett’s ‘Hero,’ Explains Why Index Investors Need Not Fear A Stock Downturn

by Mitch TuchmanFresh off a weekend visit to the “capitalist Woodstock,” Warren Buffett’s annual shareholders meeting, Vanguard Founder John Bogle addressed an interesting question that must bug any retirement investor who relies on index funds. Bogle was asked on Monday to explain if the move by investors toward index-style exchange-traded funds (ETFs) isn’t creating a new kind… Continue reading

Testosterone Messes With Your Investing Brain

by Mitch TuchmanA landmark 2001 study showed that women outclassed men as investors by nearly 1 percent per year. Now we are coming closer to understanding why: Testosterone interferes with the male investor’s brain. A new study from Caltech, Wharton, Western University and ZRT Laboratory found that men are quicker to make judgments and less likely to… Continue reading

5 Times Warren Buffett Talked About Index Fund Investing

by Mitch TuchmanOver the years, much has been made of the advice of iconic investor and billionaire Warren Buffett, including his penchant for promoting the idea that most investors should use index funds. When one mentions Buffett’s promotion of low-cost investing, usually the pushback from active investors is immediate. Certainly, they say, he can’t mean that nobody… Continue reading

John Bogle’s 7 Timeless Investing Lessons

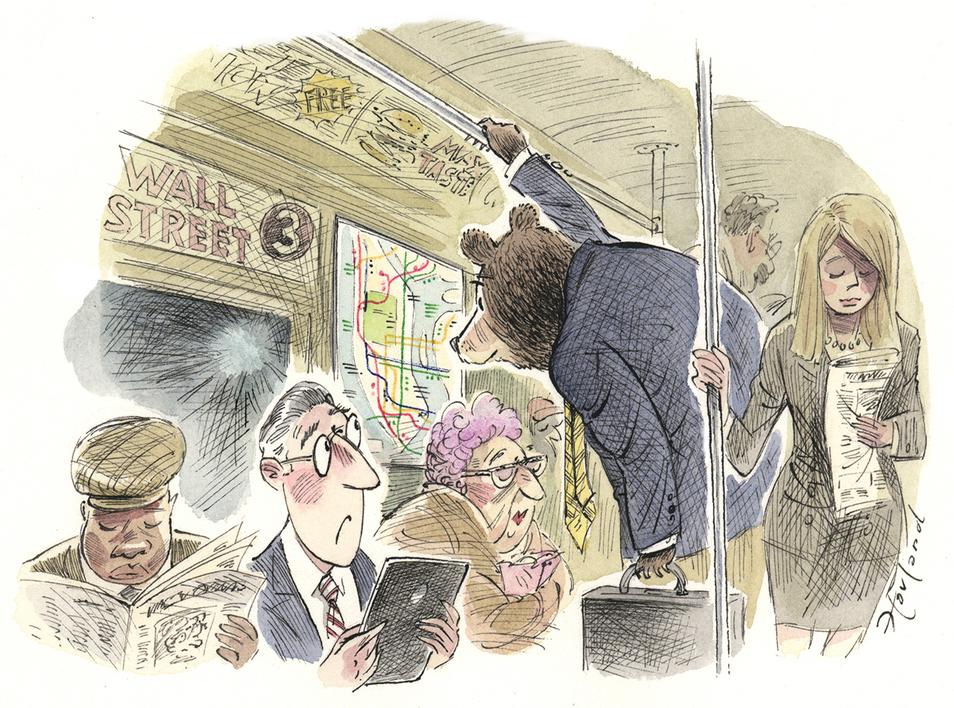

by Mitch TuchmanEvery investor should read the books of John Bogle, founder of the Vanguard Group and tireless advocate of the ordinary retirement investor, the “little guy” faced with long odds and the hungry sharks of Wall Street. One of the best is Enough: True Measures of Money, Business, and Life, a book he probably thought of as… Continue reading

‘Going In Style’ Toward Retirement, Without Robbing A Bank

by Mitch TuchmanEvery 10 years or so, Hollywood tries to latch onto the economic angst of the country with a comedy. Think of the Eddie Murphy and Dan Aykroyd classic, “Trading Places,” which skewered the misplaced values of 1980s traders. Or “Fun with Dick and Jane,” which had Jim Carrey and Téa Leoni resorting to an escalating… Continue reading

Yale Strategist Reveals The Truth About Hedge Fund Failures

by Mitch TuchmanBy now you’ve begun to notice a pattern in the news about hedge funds: Nobody is making money anymore, so managers are returning millions to disappointed investors. The latest to close is Eton Park Capital. But the decision by that fund’s managers is hot on the heels of epic losses by previously high-flying funds. A few… Continue reading

Most Americans Failed This 8-Question Retirement Quiz

by Mitch TuchmanGetting retirement right is a big deal. The data varies from survey to survey, but we know for a fact that far too many Americans have saved little (or nothing) and most of the rest of us probably haven’t saved enough. Fidelity Investments decided to tackle this problem with a short but in-depth survey based… Continue reading

Bill Gates, Trillionaire? Warren Buffett Shows Why He’ll Make It

by Mitch TuchmanWhen will the world see its first trillionaire? A British charity estimates that it could happen within 25 years and that it will be none other than Microsoft Founder Bill Gates. Oxfam, the UK world hunger organization, meant to shame the world’s richest with its list of multi-billionaires. Which is odd considering that Gates is a… Continue reading

Trump’s Last-Second Swipe At An Obama Retirement Rule

by Mitch TuchmanAs with much in the first weeks of the incoming Trump administration, there was an last-second move to delay regulations years in the making. In this case, the Department of Labor fiduciary rule. The last-ditch effort is likely to fail and not just because of legal action, although that is happening, too. No, it’s likely… Continue reading