Lessons Learned From 2008 Archive

The COVID Grind Is Unbearable, But It’s Not Forever

by Mitch TuchmanWhen will life be “normal” again? Will it ever? These are reasonable questions considering the impact that the pandemic has had on virtually everyone on the planet. Many have died, many more are sick, and millions are out of work or underemployed. Broadly, the economy seems to be finding a footing here and there, even… Continue reading

Markets Are Volatile, So What Should Investors Do?

by Mitch TuchmanFor most people, investing can feel like a long drive down the highway. The sun is out, the road is flat, the music soothing. Even at 70 miles per hour the ride is uneventful. Until, of course, you hit a pothole or enter a rough stretch of pavement. Your trip can go from a snooze… Continue reading

The Stock Market’s Next Move? Might As Well Spin A Roulette Wheel…

by Mitch TuchmanThe recent stock market news has been downright scary. “Biggest one-day points plunge! Stocks in freefall! Bear market begins!” You’re probably expecting me to say “Don’t worry, everything is going to be fine.” But I won’t — because I can’t. I don’t know if stocks will recover tomorrow or take another big dive. I don’t… Continue reading

Heed Warren Buffett’s Warning: Bitcoin Is Pure FOMO

by Mitch TuchmanTo the surprise of nobody, billionaire investor Warren Buffett isn’t interested in Bitcoin, the electronic currency that has zoomed higher in value over the past few weeks. Bitcoin is a complex idea. Simply put, it’s a virtual currency that is created, owned and traded entirely online in anonymous and unregulated settings. In theory, there is… Continue reading

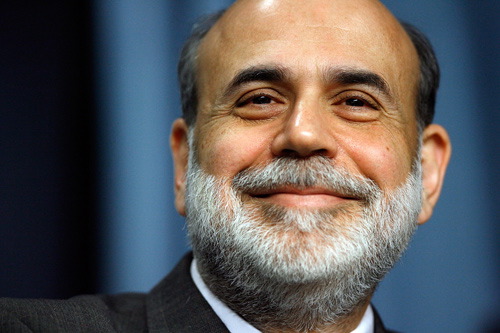

Ben Bernanke Nails The Case For Passive Portfolio Investing

by Mitch TuchmanIt’s always tricky when the past holder in a major office — say, a former U.S. president — gets interviewed. You can’t second-guess your successor, nor can you offer fluffy non-answers to pointed questions. Ben Bernanke, the recent former head of the U.S. Federal Reserve, found himself on the hot seat recently, answering very pointed questions about… Continue reading

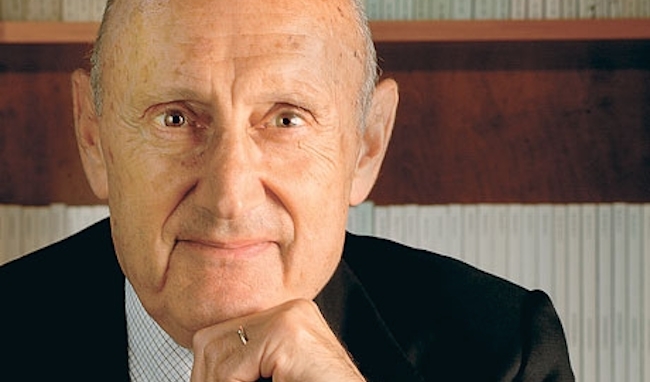

Burton Malkiel On October’s Rough Ride: Hang On

by Mitch TuchmanIt has been a rough October, the kind of month that has many retirement investors stopping to take stock of their assumptions. Too often, though, they react to “down” months like this one by making wholesale changes to their investments. Can you make the right move at the right time? Can anybody? Princeton’s Burton Malkiel, author… Continue reading

Warren Buffett Is Not Worried About This Market

by Mitch TuchmanAmid all the of doomsday predictions and fearful hand-wringing about the stock market, the knowing chuckle of billionaire investor Warren Buffett once again puts panic into context. Of course he’s buying stocks. Prices are falling, so why not? Like with his famous “hamburger quiz,” the best time to buy any asset is when it’s cheaper,… Continue reading

The Lessons of 2008

by Jay VivianJay Vivian, former managing director of the IBM Retirement Funds, explains the lessons of 2008 to retirement investors. Continue reading