Investment Advisors Archive

Beware: Stock Broker Fraud Is Rampant

by Mitch TuchmanYou probably have at least a minimal expectation that financial regulators in Washington are looking out for you. And you’d be wrong — and a lot poorer in retirement as a result of that misplaced trust. While the fight continues to enact clearly written and fair rules of engagement for investors, stock broker fraud cases… Continue reading

Yes, Ignore That ‘Sell Everything’ Call

by Mitch TuchmanThe U.S. Federal Reserve has begun to raise the interest rate, generally a sign of a strong recovery and a growing economy, and often a trailing indicator of growth. The Fed typically only acts late in the process, arguably too late at times. Meanwhile, one European bank’s economists are making waves with a note to clients… Continue reading

Bogle’s Legacy: Falling Prices Everywhere

by Mitch TuchmanIn case you missed it, a chart making the rounds in financial circles puts a fine point on what happens when a $3 trillion gorilla walks into a room. That’s the level of assets under management at Vanguard, the low-cost fund giant created by the legendary John Bogle. In short, when Bogle’s crew comes into… Continue reading

John Bogle: Big Funds Rip Off Investors

by Mitch TuchmanWhat makes an investment fund cheap to own? Low fund fees, of course. But investors completely misunderstand what “low” means, charges Vanguard Group founder John Bogle. The problem comes with using percentages, specifically percentage expense ratios, to gauge the value of a fund relative to its cost of doing business. Consider something you buy every week,… Continue reading

Annuity Kickbacks A Huge Conflict: Senator Warren

by Mitch TuchmanElizabeth Warren, the hard-charging Senator from Massachusetts, has new questions for financial advisors who sell annuity products to folks nearing retirement age: If an annuity company gives advisors rewards and incentives such as resort vacations, iPads and jewelry, isn’t that a huge conflict of interest? Warren recently made headlines in an important Senate Committee hearing at… Continue reading

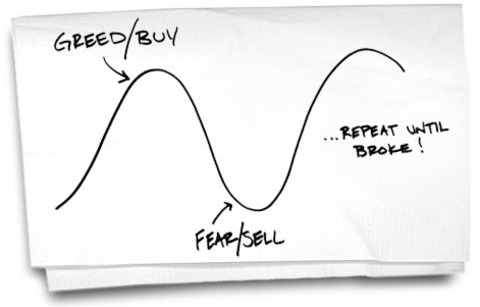

Warren Buffett: Why Hedge Funds Fail

by Mitch TuchmanYou might be surprised to see occasional headlines bemoaning the poor performance of hedge funds compared to the market indexes. Not Warren Buffett. Hedge fund managers serve two masters: their clients and themselves. That sounds like a solid alignment of interests, but it’s not, the billionaire investor says. That’s because hedge fund chiefs get paid win… Continue reading

How Does Rebalance Build Trust With Its Clients?

by Scott PuritzManaging Director Scott Puritz shares how Rebalance builds trust with clients. More on how Rebalance provides clients with peace of mind. transcript We build trust with our clients first and foremost by listening to them and fully understanding what’s going on in their lives and what they need from their retirement investing. Second, every one… Continue reading

What Should I Expect In My Initial Interview With My Rebalance Advisor?

by Mitch TuchmanMitch Tuchman, Managing Director, describes the initial interview that every client has when they first sit down with their financial advisor. More on the Rebalance approach to retirement investing. transcript In our initial interview with a client, we’re trying to figure out a few things. What is the end result? In other words, what does retirement… Continue reading

Mutual Fund Fees Cost Investors Billions

by Mitch TuchmanThere’s an old Arab saying: “If a camel gets his nose in the tent, his body will soon follow.” It’s a great, funny metaphor. You can picture the curious nose of the camel poking in, then the neck and, before long, all the rest of it. In English we would say “Give them an inch and… Continue reading