Investment Advisors Archive

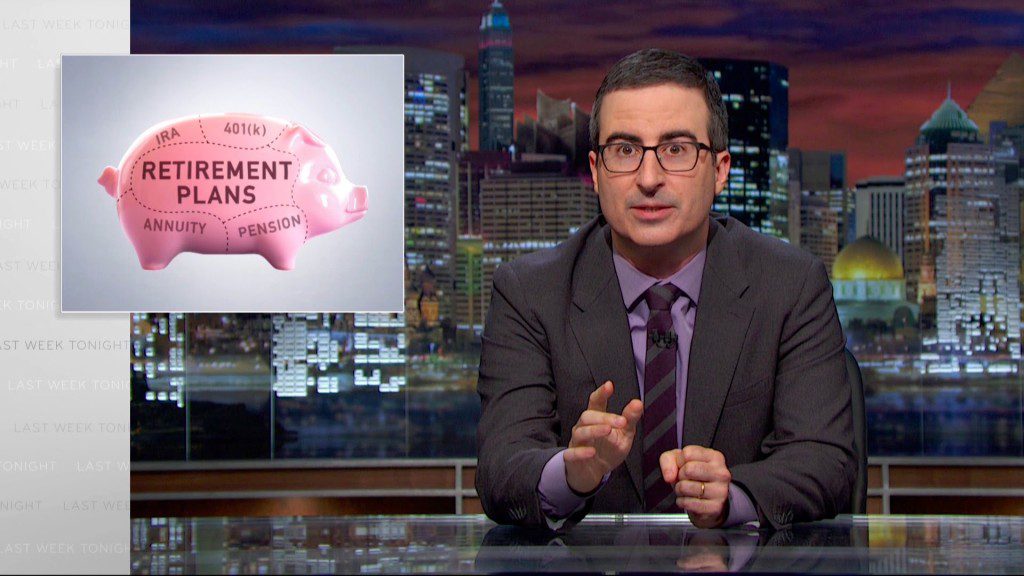

John Oliver, A Comedian, Might Just Save Your Retirement

by Mitch TuchmanYou might not know John Oliver. He’s British, first of all, and his comedy program “Last Week Tonight” airs on late-night cable. The segments on the show are long (22 minutes long!), very wonky and tend to tackle subjects most of us actively avoid — international affairs, payday lending, the downside of the U.S. energy boom, infrastructure spending.… Continue reading

For Bogle Wall Street Is The Problem, Not Stocks

by Mitch TuchmanJohn Bogle, founder of passive investing giant Vanguard, believes that the animating force behind the stock market is to make money — just not for investors. In a recent interview and a separate letter to the editor, Bogle makes the case that virtually all stock trading benefits the handlers of that money and not retirement savers.… Continue reading

John Bogle: Extend ‘Clients First’ Fiduciary Rule To All Investors

by Mitch TuchmanJohn Bogle, the longtime champion of low-cost investing and founder of the Vanguard Group, is not one to rest on his laurels. You would think that the recent Department of Labor “clients first” fiduciary standard ruling — earned after decades of fighting an investment industry focused on profits over people — would qualify as a big win. Don’t get me wrong, it… Continue reading

The Single Biggest Risk To Your Retirement

by Mitch TuchmanIf you’re like most investors, you likely believe that stockbrokers with checkered pasts get drummed out of the industry. Certainly, out-of-work stockbrokers would like you to believe that. But the data tells a different story: Of brokers fired for misconduct, 44% are back at work within a year. That’s the conclusion of researchers at the… Continue reading

John Bogle’s Low-Cost Retirement Advice Wins Out

by Mitch TuchmanIt’s gospel in some circles that government is the problem, not the solution. Yet it is possible, even today, to find clear examples of political leadership coming together to get something right. That happened just this past month with the announcement by the Department of Labor of a rule that will make retirement investment safer and more transparent for millions… Continue reading

Retirement Victory: The End Of Hidden Fees

by Mitch TuchmanIt has taken years of effort, but this week the playing field finally was leveled for Americans saving and investing for retirement. Stock brokers now have to act in the interests of their clients, and they can no longer fail to disclose how they are paid and by whom. Hidden fees must end. Known as… Continue reading

John Bogle’s Long Overdue Fiduciary Dream

by Mitch TuchmanIf anybody has the truly long view on retirement investing, it’s Vanguard Group Founder John Bogle. He has retired from his own firm but definitely is still in the fight, by his reckoning well over a quarter century now trying to get retirement investment advisors to do what they say and be legally bound to… Continue reading

Bogle: A Clear Sign A Fund Will Lose Big

by Mitch TuchmanJason Zweig, The Wall Street Journal’s “Intelligent Investor” columnist, recently wrote about a curious trend among financial advisors — holding index-style exchange-traded funds. That’s right, owning the index, yet still charging a premium for advice because, well, why not? The argument from the managers is disarmingly simple: While they still make some bets on specific stocks, it’s getting… Continue reading

New Rules Designed To Make Retirement Investing Safer

by Mitch TuchmanIf you book a hotel online, you expect to see the prices first. When you go to take a trip by airplane or rent a car, same thing. Why not the same with retirement investing costs? Is there something special about investing for retirement that requires secrecy, obscurity, a lack of simple disclosure? Of course… Continue reading