Investment Advisors Archive

Cheers to 50 Years of Outward Bound!

by Scott PuritzNorth Carolina Outward Bound School (NCOBS) is not just a group I give charity to— it is an integral part of my life. As an avid outdoorsman, I find the core values of Outward Bound especially appealing. But it is their tremendous work with young people that motivated me to support NCOBS in a more hands-on role.… Continue reading

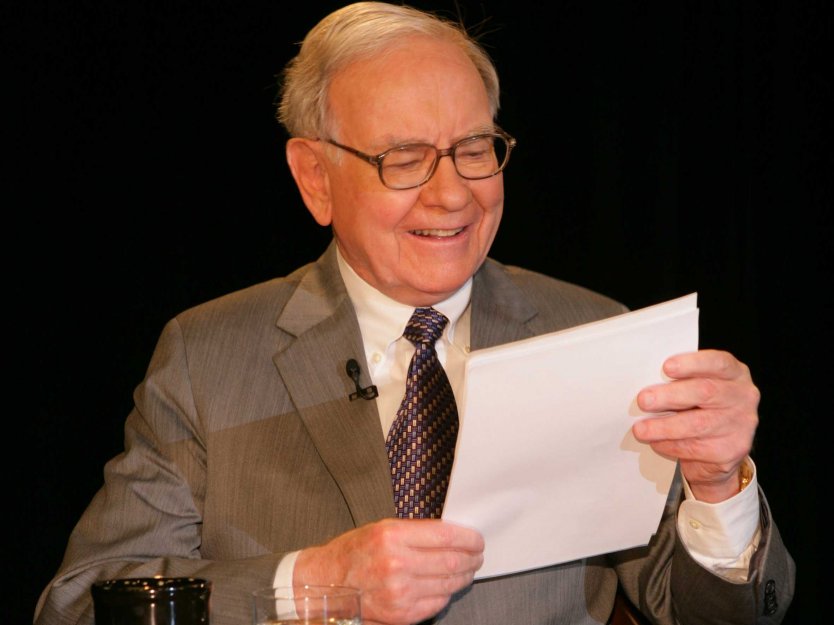

How Buffett Won His $1 Million Hedge Fund Bet

by Mitch TuchmanNearly 10 years ago, iconic billionaire investor Warren Buffett took what seemed like a contrarian bet for a professional stock picker. He bet any comer that a simple, low-cost investment in the S&P 500 would beat a hedge fund strategy over 10 years. On the line was $1 million, to be paid to a charity… Continue reading

Careful! “Robo” Advice Isn’t Necessarily Conflict-Free

by Mitch TuchmanWalk down the aisles of your local grocery store. If you’ve been shopping for a few decades, you know a few things almost without thinking. Fresh foods are along the walls, dry goods in the center aisles. Store brands are usually just fine and cheaper. Now look at the shelves. Some products (say, fancy ground… Continue reading

Report: ‘Closet Indexers’ Massively Overpay For Investment Advice

by Mitch TuchmanA friend of mine was complaining recently about the price of apples, specifically a variety marketed as a “Honeycrisp” apple. He would go to the grocery store to buy a bag of apples and find Honeycrisps at $7.99 a three-pound bag. Right next to them would be Gala apples at $3.99. “Why are Honeycrisp apples… Continue reading

John Bogle’s Enduring Insight On Investment Risk

by Mitch TuchmanBack in the 1980s, stock picking gurus such as Peter Lynch at Fidelity offered small investors a strikingly simple mantra: “Invest in what you know.” The idea was intuitive and highly attractive for a number of reasons. Essentially, if you noticed a small coffee chain with a line out the door, you bought that stock.… Continue reading

‘Going In Style’ Toward Retirement, Without Robbing A Bank

by Mitch TuchmanEvery 10 years or so, Hollywood tries to latch onto the economic angst of the country with a comedy. Think of the Eddie Murphy and Dan Aykroyd classic, “Trading Places,” which skewered the misplaced values of 1980s traders. Or “Fun with Dick and Jane,” which had Jim Carrey and Téa Leoni resorting to an escalating… Continue reading

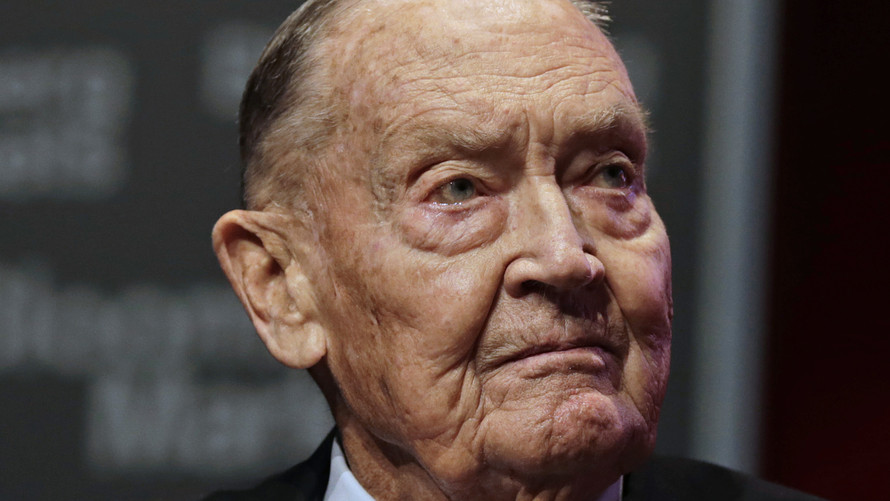

Buffett, Bogle and Berkshire: 5 Amazing Numbers

by Mitch TuchmanBy now you’ve likely seen billionaire investor Warren Buffett’s latest effusive praise of Vanguard Group founder John Bogle. “If a statue is ever erected to honor the person who has done the most for American investors, the hands-down choice should be Jack Bogle,” Buffett wrote in his latest letter to investors in Berkshire Hathaway, Buffett’s… Continue reading

Seth Klarman Has Concerns About Indexing. We Don’t.

by Mitch TuchmanSeth Klarman is one of the few hedge fund managers praised by Warren Buffett. His Boston-based Baupost Group is famously tight-lipped and extraordinarily successful, currently managing around $30 billion. That puts him on par with the endowments of schools such as Harvard and Yale. As it happens, my business partner Scott Puritz and I were… Continue reading

Jack Bogle: Despite Trump, ‘Clients First’ Fiduciary Rule Here To Stay

by Mitch TuchmanJack Bogle, the visionary founder of Vanguard Group and father of index investing, has this to say about rumblings that the incoming Trump administration could kill the fiduciary rule: Don’t bet on it. Far from shrinking back, the Department of Labor’s fiduciary rule protecting retirement savers — which takes full effect in April — is likely… Continue reading