Index Funds & ETFs Archive

Lower Fees = Higher Returns

by Burt MalkielProfessor Burton Malkiel of the Rebalance Investment Committee on how lower fees mean a higher net return for investors. Continue reading

Indexing — The Only Rational Choice

by Charley EllisProfessor Charles D. Ellis of the Rebalance Investment Committee explains the clear disadvantages of using actively managed funds rather than indexing. Continue reading

Retirement Indexing Has Come to Conquer Wall Street

by Mitch TuchmanRegular readers of my column here likely recall that I recently wrote about the move by the California state retirement plan toward retirement indexing over active management. It will take the Calpers system, which manages several hundred billion in retirement funds, some time to make this kind of change — but things will change. For… Continue reading

Retirement Savers Take Note: California Has Abandoned Active Investing

by Mitch TuchmanWhen the world’s 12th-largest economy makes a big decision about its finances, you tend to notice. That’s what California is, budget problems aside. Now its state employees retirement fund, CalPERS, is on its way toward quitting the active investing game. Not quitting the markets. Just dropping all pretense that beating the market is a worthwhile… Continue reading

You’re Paying Too Much For Investment Help

by Burt MalkielFrom 1980 to 2006, the U.S. financial services sector grew from 4.9% to 8.3% of GDP. A substantial share of that increase represented increases in asset-management fees. Excluding index funds (which make market returns available even to small investors at close to zero expense), fees have risen substantially as a percentage of assets managed. In… Continue reading

An Intelligent Approach to Lowering Investment Risk

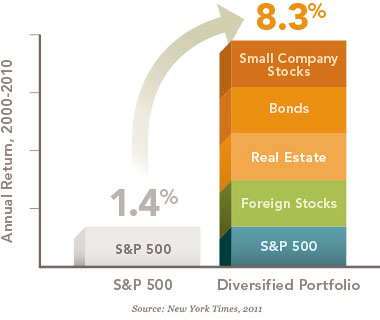

by Scott PuritzPeople understand diversification in principle. It is as simple as “don’t put all your eggs in one basket.” In practice, however, lowering investment risk is a bit more complex. For instance, some want to believe that owning a stock mutual fund is diversification, at least in comparison to owning the stocks of just four or… Continue reading

Don’t Fall Into the Market Timing Trap

by Scott PuritzOne of the more interesting reactions to the Rebalance approach is hearing the ideas people have of “passive” investing and “market” returns, especially investors who still believe in market timing. “Oh, I would never be a passive investor. There is too much money to lose that way,” some argue. They feel a primal urge to… Continue reading