Index Funds & ETFs Archive

Nobel Winner Fama: Active Management Never Works

by Mitch TuchmanMany smart people have spent years trying to explain exactly why active management can’t keep up with the investment indexes. Leave it to Eugene Fama, the University of Chicago researcher and Nobel Prize winner, to make things painfully simple. It’s nothing more than slicing a pie. If I get a bigger piece, everyone else is… Continue reading

Mutual Fund Performance — Buyer Beware

by Jay VivianJay Vivian, former managing director of the IBM Retirement Funds, on how mutual fund performance can be manipulated. Continue reading

Why IBM Moved To Index Investing

by Jay VivianJay Vivian, former managing director of the IBM Retirement Funds, explains why IBM moved to index investing over active management. Continue reading

Retirement Investing Lightning Round

by Mitch TuchmanDo you know someone who has been hit by lightning? Do you know anyone who knows anyone who has been hit by lightning? Exceedingly unlikely, right? But it turns out to be roughly the same chance as knowing someone — anyone — whose mutual fund consistently stays ahead of the pack. Put another way, your… Continue reading

How To Lower Retirement Investment Costs

by Jay VivianJay Vivian, former managing director of the IBM Retirement Funds, on using index funds to lower retirement investment costs. Continue reading

Return Envy: Are Managers ‘Drifting’ With Your Money?

by Mitch TuchmanA great retirement portfolio owns precise measures of specific investment types, depending on your age and personal tolerance for the ups and downs of the market. But what if the mutual funds you buy don’t hold the investments you think they do? Known as “style drift” in the finance world, the more accurate word for it… Continue reading

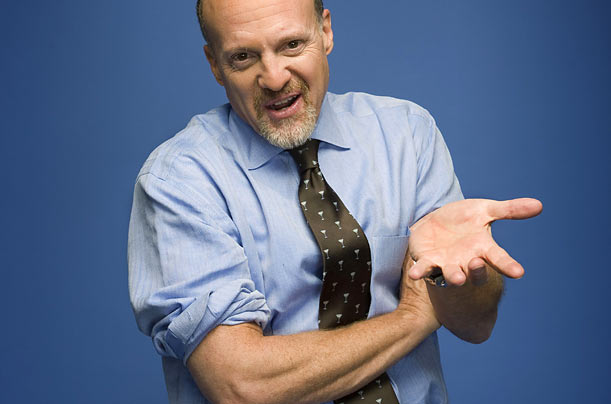

Jim Cramer: Mutual Funds Lose Money By Design

by Mitch TuchmanJim Cramer, the “Mad Money” cable TV host known for using his perch to preach stock-picking to the masses, has a simple message for retirement investors: Don’t buy stock-picking mutual funds. Yes, he still believes that picking stocks is time well-spent for some, but in a recent episode of his hugely popular show Cramer launched… Continue reading

Get “Above Average” Returns

by Burt MalkielProfessor Burton Malkiel of the Rebalance Investment Committee on how cost predicts investment returns. Continue reading

How Superior Active Managers Help Index Investors Win

by Mitch TuchmanAre active managers getting better and better at their jobs? Yes. Does that mean that it’s getting harder and harder for active managers to beat their own benchmarks? Also yes. In fact, money managers are getting better, researchers have found. They are better informed, better equipped and often better traders than a few decades ago.… Continue reading