Financial Planning Archive

Help! I’m About to Retire and Inflation Scares Me

by Sonja Breeding, CFP®Picking a date to retire is a big decision, even in the best of times. What does one do in an environment of rapidly rising inflationary pressures? After all, being retired means living on an income that is likely to be the same or less than you had when working, and there will be no… Continue reading

Have I Saved Enough for Retirement Yet?

by Christie Whitney, CFP®For many folks, retirement planning comes down to their personal “number,” the savings level at which you can leave work behind and relax in a folding chair on a beach. That milestone number for many of us seems to be $1 million. If we can get to $1 million in the bank, well, that’s plenty… Continue reading

Six Steps to Building an Effective Financial Plan

by Sonja Breeding, CFP®A goal is a dream with a plan and a deadline, as the saying goes. So what does your dream of retirement life look like, and I mean really look like? Making a commitment to your retirement goals requires getting your financial life in order today. That means writing down a financial plan, and I… Continue reading

5 Practical Steps Toward a Secure Retirement

by Sonja Breeding, CFP®Back in 2006, a couple of U.S. Senators took it upon themselves to create a national retirement security awareness week, set for the third week in October. As you can imagine, the intervening twists and turns in the stock market — the 2008 Great Recession and the Covid crash in 2020 — only served to… Continue reading

Your Retirement Tax Planning Checklist

by Christie Whitney, CFP®The past year certainly has been tumultuous in many ways, including for retirement savers trying to keep up with tax planning. There have been a number of changes to your taxes on the legislative front in regard to the pandemic, of course. Add to the confusion an understaffed IRS and questionable mail service and you… Continue reading

Avoid Holiday Spending Blues With These Expert Tips

by Christie Whitney, CFP®Overspending can be as much a part of the holidays as latkes and caroling. While it’s easy to say “make a budget” there are ways to simplify the process and stay on track. First, go ahead and make that budget, but think beyond your immediate household. The budget should be as broad as possible to… Continue reading

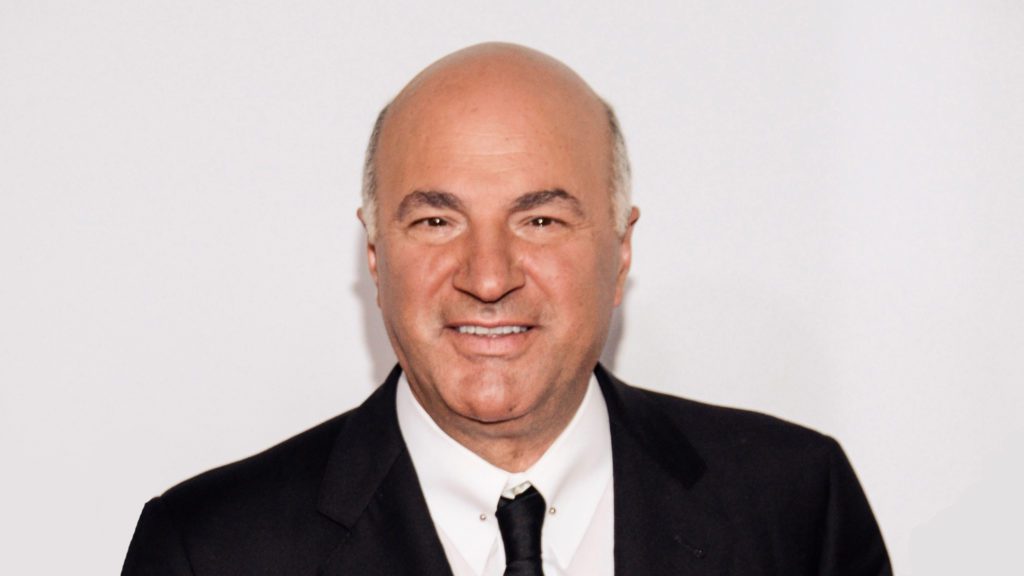

Kevin O’Leary Says Pay All Your Debts By Age 45 — Including Your Mortgage

by Mitch Tuchman“Shark Tank” star Kevin O’Leary knows how startup businesses succeed — or fail. Most businesses make it past that crucial first year by finding investors while controlling costs tooth and nail. If only retirement investment advice had that same approach. “If you want to find financial freedom, you need to retire all debt — and… Continue reading

Everything You Need To Know About the CARES & SECURE Acts

by Sally BrandonAs we enter the next few weeks of the ongoing COVID-19 pandemic the headlines are sure to disorient and worry us all. Federal, state and local responses will unfurl in real time with varying degrees of effectiveness, further confusing matters. It’s a difficult time to plan logically and efficiently on many fronts. In terms of… Continue reading

Retirement Investors Have A Chance To Stretch Their Charitable Dollars

by Mitch TuchmanTumultuous times like today’s COVID-19 pandemic tend to bring out the best in us, and you don’t have to look far to find examples: Canned food drives for local food banks, a surge in blood donation, and otherwise idled restaurants providing donated meals for healthcare workers. There’s no lack of need, more so given the… Continue reading