Featured Archive

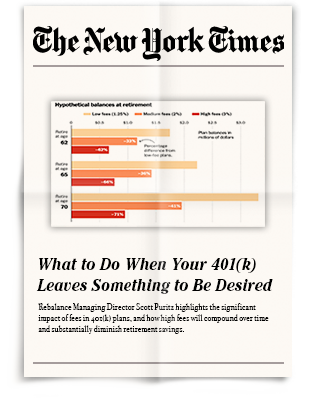

What to Do When Your 401(k) Leaves Something to Be Desired

by Scott PuritzOver the course of a career, the high fees and a lower-quality menu of investment options found in some plans can shrink your balance significantly. Chris Gentry is meticulous about his craft — he’s a professional woodworker at a small company in Brooklyn, N.Y., that makes custom dining and coffee tables, cabinets and interiors. He… Continue reading

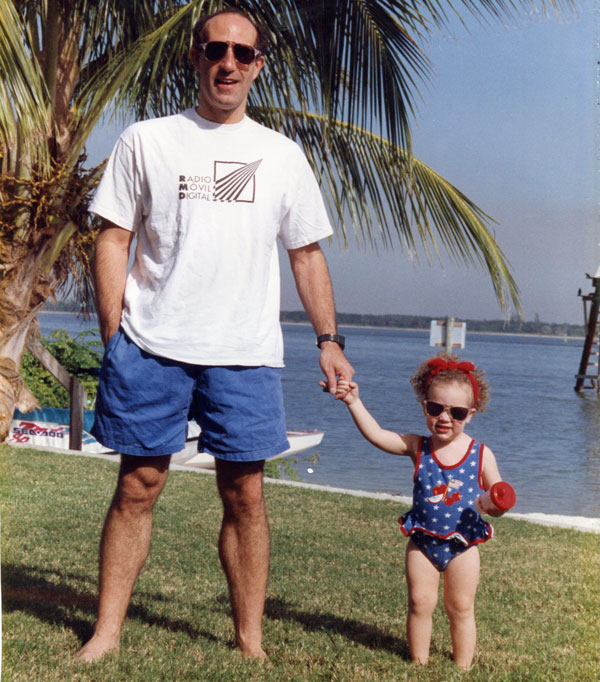

The Best Father’s Day Gift Ever

by Scott PuritzNot long ago, I received an unexpected early Father’s Day gift from my older daughter when she returned home for a long weekend visit with mom and dad. Since graduating from college Alyssa had been living in the Chicago area, where she worked as a research assistant for a prestigious university. She thoroughly enjoyed living… Continue reading

A Foolproof, One-Move New Year’s Resolution Anyone Can Make

by Christie Whitney, CFP®Every January, a flood of people resolve to lose weight. Then they show up at a nearby gym for the first time ever. By February, everything settles down and the true gym rats are left to grunt in peace. That’s how it goes with resolutions. We break them at the slightest test of will. What… Continue reading

Rebalance Spotlight: Q & A with Drew Pratt, Vice President of Investment Advice

by Scott Puritz“I want to help people do the right thing and to be at ease” Drew Pratt is the latest addition to the Rebalance team. As Vice President for Investment Advice, Pratt will contribute to the firm’s wealth management practice while also advancing the Rebalance 360 Product Suite, a full-service wealth management offering. Pratt brings more… Continue reading

Straight Answers About Annuity Risk

by Mitch TuchmanIn this piece for The Philadelphia Inquirer, journalist Erin Arvedlund reports on whether or not there is a direct correlation between a recession and stock market drop. In addition, Erin Arvedlund reminds investors the impending SECURE Act of 2019 goes back before Congress on Oct. 1st. The Setting Every Community Up for Retirement Enhancement Act… Continue reading

We’re Smart, Capable and Amassing Vast Wealth. So, Why Aren’t We Taking Control of Our Finances?

by Sally BrandonI’m guilty. There, I said it. And, it feels great to confess. I am among the millions of women, globally and across generations, who fall into a distinct category—highly-educated, affluent married women, widows or divorcees who defer significant financial decisions to their spouses or partners. Admittedly, the reassuring news is that I’m in excellent company. … Continue reading

Suze Orman Thinks You Need At Least $5 Million To Retire

by Mitch TuchmanAuthor and personal-finance guru Suze Orman ruffled a lot of feathers in a recent podcast, saying that people need $5 million — maybe even $10 million — in order to retire. Orman was responding to a question about the “financial independence, retire early,” or “FIRE,” movement, a growing online trend in which people in their… Continue reading

What’s New? Even Lower Investing Costs For Our Clients

by Scott PuritzThe late, great John Bogle put it best, and simplest, when he said, “Fees matter.” We take those words seriously at Rebalance. We should, since several members of our all-star Investment Committee are longtime colleagues of the Vanguard Group founder. One is Burton Malkiel, Princeton professor and author the investing classic A Random Walk Down… Continue reading

Rebalance’s Investment Committee: Investing’s Brightest Minds At Your Service

by Scott PuritzEvery year, billionaire investment icon Warren Buffett auctions off lunch with him to anyone willing to write a big check to charity. Last June, someone paid an astounding $3.3 million for the privilege of having lunch with him. Imagine sitting with an investing icon for a whole hour, him open to any investing question you… Continue reading