What Role Does Rebalancing Play In Portfolio Management?

by Scott PuritzScott Puritz, Managing Director of Rebalance, explains the role that rebalancing plays in portfolio management. Continue reading

What Do You Tell A Client When The Market Goes Down?

by Scott PuritzScott Puritz, Managing Director of Rebalance, shares how to reassure a client when the market goes down. Continue reading

Rules to Make Retirement Investing Safer

by Scott PuritzRebalance has always put our clients’ interests front and center, with a passionate commitment to providing retirement investment management at the highest levels of professional and ethical standards. In addition, our firm, as a Registered Investment Advisor, is regulated by the SEC and adheres to a strict fiduciary legal standard. We are pleased that the Department… Continue reading

How Does Rebalance Help Clients Retire With More?

by Scott PuritzScott Puritz, Managing Director of Rebalance, discusses ways to successfully help clients achieve their retirement goals. Learn how to retire with more. transcript Scott Puritz: The key to successful retirement investing is to think about it as a marathon, a long-term endeavor. We help clients retire with more by providing them with low-cost proprietary portfolios, establishing the right plan that… Continue reading

Retirement Planning – Freelancers Have A Secret Weapon, The Solo 401(K)

by Scott PuritzAn amazing 40 percent of American workers will be classified as freelancers by 2020, according to the Bureau of Labor Statistics. Once the province of recent graduates and those “in between” jobs, the wave of the future seems to be contract work as a long-term career for millions of Americans. And because of this trend,… Continue reading

Meet Scott Puritz

by Scott PuritzScott Puritz, Managing Director of Rebalance, discussses how much emotion is wrapped up in retirement investing. Continue reading

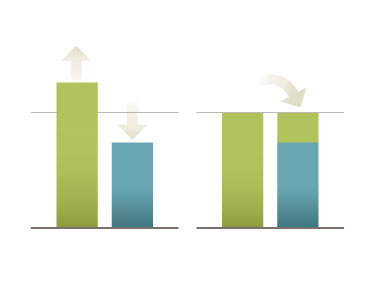

The Art and Science of Effective Rebalancing

by Scott PuritzOne of the more mysterious aspects of portfolio management is effective rebalancing. Simply put, it is the disciplined practice of selling investments that have risen in value while buying more of those that have declined. Imagine that you own a portfolio that holds 60% stocks and 40% bonds. Naturally, you check on it periodically. If… Continue reading

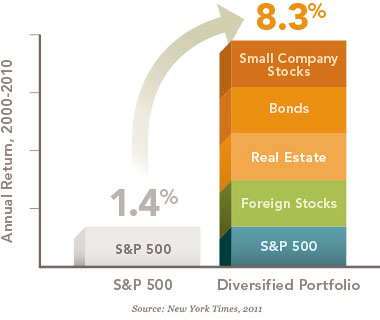

An Intelligent Approach to Lowering Investment Risk

by Scott PuritzPeople understand diversification in principle. It is as simple as “don’t put all your eggs in one basket.” In practice, however, lowering investment risk is a bit more complex. For instance, some want to believe that owning a stock mutual fund is diversification, at least in comparison to owning the stocks of just four or… Continue reading

Don’t Fall Into the Market Timing Trap

by Scott PuritzOne of the more interesting reactions to the Rebalance approach is hearing the ideas people have of “passive” investing and “market” returns, especially investors who still believe in market timing. “Oh, I would never be a passive investor. There is too much money to lose that way,” some argue. They feel a primal urge to… Continue reading