Lessons From the Great Inflation of 1973-81

Former Federal Reserve Chairman, Paul Volcker, will be remembered for many policy decisions that still outlive his tenure. More specifically, the lessons learned from his handling of the Great Inflation of 1973-81 will be amongst the most relevant. As we live through a similar economic challenge today, it is important to remember the role that… Continue reading

The Ukraine War and Your Portfolio

by Scott Puritz“Never bet on the end of the world, it only happens once and the odds are long.” — Unknown “The way to make money in the market is not by timing the market but by your time in the market.” — Unknown The war in Ukraine is creating an environment that is unpredictable and full of humanitarian… Continue reading

Recent Rise in Inflation: Temporary or Permanent?

by Scott PuritzHow each generation invests is a fascinating topic. For instance, the generation that grew up in the Great Depression is known for over-the-top frugality. What people today might call “life hacks” often are nothing more than the way great-grandma and great-granddad got by. Vegetable gardening, sewing old clothes, fixing things instead of replacing them, sharing… Continue reading

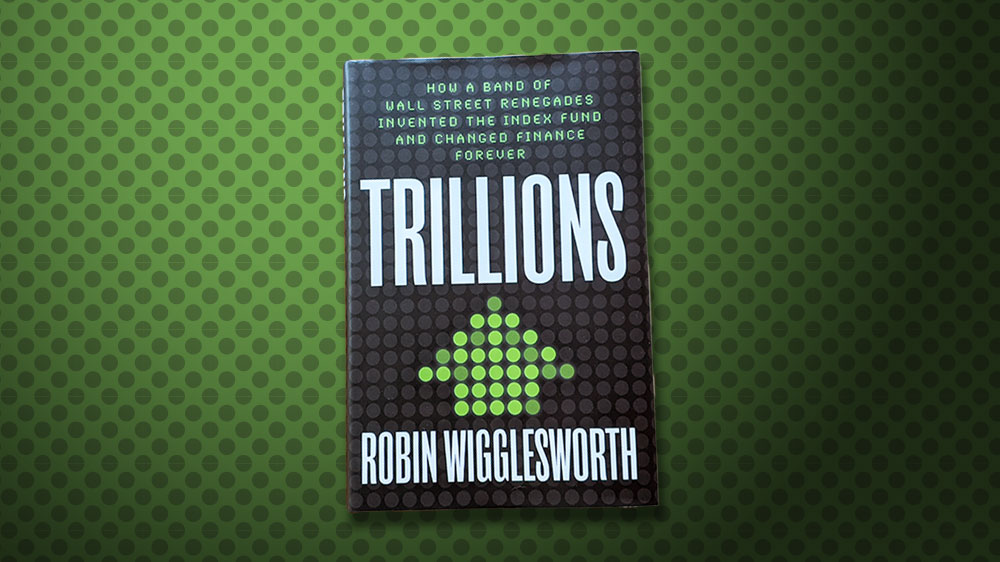

Burton Malkiel’s Compelling Book Review of ‘Trillions’

by Scott PuritzBig investment funds have a public face, a famous money manager who is constantly “talking up his fund” on financial television shows. By contrast, index fund investing is hard to comprehend. The Financial Times journalist Robin Wigglesworth got curious about those “missing faces” and wrote a fascinating history of how indexing got started. The resulting… Continue reading

$1 Billion Dollars Is Just the Starting Point

by Scott PuritzMy firm, Rebalance, recently celebrated a milestone — $1 billion in assets under management. It is an easy figure to misunderstand. The firm is not “bigger” or “more important” than a few years ago. What has changed is that an increasing number of people trust us with their investments, and those investments have grown. That… Continue reading

An NFL Fantasy Football Draft Strategy Is Not An Investment Strategy

by Scott PuritzAs summer winds down many of us are heartened by the promise of crisp autumn air, pumpkin spice coffee drinks, and the weekly showdowns of NFL football giants. Amazingly, alongside the absolutely enormous revenue machine that is pro football, a secondary, completely virtual game has grown into a massive industry of its own — fantasy… Continue reading

5 Reasons to Consider a Modern 401(k) Provider

by Scott PuritzAll 401(k) services are not created equal. You may have had a plan in place for years and never questioned the fees and exactly what roles and responsibilities you might have toward employees. It’s time to dig in and ask those questions. Read this brief guide to learn five reasons to consider a new, more… Continue reading

An Appreciation of Yale’s Star Investment Chief, David Swensen

by Scott PuritzThe lives of financial titans can seem otherworldly, replete with the trinkets of absurd wealth that come from commanding personal billions. Then there’s David Swensen, the one-time Wall Streeter who passed up all that and instead focused on something larger than himself: building a massive gift for the benefit of generations of students to come.… Continue reading

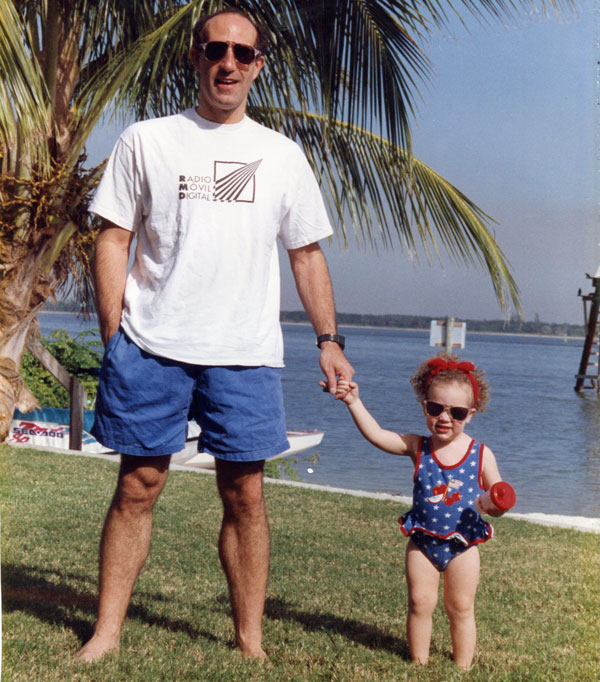

The Best Father’s Day Gift Ever

by Scott PuritzNot long ago, I received an unexpected early Father’s Day gift from my older daughter when she returned home for a long weekend visit with mom and dad. Since graduating from college Alyssa had been living in the Chicago area, where she worked as a research assistant for a prestigious university. She thoroughly enjoyed living… Continue reading