A Three-Step Income Plan for Those Nearing Retirement

by Sonja Breeding, CFP®As a financial advisor, increasingly I find myself in a ticklish situation: Trying to convince people that taking an easy yield on cash is not a long-term investment strategy. Here is what typically happens, in my experience. Imagine a couple in their early 60s. They have diligently saved for retirement. As they approach the… Continue reading

Medicare plan options are confusing. This book may help.

by Sonja Breeding, CFP®Medicare Made Simple? Not Quite: Decoding the Alphabet Soup to Maximize Your Coverage. Medicare plan options are confusing. This book may help. By Michelle Singletary, November 22, 2024 For all its pluses, Medicare can be a hellish system that befuddles and frustrates so many beneficiaries. Medicare provides health insurance for millions of Americans 65… Continue reading

Backdoor Roth IRAs Are Promising — and Perilous

The “backdoor” Roth IRA presents a tantalizing solution for those keen on maximizing savings, offering tax-free growth and withdrawals. Read Laura Saunders’ article from the Wall Street Journal below to learn more. Backdoor Roth IRAs Are Promising — and Perilous by Laura Saunders, May 3, 2024 For determined savers, the backdoor Roth IRA is an… Continue reading

Does the 4% Withdrawal Rule for Retirees Still Make Sense?

Read this Barron’s article to learn why the 4% withdrawal rule for retirees is still relevant amidst changing markets. Discover strategies like adjusting withdrawal rates, optimizing asset allocation, and utilizing Roth conversions to make the most of your retirement savings. Does the 4% Withdrawal Rule for Retirees Still Make Sense? By Elizabeth O’Brien, February 9,… Continue reading

Two Retirees Consider Their Nightmare: What Will We Do if One of Us Dies First?

In this Wall Street Journal article, delve into the emotional journey of retirees confronting mortality and the necessity of a backup retirement plan. Two Retirees Consider Their Nightmare: What Will We Do if One of Us Dies First? by Stephen Kreider Yoder, February 1, 2024 Steve We came 6 inches from death, maybe 4, just… Continue reading

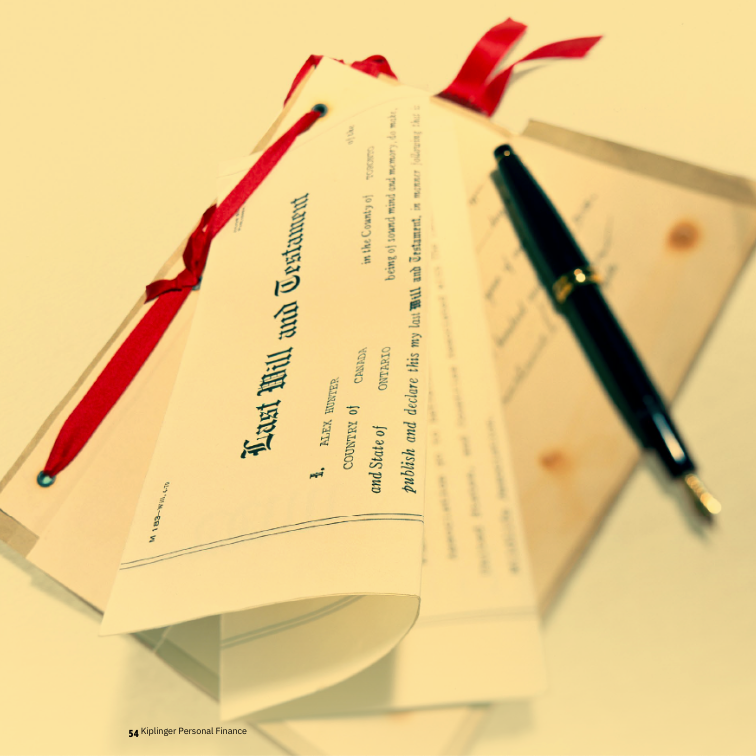

An Inheritance With Strings Attached

Have you recently received an inheritance? Avoid hefty tax bills that can come from inherited IRAs. An Inheritance With Strings Attached New rules for inherited IRAs could leave some heirs with a hefty tax bill. By Sandra Block, September, 2023 In the first quarter of 2023, Americans held more than $12 trillion in IRAs. If… Continue reading

Why It’s Smart to Revisit New Year’s Savings Goals Now

Summer is the perfect time to check in on the financial goals set in January at the beginning of the year. Columnist Ann Carrns outlines how to conduct a personal audit, which is essentially a financial health “checkup.” Why It’s Smart to Revisit New Year’s Savings Goals Now There’s still time this year to make adjustments, especially with… Continue reading

With the Odds on Their Side, They Still Couldn’t Beat the Market

The Rebalance tried-and-true adage remains the same, echoed by this NYTs columnist: it is nearly impossible to beat the stock market. The most prudent long-term investing strategy is to “own” the entire stock market through low-cost, broad exposure index funds. Source: The New York Times April 14, 2023. With the Odds on Their Side, They… Continue reading

Should I Start a Donor-Advised Fund?

by Sonja Breeding, CFP®It seems like everyone these days has started a foundation. There’s a reason for that. It’s easier than ever to create one and there are many incentives to go down that path, even with smaller amounts of money. The reason such “foundations” are so prevalent now is because most of them are, in fact, the… Continue reading