The ‘Vanguard Effect’ Means Your Investments Could Soon Cost Zero

by Mitch Tuchman“Disruption” is a term you hear bandied about in Silicon Valley, usually associated with young CEOs in t-shirts. The idea isn’t new. The 19th-century industrialist Andrew Carnegie would recognize it as competition. Joseph Schumpeter, an Austrian economist from the 1930s, would call it “creative destruction.” In finance world terms, my favorite version of disruption is… Continue reading

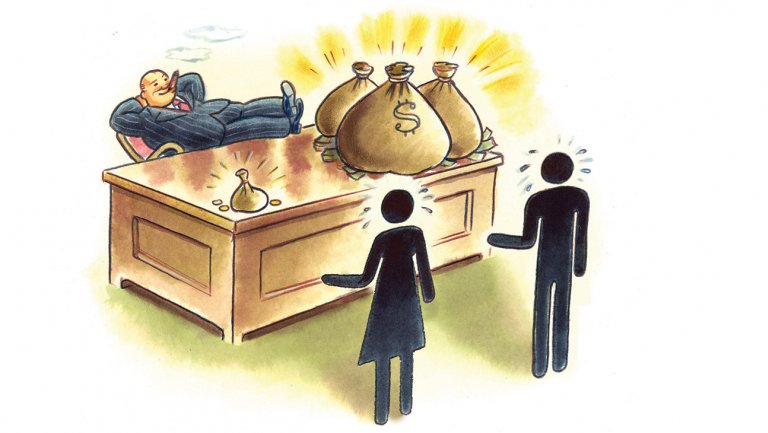

Is Your Financial Advisor In The Hidden Fee Hall Of Shame?

by Mitch TuchmanGasoline right at the highway exit is usually cheapest. Drive a few miles toward town and you might see a 10 cent per gallon jump. Ever wonder why? If you said “competition,” go to the head of the class. Gas stations tend to cluster around knots of highway traffic. The driver near empty on a country… Continue reading

Beware This Dangerous Tax Avalanche In Retirement

by Mitch TuchmanNearly eight in 10 Americans have access to a 401(k) retirement investment plan. Many more should consider adding or using Roth IRA accounts. Roth accounts are funded with after-tax money — there’s no tax savings now — but the investment growth and withdrawals are tax-free forever. Short-term pain for long-term gain. Is a Roth IRA the… Continue reading

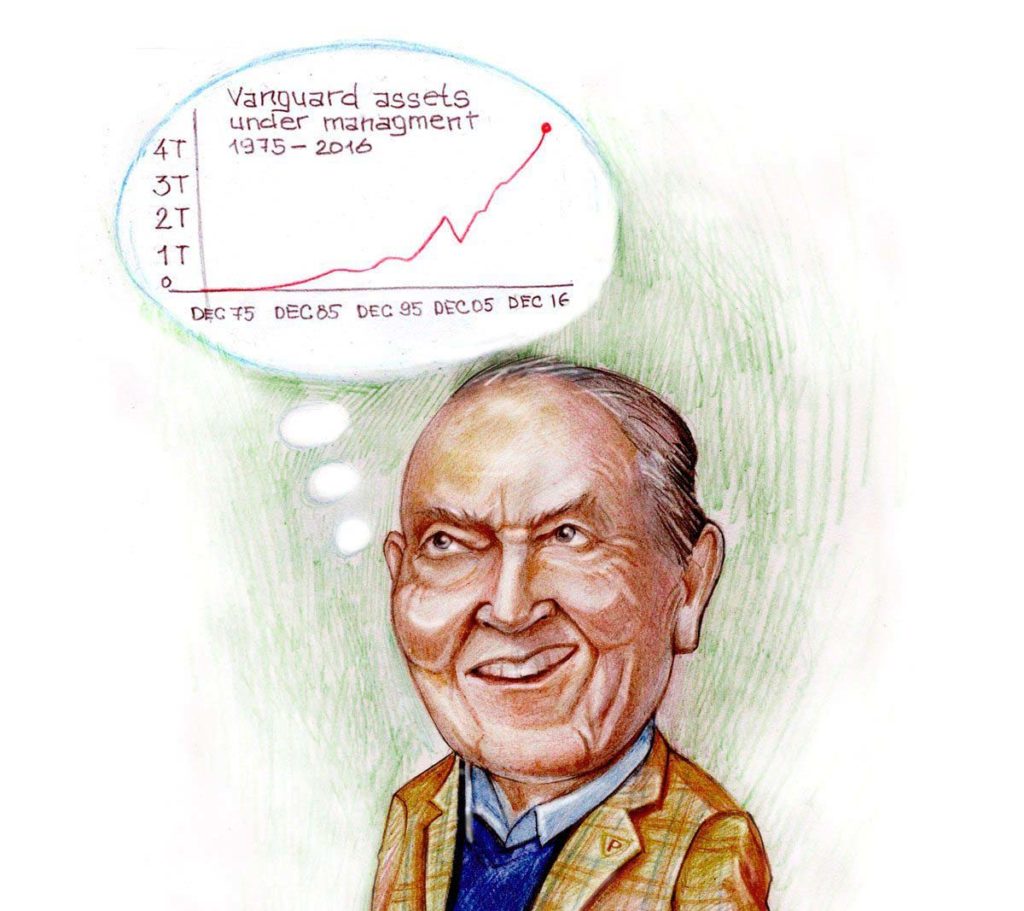

Jack Bogle Says Vanguard Is Getting Too Big. Now What?

by Mitch TuchmanJack Bogle, the founder of the massively ayuccessful (and just plain massive) Vanguard Group, recently said his former company is perhaps getting too big for its own good. And big it is. The house that Jack built took in $276.2 billion so far this year, more than its eight largest competitors combined. Much of that… Continue reading

John Bogle Saw The Nobel Prize In Economics Coming

by Mitch TuchmanRichard Thaler, the recent winner of the Nobel prize for economics, is a brilliant man. Anyone interested in how the human mind works should read Nudge: Improving Decisions about Health, Wealth and Happiness, the 2008 book he wrote with Cass Sunstein. Thaler and Sunstein make a relatively simple argument based on years of economic research… Continue reading

What Trump’s Tax Plan Means For America’s Retirees

by Mitch TuchmanWhatever you might think of our current president, you can’t say he doesn’t think big. The Trump-GOP tax plan just announced has the potential to impact retirement savers in fundamental, long-term ways that could be positive for many Americans. The plan is a long way from reality and is likely to see some changes before… Continue reading

How Buffett Won His $1 Million Hedge Fund Bet

by Mitch TuchmanNearly 10 years ago, iconic billionaire investor Warren Buffett took what seemed like a contrarian bet for a professional stock picker. He bet any comer that a simple, low-cost investment in the S&P 500 would beat a hedge fund strategy over 10 years. On the line was $1 million, to be paid to a charity… Continue reading

John Bogle’s Advice On Stocks Proven Again — By Science

by Mitch TuchmanA new study of our innate human biases reinforces the value of diversification when it comes to stock investing. Short version: We just can’t help ourselves when we think we know something. Scientists call this confirmation bias, the unconscious way we seek out information that proves we are “right” about closely held ideas. The problem is… Continue reading

Careful! “Robo” Advice Isn’t Necessarily Conflict-Free

by Mitch TuchmanWalk down the aisles of your local grocery store. If you’ve been shopping for a few decades, you know a few things almost without thinking. Fresh foods are along the walls, dry goods in the center aisles. Store brands are usually just fine and cheaper. Now look at the shelves. Some products (say, fancy ground… Continue reading