Jack Bogle Is Right: Don’t Be A Passive Investor, Be A Frugal Investor

by Mitch TuchmanThe money manager and columnist Barry Ritholtz makes a timely and important point in his most recent opinion piece for Bloomberg: Passive investing is an illusion. Nobody is truly a passive investor because all investing involves selection. Even if you choose the broadest possible global stock index fund, you’ve still chosen some stocks and ignored… Continue reading

What Should You Do With Your 401(k) Plan When You Retire?

by Mitch TuchmanAn interesting new analysis of the retirement business points out that, more than ever, people are stepping away from trading and into automated, low-cost portfolios. Three cheers for that, we say, but it raises an interesting question. Once you retire, should you stay in your set-it-and-forget-it company plan or do something different? How does “investing… Continue reading

Big Data Explains Warren Buffet’s Disarmingly Simple Investment Strategy

by Mitch TuchmanIn a fascinating new book, a former Google data scientist offers a whole chapter about his brief misadventures in trying to apply big data — what we know from massive amounts of Internet searches — to investing. The chapter, part of the book Everybody Lies: Big Data, New Data, and What the Internet Can Tell Us… Continue reading

Report: ‘Closet Indexers’ Massively Overpay For Investment Advice

by Mitch TuchmanA friend of mine was complaining recently about the price of apples, specifically a variety marketed as a “Honeycrisp” apple. He would go to the grocery store to buy a bag of apples and find Honeycrisps at $7.99 a three-pound bag. Right next to them would be Gala apples at $3.99. “Why are Honeycrisp apples… Continue reading

John Bogle’s Enduring Insight On Investment Risk

by Mitch TuchmanBack in the 1980s, stock picking gurus such as Peter Lynch at Fidelity offered small investors a strikingly simple mantra: “Invest in what you know.” The idea was intuitive and highly attractive for a number of reasons. Essentially, if you noticed a small coffee chain with a line out the door, you bought that stock.… Continue reading

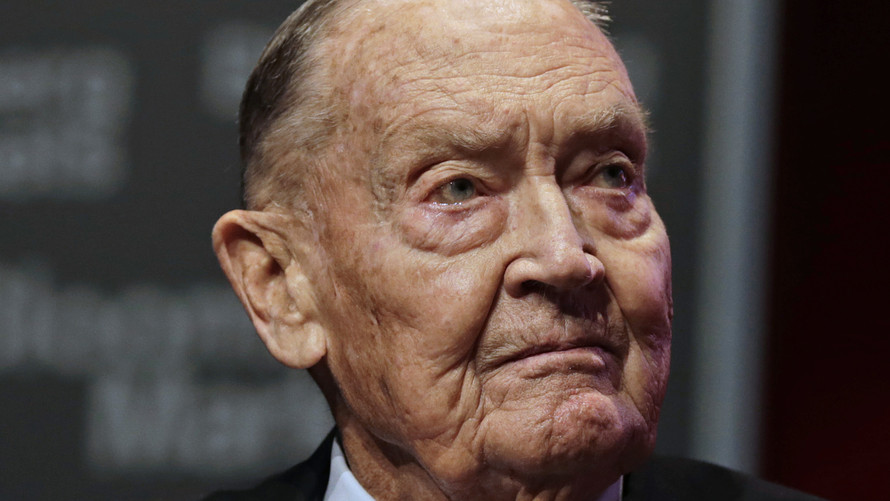

John Bogle, Buffett’s ‘Hero,’ Explains Why Index Investors Need Not Fear A Stock Downturn

by Mitch TuchmanFresh off a weekend visit to the “capitalist Woodstock,” Warren Buffett’s annual shareholders meeting, Vanguard Founder John Bogle addressed an interesting question that must bug any retirement investor who relies on index funds. Bogle was asked on Monday to explain if the move by investors toward index-style exchange-traded funds (ETFs) isn’t creating a new kind… Continue reading

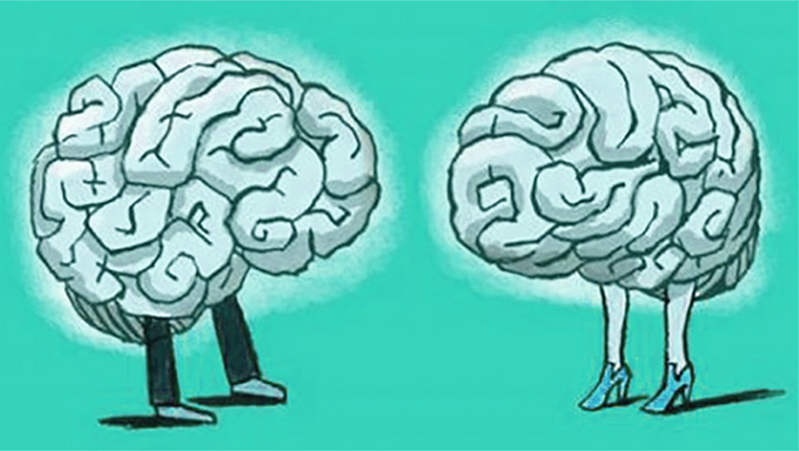

Testosterone Messes With Your Investing Brain

by Mitch TuchmanA landmark 2001 study showed that women outclassed men as investors by nearly 1 percent per year. Now we are coming closer to understanding why: Testosterone interferes with the male investor’s brain. A new study from Caltech, Wharton, Western University and ZRT Laboratory found that men are quicker to make judgments and less likely to… Continue reading

5 Times Warren Buffett Talked About Index Fund Investing

by Mitch TuchmanOver the years, much has been made of the advice of iconic investor and billionaire Warren Buffett, including his penchant for promoting the idea that most investors should use index funds. When one mentions Buffett’s promotion of low-cost investing, usually the pushback from active investors is immediate. Certainly, they say, he can’t mean that nobody… Continue reading

John Bogle’s 7 Timeless Investing Lessons

by Mitch TuchmanEvery investor should read the books of John Bogle, founder of the Vanguard Group and tireless advocate of the ordinary retirement investor, the “little guy” faced with long odds and the hungry sharks of Wall Street. One of the best is Enough: True Measures of Money, Business, and Life, a book he probably thought of as… Continue reading