Do-It-Yourself Finance VI: Red Flags and Scams

by Christie Whitney, CFP®There are all kinds of scams out there. Knowing where you are investing and how to avoid swindlers are important for your financial future. Here are 10 warnings and recommendations to help keep your savings and investments safe. Red Flag #1: Variable Annuities Consumer Reports Money Adviser commented in a recent “Red Flags” article: They’re… Continue reading

Gain An Early Financial Advantage

by Christie Whitney, CFP®You are finally done — a doctor. And you’ve waited seemingly forever as your non-medical friends now have nice autos and purchased a home. They also have the time and money to dine out and entertain frequently. But it’s your time to shine! That first BMW and mortgage are way overdue. And these possessions need… Continue reading

Is It My Retirement Or … My Children’s?

by Christie Whitney, CFP®Dr. Bob, age 55, with an income exceeding $250,000 and a portfolio approaching $400,000, lived with his wife, Claudia, in a lovely community. He was determined to enhance the lifestyle of his daughter, Kelly, and son-in-law, Matt, both age 28. Bob paid a sizeable portion of the down payment for a home in an upscale… Continue reading

Recent Arizona Dental Grad vs. $10,000 Per Month Debt

by Christie Whitney, CFP®I received the following letter from a young dentist recently. He represents the typical new general dentist in many ways. I am 32 years old with three children aged four, two and one-half, and 6 months. I graduated from dental school in 2013. My wife has a master’s degree, yet plans to raise the kids… Continue reading

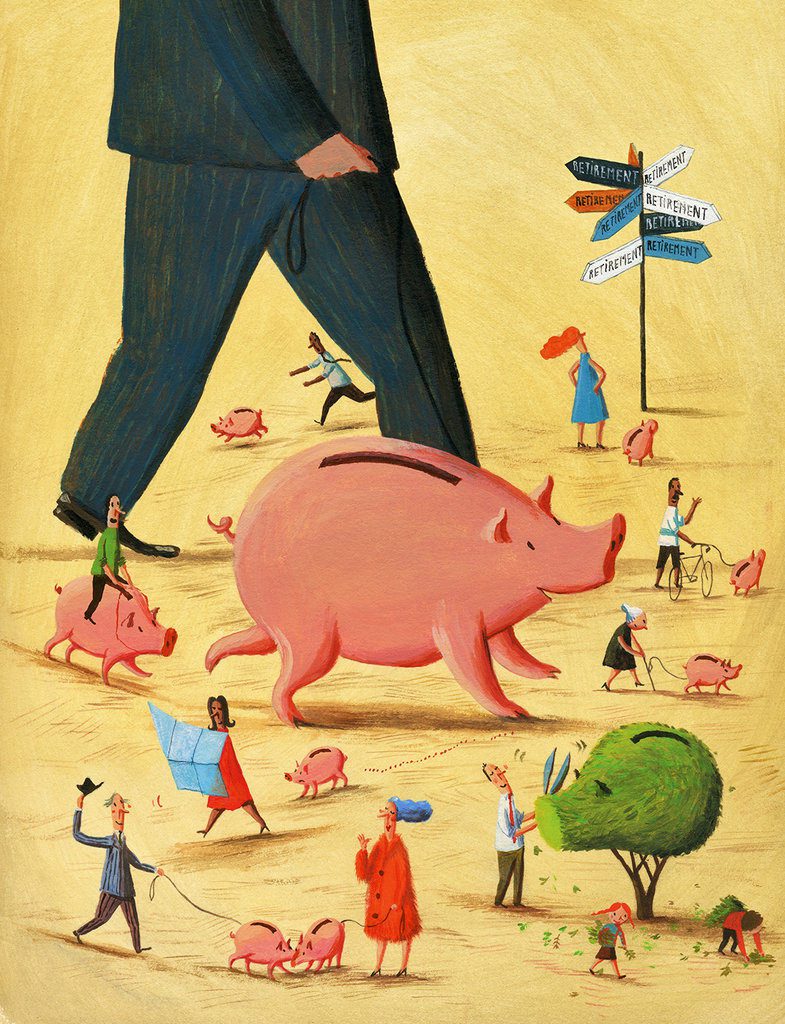

The Basics of 401(k) Retirement Planning

by Christie Whitney, CFP®The history of the most common American retirement plan — the workplace 401(k) — is long, but the essential idea is simple. Save money today and lower your current income taxes. Put in pre-tax money while you are working and take money out later, and pay the income taxes when you take money out in… Continue reading

Financial Planning Is About Freedom From Worry

by Christie Whitney, CFP®I once had a client who asked me, point-blank: “Do I have enough money that I can fly business class the rest of my life?” So, we had a few discussions and I drew up her financial plan. The answer was “yes.” Talk about a happy customer! And that’s the important point about financial planning… Continue reading

Back to School: 5 Resources for Financial Education

by Christie Whitney, CFP®It’s that time again. The weather is starting to cool, and the long hazy days of summer are winding down as kids (and adults alike) retreat to the classroom. While the back to school focus is typically on children, have you thought about giving yourself some homework? I don’t mean homework for a grade, of… Continue reading

A Financial Advisor Cares About Your Financial Health

by Christie Whitney, CFP®Being a good financial advisor is a lot like being a good personal physician. You have to listen to what the patient means, whether they are saying it out loud or not. Every primary practice doctor has this experience. The patient comes in, gets weighed, blood pressure taken, and the doctor does his or her… Continue reading

Women & Investing: Making The Connection

by Christie Whitney, CFP®Throughout my professional life I’ve always been a connector, the person who helps people move from feeling uncomfortable and alone to a more stable footing. It started with military families early in my career and continued later, when I directed children’s ministries at the national level. Today, through my work in the financial services field,… Continue reading