The U.S. Federal Reserve has begun to raise the interest rate, generally a sign of a strong recovery and a growing economy, and often a trailing indicator of growth. The Fed typically only acts late in the process, arguably too late at times.

Meanwhile, one European bank’s economists are making waves with a note to clients that says, in so many words, “get out now!”

Get out of large and small-cap stocks, get out of commodities, lose your high-yield debt, real estate — all of it. “Sell everything except high quality bonds,” they said in a note to clients making the rounds on the Internet. “This is about return of capital, not return on capital. In a crowded hall, exit doors are small.”

One of these views must be wrong, clearly. But maybe not so clearly.

Without delving too deeply into the track record of economists (or anyone else) in predicting the stock market, it’s worth remembering that the biggest risk people run when investing is not in taking too little action, but too much.

You don’t need to look any farther than the excellent quarterly chart book put out by J.P. Morgan. As usual, there is an updated version of a chart that shows how the major investment class indexes — stocks, bond, real estate, commodities and the rest — performed against the “average investor.”

The short answer is this: The little guy gets creamed. The typical retail investor saw a return of 2.5%, just a hair above inflation, over the past two decades. The S&P 500 returned 9.9% annualized.

What’s going on here? Well, high investment manager fees are certainly a big part of the problem, particularly over periods of decades. Money leaving your account in fees doesn’t compound for you anymore and instead compounds for the high-cost manager.

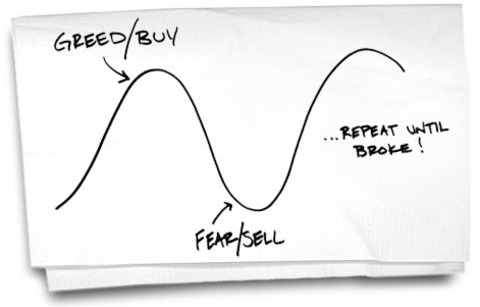

But another big part of the problem is market timing, that is, reacting to headlines that scream “sell everything.” If you want to hear that, there has been no shortage of market prognosticators making the same warning. In fact, they have been saying it for seven years running, even as the stock market busted to new highs over and over.

The history of investing is full of years when absolutely horrific, frightening events took place, wars, scandals, social unrest, and yet stocks put on steady gains. Taking the current headlines and making them into a reason to sell is a tactical mistake.

The markets are the markets. The news is the news. Sometimes they seem to sync up, but more often any resemblance is purely coincidental.

For the past century, the stock market has doubled in value roughly every eight years and there is no 5-year period where stocks did not register a positive return. Stock markets fall, then they recover.

Buyers and sellers

You might not be convinced by facts, but how about this simple, undeniable truth: If you sell your investments today, somebody else is buying them.

They’re not going back into “inventory” at some store. They’re not getting tossed out to be recycled. Every single transaction that takes place in the stock market is a meeting of buyer and seller.

All you are doing by selling is choosing a side. Someone wants to own your investments and enjoy that compounding effect for years to come. If you no longer want them, you are free to sell.

If in fact you want to own them, selling makes no sense at all. Rather, as stock prices fall you have a chance to buy more at lower prices.

Is the Fed wrong and the “sell it all” bank right? It doesn’t matter in the least to the serious long-term retirement investor.