A professor at the University of Chicago, Harold Pollack, made a big splash recently with a pretty simple idea: What if all you needed to know about personal finance could fit on a single index card.

Not reams of stock charts. Not years of study in some business school. Not even a book from the library, but an index card.

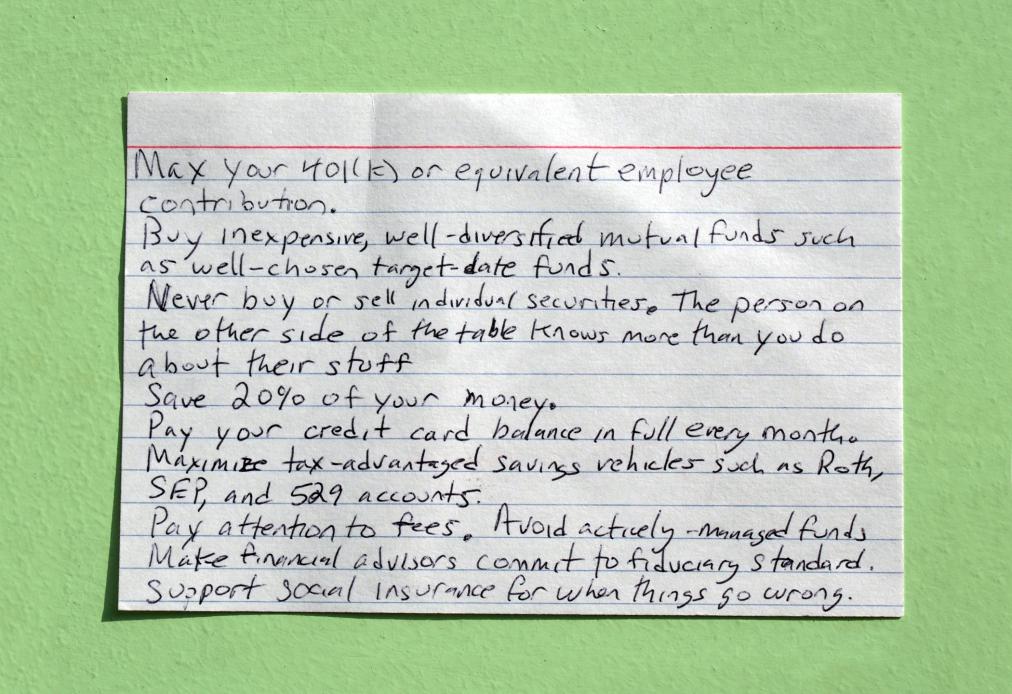

So Pollack produced this card, and it’s refreshingly simple and to the point. In summary form, Pollack advises that people:

- Save 10% to 20% of their income

- Pay credit cards in full monthly

- Max out workplace retirement plans

- Never buy individual stocks and instead use diversified mutual funds

- Hire a financial advisor who is a fiduciary

- Buy a home when you are ready

- Own adequate insurance

- Provide for others through the “social safety net”

Simple, right? What he said next, to PBS, was even more interesting. You can’t be Warren Buffett. You won’t be Warren Buffet. But you can invest in exactly the way that Warren Buffett advises.

Buffett has more resources than you and pretty much all other investors. He brings his reputation and experience to his dealings. He gets offered things nobody else gets offered.

“None of us are Warren Buffet,” Pollack said. “In fact, Warren Buffett tries to remind his children that they are not Warren Buffett, and he advises them to invest his fortune in index funds rather than try to emulate what he did.”

And that’s an important point. The financial industrial complex — Wall Street, the financial media and even rank-and-file stockbrokers — have no vested interest whatsoever in telling that what they do is simple.

They can’t. If they did, then they would have to admit that the fees they charge are way out of touch with the value of the services rendered.

That’s Pollack’s point about hiring a fiduciary. It’s a mouthful, but the idea is pretty simple. A fiduciary has to act in your interests. Not his own. Period.

Lower costs

A lot of financial advisors, particularly those who make their living from commission sales, will dance around this subject. “Oh, we protect you. Don’t worry.” Or maybe, “We aim to meet a fiduciary standard.” Or this classic, “If I have to be a fiduciary, you won’t be able to afford my services.”

That last one is essentially the argument lobbed against the fiduciary rule just announced by the U.S. Department of Labor, an effort my partner Scott Puritz, a Managing Director at my firm, Rebalance, took part in promoting before a key Senate subcommittee.

Here’s the thing: It doesn’t “cost more” to be a fiduciary. In fact, it can cost a lot less and lower costs lead to returns that are much more in line with retirement savers’ expectations.

Learning the basic truths of retirement investing does fit on an index card. It can be summed up in an argument as simple as “buy index funds,” as Buffett argues to his own relations.

And you can, in fact, retire with more.