Ask anyone with a 401(k) plan at work what they pay in fees and the answers may surprise you: Most people think they pay nothing at all.

Even those who know that’s impossible undershoot by a surprisingly large margin, guessing “about 1%” in fees.

The full truth is usually a shock: Many 401(k) savers pay north of 2% and some pay even more. If you own a small business and run a plan for your own employees, it’s important to understand what you get for that money.

Even more important, as a business owner you participate in the same plan at the same fee cost. The impact on your retirement is even harsher since owners usually set aside larger amounts to invest in order to take advantage of tax deferral.

So how much do you pay? And what does 1% even mean? Here’s a hint: It’s much more in dollars than you think.

Traditional 401(k) plans provide a number of different services to their participants, but it can be broken down into two basic categories: What you pay to invest, and what you pay for the plan itself.

Investment fees are usually the largest piece of the pie. Under the hood you will find fees paid to the managers of the various stock and bond funds in which your money is invested.

Those fees can range from a fraction of 1% to well over 1%, depending on the investment type, be that large company stocks, small company shares, foreign stocks or fixed-income products such as bond funds.

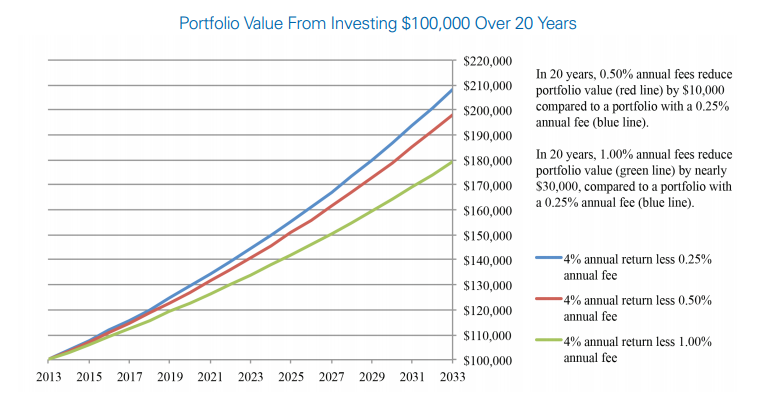

What paying 1% means is that for every $100 you have invested the funds take $1 each year to pay themselves. (If a fund charges 0.30%, then it’s 30 cents.) Scale that up to $100,000 and we’re talking about $1,000 a year.

Now, remember, that’s a percentage of your balance — not a slice of your returns in any given year. If the stock market is flat you still pay $1,000.

That means your retirement portfolio declines in value (!) even if the market returns zero. If the market declines you pay less (your balance is lower, after all) but you still pay, and your balance falls by even more, regardless.

Naturally, investment fund managers will argue that “if you do well, we do well” but what they fail to mention is that “if you do poorly we still do okay” is also true.

To invest this way you would have to believe that the fund managers you hire are right more often than they are wrong and thus earn their keep and then some. But the data doesn’t back that up.

Research shows that most of the time — typically eight or nine times out of ten — actively-managed investment funds fail to beat their respective market benchmarks. Meanwhile, modern 401(k) plans, like those offered by Rebalance, help investors avoid costly active-fund markup while delivering steadier returns year after year.

We do this by “owning the market” through very low cost funds. The fees are a tiny fraction of that 1% yet often outperform the majority of active managers, year after year.

The other 1%

But let’s move on to the second part of the fee picture, running the plan itself.

Operating a retirement plan is not a simple bookkeeping task. There are many rules around how these plans work, including facets such as custody and trading regulations, rules that if not followed diligently can result in fines, penalties and excise taxes — and even lawsuits.

On top of that, someone has to oversee the flow of money from your employees’ paychecks into the plan, provide relevant investment information and education, deal with features such as loans and withdrawals and perform scheduled tax reporting.

And that’s where the other 1% goes in many 401(k) plans. The reason that so many small businesses pay such high 401(k) fees is because of a lack of true transparency, lack of innovation, and a proliferation of unnecessarily high fees.

A study by Brightscope found that the very cheapest 401(k) plans in the country are run by the largest employers, charging well under 1% for both investment and administration. Comparatively, most small business owners ended up paying much more in fees, sometimes 2%, 3% or worse per year.

That second 1% fee hit is taken from each employee’s balance each and every year. It has nothing to do with performance or value. It’s just a cost and it’s a permanent feature of retirement plans no matter what the market does year to year.

The scary part is that once assets are scalable, often they don’t move to a cheaper platform. Instead, business owners let high fees silently eat into returns, resulting in fewer years that could be spent enjoying retirement.

This risk is why the U.S. Department of Labor requires plan benchmarking every three years and in some cases annually. You don’t know what you don’t know.

The result for many people in small business 401(k) plans is like running in sand: They are putting cash to work every pay period but their returns can’t seem to keep up with the market itself.

It’s hard to look at the educational and administrative component of a typical small business plan and say “Well, that was worth $1,000 of my money.” Most employees find 401(k) investment selections baffling.

As a result, many employees fail to invest properly for their goals, and the majority essentially ignore their own plan for decades, at their peril.

Streamlining costs

Ideally, all of these costs should be right-sized to reflect the true value to the employee and to the employer. Investment costs should be oriented toward maintaining money in investments, not draining it. Administrative costs should be streamlined, providing service but also useful guidance.

Ultimately, the plan should work hard for its participants, rather than the provider that happened to set up the plan. The good news is that market efficiencies have rapidly moved in this direction, to the benefit of both employees and employers.

Adding plan benchmarking to your annual review processes will ensure the fees you pay are fair and reasonable. Paying lower fees could be the difference that shaves months or even years off your retirement date.

Why have a tropical destination as your Zoom meeting background when instead you could be there for real?

If you would like a free audit on your plan and get a benchmark study on where you stand, please contact me.