The Dental 401(k) Plan

Rebalance‘s Managing Director Mitch Tuchman details in-depth how dental professionals can keep their best people while reducing cost and risks.

ABSTRACT

Modern 401(k) plans that are a dramatic improvement of past plans have emerged in recent years. These improvements come in the form of reduced fees, higher returns, better risk management and reporting, and valuable educational services for employees and owner/operators.

This article will highlight important questions to ask your current 401(k) provider to ensure that you are mitigating fiduciary risk and paying a fair amount for your service, and that your investment vehicles are suitable for your employees and the owner/operator’s financial goals.

COURSE DESCRIPTION

This article details how dental practice owners can implement and manage a best-of-breed 401(k) plan. This includes methods to achieve lower costs and better returns, and how to reduce personal legal risk for the dental owner/operator.

Fees and returns are the primary way many business owners measure the worthiness of a 401(k) plan. Often, however, trust in the recommendations of a family member, close friend or longtime professional relationship affects how one chooses a 401(k) provider—for better or worse.

While fees and returns are important, there are many additional issues related to 401(k) management that small business owners, including dentists, are generally unaware of. To run a truly successful 401(k) plan, it is important to consider a number of lesser-known risk factors that can leave dentists out of pocket and liable to lawsuits.

LEARNING OBJECTIVES

Upon reading this article, participants should be able to:

1. Understand the impact of high fees, which fees are reasonable and the effect of compounding.

2. Recognize the advantages and disadvantages of different investment vehicles.

3. Understand the meaning of the term fiduciary and recognize who acts as the fiduciary on a 401(k) plan.

4. Understand the risks that practice owners face when acting as the fiduciary on their own 401(k) plan.

IMPORTANCE OF 401(K) PLANS

401(k) plans provide a great tax incentive to save money and invest for retirement. They also provide an attractive benefit for recruiting staff members in a competitive labor market. A well-run 401(k) is a powerful retention tool as well—one that allows the\owner/operator a chance to share in profits while inducing employees to think long-term about their career path in the company. Likewise, high-income owners stand to benefit from the tools found in 401(k) plans, such as tax-deferred profit sharing and deductibility of employer contributions.

HIGH FEES

Many legacy 401(k) plans charge often obscured fees of up to 5% of the assets under management annually. Many modern plans, however, charge far less—costing 1% or less annually. Open, transparent, asset-based fees in 401(k) plans provide peace of mind and security from hidden costs common in legacy plans. Such hidden fees are increasingly prevalent and tend to ride along as obscured fund costs, fees nested inside investment vehicles and tacked-on service fees to pay for employee benefits such as education and required plan reporting services.

Fees are subtracted from the entire account balance, not from any gains you might make. You pay fees even if the market declines, and that missing money has an outsized effect on portfolio growth over time. Money should be compounding for the investor by growing faster over time as gains are reinvested. Yet, money removed in the form of fees forever ceases to grow for the investor and instead compounds elsewhere, to the benefit of the company offering the plan and fund managers running those actively managed products. Ultimately, one-third and up to one-half of the return an investor might have expected from a typical multidecade investment process is lost to unnecessarily high fees.

INVESTMENT VEHICLES

There are two common products available for 401(k) s: actively managed funds and index funds. Actively managed funds tend to be sold through brokers who invest your employees’ savings in stocks and shares they choose. Those same brokers often are incentivized to maximize their own commissions and fees. Those commissions add up, to the detriment of performance. Actively managed funds in 401(k) plans thus are significantly more expensive than index funds.

Index funds are inexpensive by design. Instead of trading costly mutual funds, they hold a basket of stocks and shares and only buy or sell on occasion to stay on track with a target market index, such as the S&P 500. Index funds and their low-cost cousins, exchange-traded funds, follow preset rules to faithfully re-create the return of their underlying investments.

Research has shown that index funds provide returns greater than actively managed funds more than 90% of the time. When the increased trading costs and associated friction of an actively managed fund are taken into account, this figure is even higher than 90%.

WHAT IS A FIDUCIARY AND WHY DO I NEED ONE?

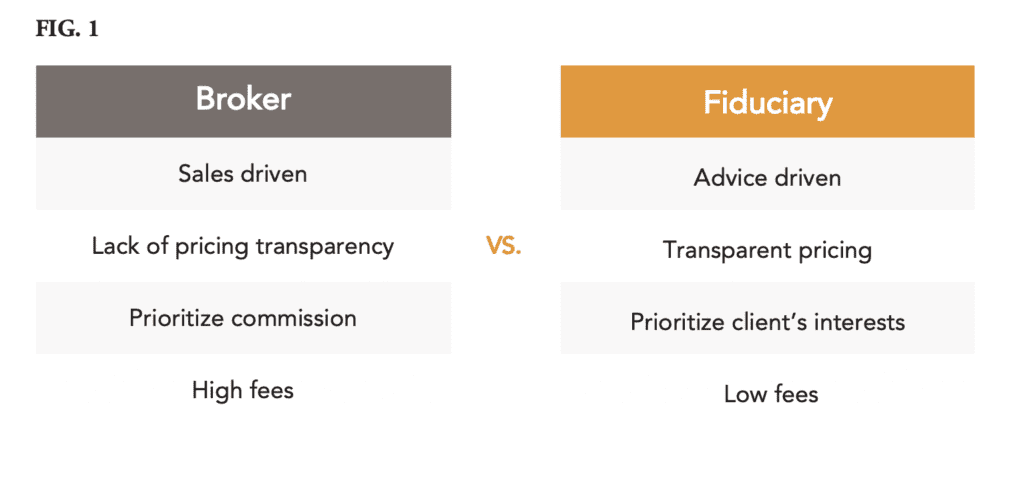

Having a fiduciary relationship with your 401(k) plan is not the industry standard, but it should be. A fiduciary on your side brings an important quality to your investment decision process that will protect you as the owner/operator and as a participant in the plan. A fiduciary who manages your 401(k) is required by law to put the clients’ and employer’s interests ahead of his or her own. Fiduciaries are different from stockbrokers, who often are motivated by commissions they might earn and who often are motivated by commissions they might earn and who typically put their own interests first.

Fiduciaries are often less expensive than brokers, yet they offer an extra layer of protection for the 401(k) plan owner/ operators. Many owners/operators fail to grasp that they can be held liable for plan losses that affect their employees. If you have a 401(k) provider that is not explicitly defined as the plan’s fiduciary, that means you, the owner, are the fiduciary for the plan and all of its employee participants.In short, you are personally liable for plan losses caused by a breach of your fiduciary responsibilities and can be called upon to restore plan losses and pay costs attached to any inappropriate actions committed—even if you didn’t take those actions yourself.

For instance, a plan provider might suggest an inappropriate portfolio for an older employee, such as one stuffed with risky investments. If the plan provider isn’t the fiduciary, then the owner is by default. Should those investments fall short, you are at legal risk, even years later. (See Fig. 1.)

RISKS ASSOCIATED WITH ACTING AS THE FIDUCIARY

Employers (plan sponsors) typically have fiduciary responsibilities over the performance of the 401(k). To mitigate risk to the dentist, the fiduciary risk should be shifted to an investment manager. If you do not have a plan where the provider acts as a fiduciary, then you should consider switching. If you are currently the fiduciary, the risks and responsibilities of making investment decisions for your employees lies with you. Class-action lawsuits against employers with poorly managed 401(k) plans are on the rise, and plan participants (employees) have been rewarded significant amounts of money because of their employer paying too much in 401(k) fees or because returns end up being meager.

As the unwitting fiduciary of the plan, small business owners end up at risk of facing legal action over a 401(k) plan that they have little practical control over. Choosing a plan where the provider is the fiduciary provides a level of security to the business owner. Legacy 401(k) plans often do not act as the fiduciary automatically, despite their higher fees. If your 401(k) provider is one of the paycheck company providers or a large bank, then it’s likely that you are the fiduciary.

MANAGING REGULATORY RISK AND ASSOCIATED REPORTING

Form 5500 is not a simple form to complete. It is time- consuming, the late filing fees are high and the 2016 instructions covered 82 pages. Additionally, errors in reporting increase the chance of audit, which will cost at least $10,000 for a small practice and can cost medium- sized businesses up to $75,000.

One of the main reasons small businesses do not provide a 401(k) to their employees is the sheer cost of reporting and keeping up with legal and regulatory changes. Recently there have been changes to allow organizations such as chambers of commerce and state governments to band together to create larger pools of like businesses to lower costs. This is a welcome change, but so far not a complete answer. The modern 401(k) cuts to the core of the problem by partnering with professional service providers to eliminate this burden for owner/operators, even while keeping fees in check.

SWITCHING 401(K) PLANS

Once established, employers infrequently change or modify 401(k) plans or providers. There is a misconception that switching providers involves terminating your current plan and then setting up a new one. This is not the case, due to the IRS regulations around what’s known as a “successor plan.” Instead, the new provider will take over administration of your current plan.

CONCLUSION

When reassessing your current 401(k) plan, or deciding which plan to choose, it is important to put any loyalties to known financialadvisers to one side and assess what is best for you and your employees.

- Make sure you know exactly what fees and costs you are Direct fees provide a level of security that many brokers do not offer.

- Look for a plan that assumes fiduciary This will reduce owner liability and will ensure that your adviser is acting inyour best interest.

- Look for a plan that incorporates reporting and management costs into the Not only will this save you time, it will also reduce the chances of error and audit risk.

- Decide which investment vehicle is best for your level of risk

This article originally appeared in Dentaltown Magazine. Verified members of Dentaltown can visit Dentaltown.com to learn how this information can be used to earn a CE credit.