Every year at tax time, your CPA goes over your company books, prepares your personal return and — after a few weeks of grinding — hands you something to sign.

Ever think about what your signature means on a tax return? And on your business return?

It means that you are filing your taxes, not the accountant. By signing, you attest to understanding every page, every deduction, every credit. If it turns out that your return is full of mistakes, you still signed it.

Should an audit come down, yes, you can fire your terrible accountant. But he won’t be paying your back taxes, you will.

Small business owners have another, completely different tax form to worry about, called Form 5500. And not one but two government agencies look at it every fiscal year.

Rather than your business, the 5500 details the health of your company’s 401(k) retirement plan.

Think of it as an annual report: Included are details about the size and participation rate of your plan, the investments held, and what you pay in fees to financial advisors and fund managers.

The IRS looks at your 5500, but so does the Department of Labor (DOL). And both have the power to audit plans found lacking. Plans above a certain size, those with 100 eligible participants and 80 participants, get audited automatically every year.

Like a tax return, business owners sign their Form 5500, attesting that they understand what their report says about their own 401(k). Unlike your tax return, the 5500 is public record, warts and all.

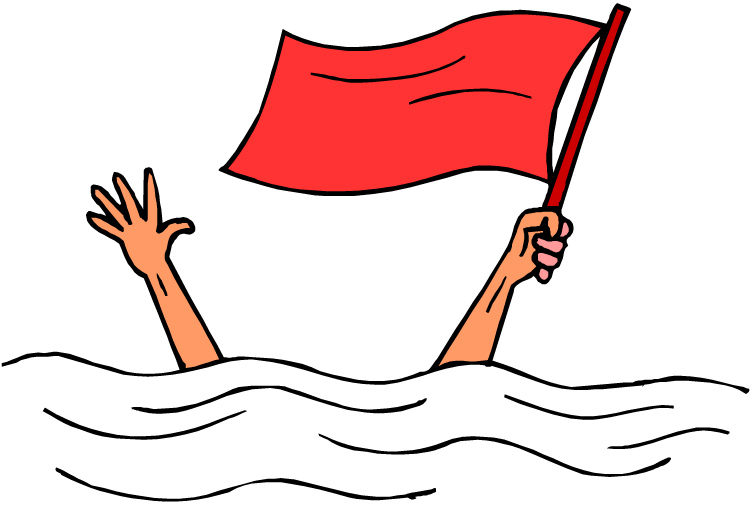

Red flags

Auditors at both the IRS and DOL look at thousands of these forms each year, on the hunt for potential red flags. Among those are:

- Failing to invest participant contributions in a timely manager. This is considered a “fiduciary breach” of your responsibility as the business owner and could subject your plan to disqualification.

- Missing the ERISA fidelity bond. This feature protects participants from potential mishandling of their money. Anyone who manages plan assets must be covered by the bond.

- Retirement plan loans that are in default or in arrears, another fiduciary breach.

- Too many “corrective” distributions, which is money moving around in a plan because contributions and deferrals are mishandled. These can be cleaned up in the same plan year but create headaches if they continue.

Fall short in any of these areas and an expensive, time-consuming audit can follow. Filing your 5500 late can cost $25 a day up to $15,000 from the IRS. On the Department of Labor side the late fee is $1,000 a day with no maximum.

What business owners too often fail to grasp is that they are the fiduciary of their own plan. Problems in their 5500 reflect as much on them as they do on the plan provider, particularly if you use a 3(21) plan provider.

The key to avoiding 5500 problems is to know that your plan provider is filing yours correctly, on time, and that your plan passes all of these audit checks, and more. You’ll need to sign it, but that’s not the same as knowing everything it says, in public, about your 401(k).

If you don’t know what’s in your 5500, it might be time for a “second look” from a qualified fiduciary. The deadline to file is April 15.

A solid review of your Form 5500 can find small problems before they become big and provide you with timely, corrective action. The IRS and DOL watch closely, as can anyone in the public who might care. As a business owner you should be looking, too.