As a nation we’ve become hyper-aware of pricing on nearly everything. Before, if you were interested in a pair of new sneakers or tires for your car, you could shop around but only at the cost of your time and, possibly, your sanity.

Thanks to the Internet we can now pre-shop those shoes or tires endlessly before even leaving the house. It has become incredibly easy to see the total price and calculate whether it’s better to go out and try those shoes on or just order them and wait.

If we’re not sure, the Internet is happy to bombard us with coupon codes and nudges to go ahead and hit checkout. If it’s only on a store shelf, they’ll even meet us in the parking lot, our goods bagged and ready to take home.

Flights, dinner and a movie, a college degree — whatever it is, we’ve got it handled in terms of finding out prices. Except for retirement plans.

The retirement business thrives on the kind of hidden pricing that used to be common everywhere. And there’s a double-whammy built in to obscuring prices: Seemingly small differences in cost today extend over decades, turning into big money for retirement plan providers.

That’s why it’s vitally important to ask questions about your own small business 401(k) plan and to check on those costs every few years. In fact, periodic price checking is a requirement for owners acting as their own fiduciaries, though few even know how to find this information out.

Not sure if you are the fiduciary? Chances are the very fact that you don’t know could mean that you are, in fact, that person. And that means it’s your responsibility to make sure your employees are getting the best deal, properly vetted investments and that plan details are reported on time to the government.

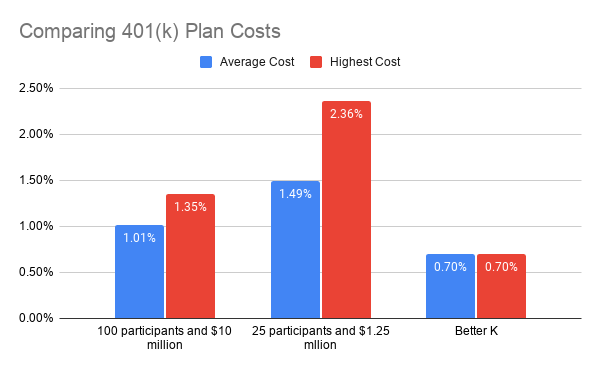

Here’s a starting point: Find out your plan’s total cost as a percentage of assets. If your plan has 100 participants and $10 million in assets, that’s likely to be 1.01%, according to the latest edition of the 401k Averages Book.

Averages can obscure a lot. The upper quartile of plans in this range paid as much as 1.35% per participant.

As plans get smaller prices tend to go higher still. For instance, the average participant in a plan with 25 participants and $1.25 million in assets paid 1.49%, while the highest quartile paid up to 2.36%.

All of these figures are for the total, bundled cost, which includes investment management and administration fees.

The modern 401(k)

What few business owners understand is that the trend toward low cost index funds and more efficient administration has created an environment where even 1% is too high. In fact, small plans can be run for as low as 0.70%, a giant step down from the current cost experience.

That doesn’t mean giving up quality. In fact, quite the opposite. Greater efficiency and modern tools can allow small business owners to replicate a “big firm” experience for their small plan participants, all the while offloading much of the risk associated with running a plan.

If you operate a small business plan and you haven’t checked on pricing in a few years, be aware that part of your job as the owner is to do precisely that — to know the actual cost of competitively priced retirement plans and endeavor to make them available to your employees.

Failing to benchmark your plan is a common mistake and one that can trigger a messy and expensive audit if not caught in time. To lower this risk and avoid the distraction it could cause while running your business, it might be time to make a solid, apples-to-apples comparison of your existing legacy plan to a nimble, modern 401(k).