Are Critics Right? Is It Time To Dump Your 401(k) Account?

How expensive is your 401(k) plan? Rebalance’s Scott Puritz talks to Investor’s Business Daily about the average fees in an employer sponsored 401(k) plan, and how you can save on cost.

Critics, including some high-profile celebrity talking heads, are bashing 401(k) accounts. They claim 401(k)s are riddled with flaws and will burn you later. Are they right? Are you sabotaging your retirement planning by stashing money inside those popular workplace retirement savings plans?

Or are there solutions and workarounds for those stinging criticisms of 401(k) accounts?

If taking one of those course corrections or avoiding some mistake lets you boost your retirement savings by, say, 5% or 10% or 20%, you’d do it, right? Of course you would.

So here are three of the most common criticisms of 401(k), with experts’ retorts on why you shouldn’t let the criticisms sway your retirement planning.

And it matters. 401(k) and related accounts are Americans’ main retirement savings tool, says the American Benefits Council.

Retirement Planning Criticism No. 1: 401(k)s Expose You To Higher Future Tax Rates

Criticism about higher tax rates: Tax rates are likely to rise in the future from where they are now. If you withdraw retirement savings after tax rates rise, your taxes may rise too.

Higher tax rates look likely. How else can the federal government pay for its humongous deficitsand its stimulus payments to help Americans cope with their losses of jobs and income due to the coronavirus pandemic?

But does the likelihood of higher tax rates mean a 401(k) should not be the foundation of your retirement planning?

Answer to criticism about higher tax rates: No. What really matters isn’t what your post-retirement tax rate will be. It’s how much savings your retirement planning leads to, says Sean Wilson, a senior director of product and portfolio solutions and distribution at retirement savings titan TIAA.

“If using a 401(k) account enables your savings to grow by more than the extra amount in taxes you pay due to higher rates, you come out ahead,” Wilson said.

And a 401(k) account makes your retirement savings grow. Money you contribute goes into your account without being taxed as income. In fact, you get a tax deduction. Then year by year the principal and its earnings are sheltered from income taxes.

Diversify Your Retirement Planning By Adding Roth-Type Accounts

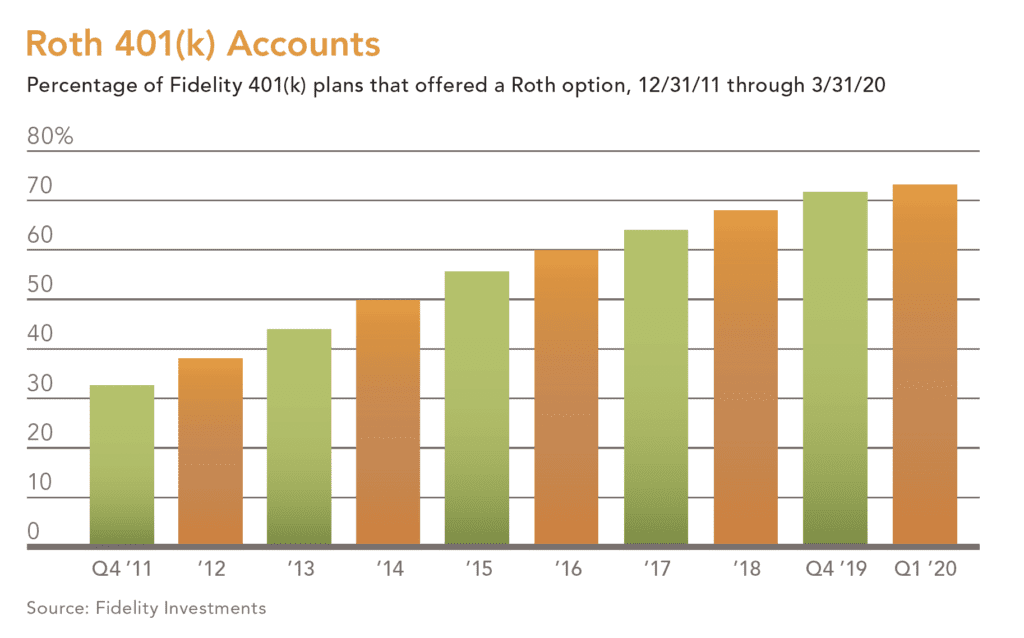

Second answer to criticism about rising tax rates: There’s a second reason not to let the prospect of higher tax rates deter you from saving inside a 401(k) account. Withdrawals from a Roth 401(k) account, offered by many employers, are tax-free. So if you use that type of 401(k) account, it does not matter how high tax rates are once you begin withdrawals.

The catch? On the front end, your contributions do not receive a tax deduction the way they do with contributions to traditional IRAs and 401(k)s.

Still, a Roth 401(k) is a way to avoid higher future tax rates. A Roth account protects your access to an automatic workplace retirement account. And a Roth 401(k) preserves your eligibility for a matching contribution from your employer. A Roth 401(k) can be a key feature of smart retirement planning. “Company contributions are like free pay raises,” said Ed Murphy, chief executive officer of Empower, the retirement plan giant. “Why give it up?”

401(k) Criticism No. 2: Investment Choices Are Weak

Criticism about limited investment choices: 401(k) plans do not offer members enough investment choices.

In comparison, your choices are virtually unlimited in an Individual Retirement Account.

And 401(k) choices are declining. The average number of investment options in 2019 was 17.4, says Vanguard. That’s down by one over the past 10 years.

Some critics say that’s reason enough to not bother using a 401(k). After all, how can you create a portfolio that truly reflects your exact risk tolerance, goals and time horizon when you’re offered so few options?

First answer to criticism about investment choices: The truth is that the vast majority of plan members don’t want a huge number of investment options.

Members of plans run by Vanguard may have just 17.4 investment choices on average. But they only use 2.4 of them on average.

Second answer to criticism about investment choices: “The real question is whether an individual can put together a fully diversified portfolio that meets their needs inside a 401(k),” said TIAA’s Wilson. “You don’t need a menu that offers 10 versions of an S&P 500 index fund to do that. Instead, with diversified stock funds and bond funds you get many of the tools you need for a diversified portfolio. And if your plan offers target date funds, you have an investment option whose asset allocation changes as you approach retirement.”

Target date funds invest in a mix of stocks and bonds. That mix customarily changes over time, growing more conservative and less volatile as your target retirement date approaches. A target date fund uses many of the same retirement planning goals you would, if you were building a portfolio from scratch. It can build an asset allocation similar to what you would on your own.

Third answer to criticism about investment choices: In addition, more 401(k) plans offer access to a professional advisor. Wilson said, “A professional can help you decide when to retire and what’s a reasonable mix of stocks and bonds for your situation. And that mix should be rebalanced on a regular basis.”

That can save you a lot of time and sweat. “Most people don’t have a lot of time to spend on picking individual investments,” Murphy said.

And, maybe most importantly, target date funds stick with the asset allocation that your retirement planning targeted in the first place, even amid market volatility. Murphy said, “They don’t panic. They tend not to sell low and buy high when the market is wild, which is the mistake a lot of individual mutual fund investors make.”

Don’t forget the self-directed option: If you crave securities that are not on your 401(k) plan’s menu, see if your plan offers a self-directed brokerage window. That gives you the right to invest in a vast number of securities, the way you could through an IRA, while staying inside your 401(k). Forty-four percent of members of 401(k) plans serviced by Fidelity Investments have access to a self-directed brokerage window.

401(k) Criticism No. 3: Fees Are Too High

Criticism about high 401(k) fees: Yes, 401(k) plans charge fees. Some IRAs do not, or they’re lower.

First answer to criticism about high fees: The services and investment opportunities you get in return for your 401(k) fee can more than make up the difference, says TIAA’s Wilson. Your 401(k) may offer advice from a professional, while your IRA may not. Some large IRA custodians like Empower and Fidelity as well as independent advisors like wealth-management firm Rebalance do — although there might be fees or eligibility requirements.

Second answer: Scott Puritz, Managing Director of Rebalance, points out that while some funds in a 401(k) plan may charge pricey sales loads and annual fees, odds are that your plan offers similar lower-cost funds as well.

Third answer: Not all 401(k) plans are spendthrifts. Many offer low fees. “Plans bargain on behalf of plan participants,” Wilson said. “You have little or no bargaining power in an IRA.”

Fees charged by your 401(k) plan are on top of whatever fees are levied by mutual funds in your plan. Aim for lower costs funds. “I recommend seeking funds with annual expense ratios below 0.5%,” said Rebalance’s Puritz.