Blog Archive

The Ukraine War and Your Portfolio

by Scott Puritz“Never bet on the end of the world, it only happens once and the odds are long.” — Unknown “The way to make money in the market is not by timing the market but by your time in the market.” — Unknown The war in Ukraine is creating an environment that is unpredictable and full of humanitarian… Continue reading

Warren Buffett’s Most Powerful Life Lesson Has Nothing to Do with Stocks

by Mitch TuchmanNothing about the news cycle these days is remotely “normal,” which is understandable considering events in Europe. So you probably missed the most recent letter to investors from Warren Buffett. Usually, his annual missive to shareholders in his holding company, Berkshire Hathaway, is front page news for a few days each year. It is a… Continue reading

Six Steps to Building an Effective Financial Plan

by Sonja Breeding, CFP®A goal is a dream with a plan and a deadline, as the saying goes. So what does your dream of retirement life look like, and I mean really look like? Making a commitment to your retirement goals requires getting your financial life in order today. That means writing down a financial plan, and I… Continue reading

The Great Resignation: What to Do About Your 401(k)

by Christie Whitney, CFP®The Great Resignation, the Big Quit, the Extraordinary Exodus — whatever you want to call it, 4.5 million Americans voluntarily left their jobs this year, according to current government data, while job openings hover around 10.6 million. A recent analysis of 4,000 companies identified mid-career professionals as the most prolific quitters, a trend that held… Continue reading

Recent Rise in Inflation: Temporary or Permanent?

by Scott PuritzHow each generation invests is a fascinating topic. For instance, the generation that grew up in the Great Depression is known for over-the-top frugality. What people today might call “life hacks” often are nothing more than the way great-grandma and great-granddad got by. Vegetable gardening, sewing old clothes, fixing things instead of replacing them, sharing… Continue reading

How Rebalance Changed Its Portfolios to Manage Increased Inflation Risk

by Mitch TuchmanInvestors of a certain age, almost all, remember the last bout we faced as a country in terms of serious inflation, back in the late 1970s and early 1980s. Those years of rising prices baked into the economy came to head with double-digit price increases and, shortly after, a rapid increase in interest rates in… Continue reading

The ‘Secret Sauce’ At Rebalance

by Mitch TuchmanOver the past decade or so, a lot of well-meaning investment writers have tried to explain what is “special” or “different” about index investing. After all, American savers have put literally trillions of dollars to work in index funds over the years. There must be something going on, right? There must be some reason legacy… Continue reading

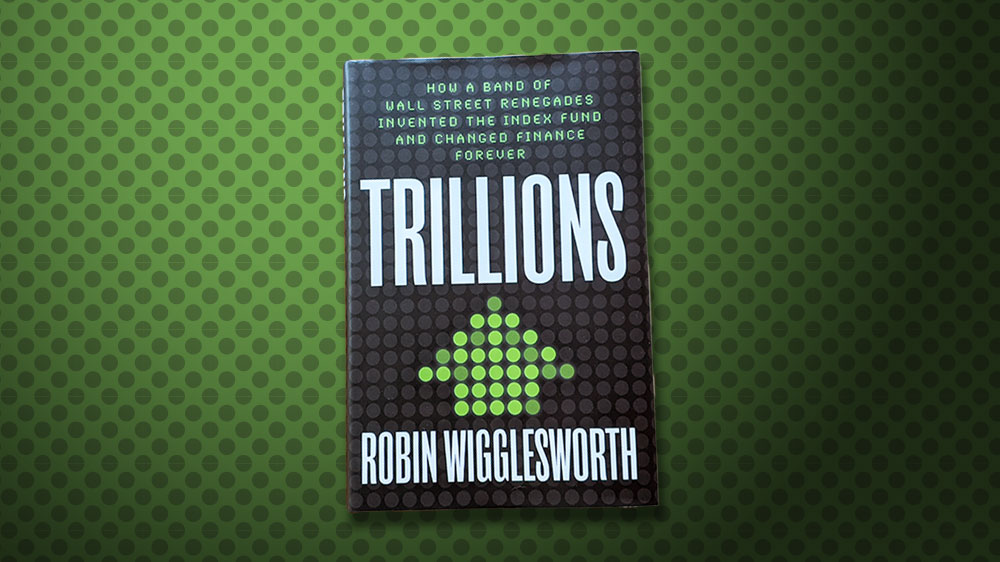

Burton Malkiel’s Compelling Book Review of ‘Trillions’

by Scott PuritzBig investment funds have a public face, a famous money manager who is constantly “talking up his fund” on financial television shows. By contrast, index fund investing is hard to comprehend. The Financial Times journalist Robin Wigglesworth got curious about those “missing faces” and wrote a fascinating history of how indexing got started. The resulting… Continue reading

$1 Billion Dollars Is Just the Starting Point

by Scott PuritzMy firm, Rebalance, recently celebrated a milestone — $1 billion in assets under management. It is an easy figure to misunderstand. The firm is not “bigger” or “more important” than a few years ago. What has changed is that an increasing number of people trust us with their investments, and those investments have grown. That… Continue reading