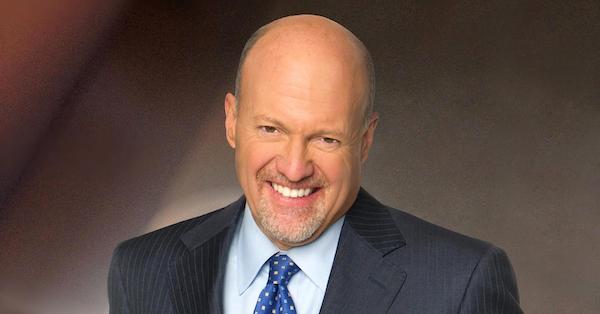

Mad Money host Jim Cramer, best known for offering stock tips on cable TV, is quickly becoming famous for taking what would seem for him a contrarian viewpoint — that investors should avoid stock-picking mutual funds like the plague.

Actively managed funds are in one business and one business only, Cramer argues. They must grow their client base in order to maximize their own fee income, regardless of performance.

The incentive to pick better investments just isn’t there, Cramer said on his CNBC show. Managers get paid to bring in new clients — not for paying attention to the companies they buy for those clients.

“The companies that run these funds want your money. And of the biggest mistake you can make as an individual investor is to give it to them, with a few significant exceptions,” Cramer said.

Instead, he says, use index funds that track the whole market. If you can get exposure to the strength of the market without taking on the cost of actively managed funds, why not? “At the end of the day, I think a cheap S&P 500 index fund is the least bad way to passively manage your money — better than the vast bulk of actively managed funds,” he said.

It makes a sick sort of sense. Wall Street rewards uninterrupted growth, yet the stock market is a notoriously unsteady source of growth in the short term. Some years stocks go way, way up. Some years they fall back.

Publicly traded investment firms can’t afford to live by those rules. They have shareholders, too. They’re under the same microscope as the companies they are supposed to research and recommend, and they have to produce the same endless stream of rising profits. Their bonuses ride on that and that alone.

How do you guarantee steady, strong growth in a stock market that fails to cooperate every single quarter? You don’t worry about the stock market at all. Instead, your profits are tied to increasing the level assets you manage. You need new clients.

Assets under management is not the worst business model in the world. We use it in my own firm, Rebalance. But you have to ask what you get for your money, and you have to be sure the cost reflects actual value

Consider this: For a fee of 1% of your assets, an active manager is going to buy some stocks in your name. He or she also is going to buy some mutual funds, basically farming out the stock picking to others. The mutual funds charge their own fees as well, which you pay.

Worse, financial advisors can be separately compensated, amazingly, for recommending one mutual fund over another. The vast majority of investors miss this in the fine print of the prospectus, but it’s true.

You also pay a fee to help mutual funds market themselves, bizarrely enough. You pay for the research they buy, secretarial help, the electricity bill. All in, you’re likely paying something well north of 2% of your assets a year, every year, forever.

Slim chance

For what? A slim chance of beating the market…and a nearly sure bet that your investments will radically underperform the market, even before all of their fees are taken out. Do you get actual, personalized financial advice? The occasional e-mail? Do you even remember the name of your financial advisor?

You should pay less and get more. You should know the name of your advisor and be able to call him or her up at any time. You should see your portfolio capture the market while adjusting for your personal level of risk tolerance.

Yes, Cramer wants you to pick stocks. But, he points out, if that’s not what you want to do with your time, just buy an index fund. If you need help keeping a portfolio in balance, you can get that, too. There’s just no reason to pay crazy high fees to achieve what should be a simple, clear-cut goal — retirement.