Rebalance 401(k) News

For Business Owners, The Real 401(k) Risk Is Doing Nothing

by Svetlana KotAs an employer, can you one day be sued by your long-ago employees for how you managed their retirement money? You bet you can! All it takes is allegedly failing to offer investments with competitive fees, as Wake Forest University Baptist Medical Center is finding out. In the Pensions & Investments story below, author Robert… Continue reading

Loans From Your 401(k): Understand the Facts

by Nicole Cervi-McKeeverThe pandemic year has a been a hard one for otherwise diligent savers and investors. Some of your employees may have opted to take out loans from their 401(k) plan to cover expenses. It’s important as a plan provider to educate your employees on the importance of staying current with 401(k) loan terms and, if… Continue reading

Rebalance’s Better K Launch Highlights How 401(k) Admin is Changing

by The Rebalance TeamIn just the past week, three companies of widely varying sizes introduced new products aimed at the retirement market, demonstrating the growing trends of personalized financial planning and providing capabilities (and pricing) previously reserved for larger 401k plans. Innovation in the retirement industry continues to make strides in providing increased access to tools designed to… Continue reading

Small Business 401(k) Red Flags You Should See…Before The IRS Does

by Svetlana KotEvery year at tax time, your CPA goes over your company books, prepares your personal return and — after a few weeks of grinding — hands you something to sign. Ever think about what your signature means on a tax return? And on your business return? It means that you are filing your taxes, not… Continue reading

Are Pooled Employer Plans Right For You?

by Sally BrandonBrand new to the 401(k) marketplace as of January 1 2021, Pooled Employer Plans (commonly referred to as PEPs) are made possible thanks to the SECURE Act. PEPs allow unrelated employers to “pool” together, along with other employers (traditionally small businesses) in order to participate in a retirement plan for their employees. PEPs differ from… Continue reading

An Entrepreneur’s Guide to Financial Success

by Sally BrandonThis Sunday’s Washington Post shared something I’ve long known…namely that my partners Scott Puritz and Mitch Tuchman are world-class human beings. The Post profiled Scott to share his entrepreneurial spirit and how Rebalance came to be. And what an exciting story it is! Rebalance was born out of a desire to help investors save and… Continue reading

Finding Investment Advice For More Modest Retirement Accounts

by Mitch TuchmanIf you’re perfectly capable of running your own retirement savings, selecting the right mix of low-cost investments, rebalancing at the right time and not buying and selling out of fear or greed, then good for you. But the majority of people — maybe the vast majority — are not like that. They may be smart enough… Continue reading

Retirement Planning – Freelancers Have A Secret Weapon, The Solo 401(K)

by Scott PuritzAn amazing 40 percent of American workers will be classified as freelancers by 2020, according to the Bureau of Labor Statistics. Once the province of recent graduates and those “in between” jobs, the wave of the future seems to be contract work as a long-term career for millions of Americans. And because of this trend,… Continue reading

Decisions About Rolling Over Your 401(k) or 403(b)

by Jay VivianJay Vivian, former managing director of the IBM Retirement Funds, on why rolling over your 401(k) is important. Continue reading

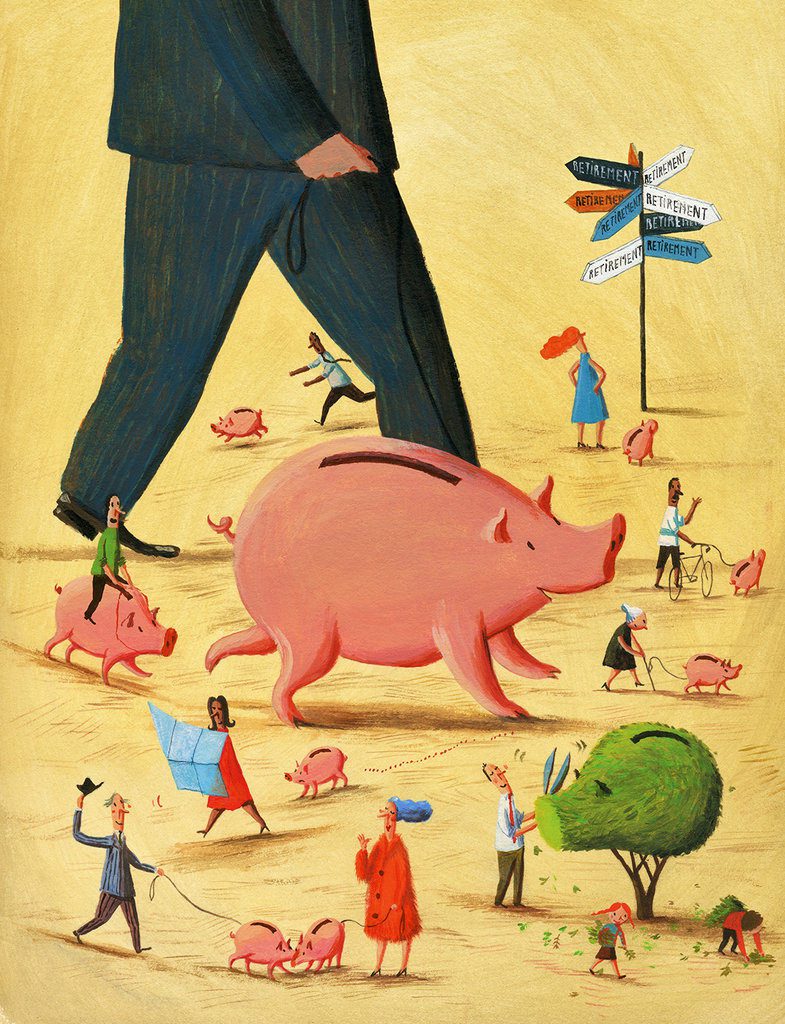

The Basics of 401(k) Retirement Planning

by Christie Whitney, CFP®The history of the most common American retirement plan — the workplace 401(k) — is long, but the essential idea is simple. Save money today and lower your current income taxes. Put in pre-tax money while you are working and take money out later, and pay the income taxes when you take money out in… Continue reading

Rebalance Featured On PBS Finance Show Wealthtrack

by Scott PuritzConsuelo Mack is a long time fan of Professor Burton Malkiel and Dr. Charles Ellis. In fact, she had both of them on her show several times. So naturally, she was intrigued when Burt and Charley joined the Rebalance team and took a central role leading the firm’s Investment Committee and helping to design and monitor the… Continue reading

Retirement Industry People Moves: Rebalance Hires Retirement Services Director

by Scott PuritzWealth management firm Rebalance has added Nicole Cervi-McKeever as director of retirement services. In the role, Cervi-McKeever works directly with Rebalance’s Better K small business 401(k) clients and is responsible for the entire 401(k) client lifecycle, serving as the daily point of contact for all Better K clients. “Over the past year, our Better K… Continue reading